Cracking the Code of the “Deal or No Deal” Market: What is Next for the Investors? 🕵️♂️| Stock Market Weekly Update 27 May

What is Next for the Investors? 🕵️♂️| Stock Market Weekly Update 27 May

Hey there, fellow Investors!

Can you Feel the Excitement in the Air? 🔥

The “Deal or No Deal” game continues, creating anticipation in global markets. Based on past experience, US politicians are likely to reach a debt deal before the June 1st deadline. They have successfully averted this crisis 78 times before, inspiring optimism for a similar outcome. The unfolding events hold our attention as we eagerly await their impact on the economy and financial markets.

Now, what should investors do amidst all this chaos? 💼💰

Don’t worry, we’ve got you covered. As the result season comes to a close end, it’s important to focus on individual stocks after the recent market rally. With liquidity still flowing, there might be more room for the rally to continue. But remember to be cautious and selective when choosing stocks.

So, where should you invest? 💡

We have a few recommendations for you. Consider stocks like UBL, MCX, Cipla, and Mannapuram at their current levels. These stocks have great potential. Additionally, in the midcap segment, Thomas Cook Limited could be an interesting option. They faced some one-time challenges in Q4, but we expect improvements going forward. Our target price for this stock is 155.

Investing can be exciting, just like playing “Deal or No Deal.” With a thoughtful and informed approach, even someone new to investing can navigate through these uncertain times and find opportunities. So, let’s explore the fascinating world of finance together!

🧾In this Article

- Stock Market Outlook

- Stock Picks

- Quick Bites

- Corporate Actions

- Sustainability Corner

- Result Calendar

– Mr. Abhishek Jain, Head of Research at Arihant Capital

Weekly Update, 22nd May – 27th May 2023

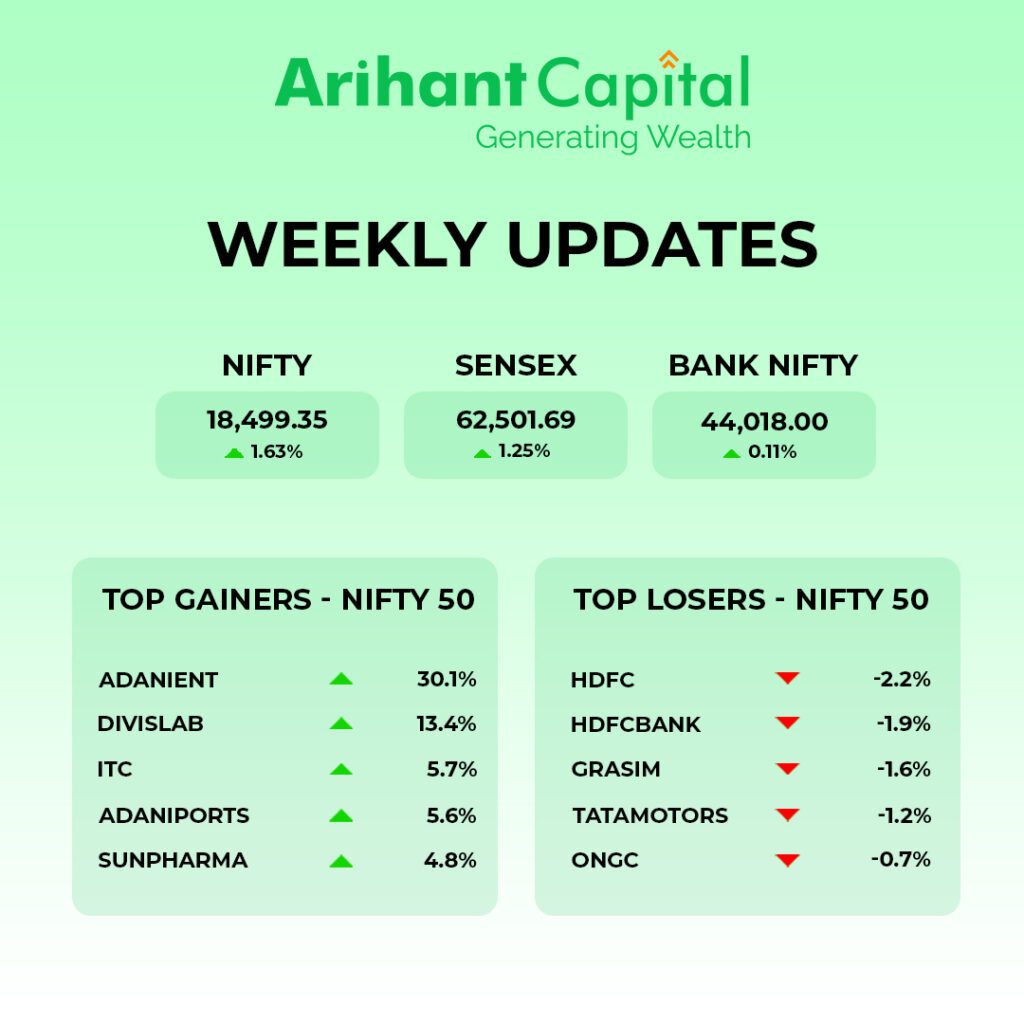

Throughout the week, Indian equity benchmarks witnessed a positive trend, showcasing notable growth and gains. The markets displayed consistent advancements over the course of the week, contributing to an overall positive sentiment.

Various sectors played a role in shaping the market’s performance. Sectors such as media, fast-moving consumer goods, and information technology emerged as leaders, driving the upward momentum. Companies operating in these sectors, including HCL Technologies Ltd., Hindustan Unilever Ltd., and Sun Pharmaceutical Industries Ltd., made significant contributions to the positive change in the benchmark indices.

However, certain sectors experienced a decline during the week. Utilities, power, and oil and gas sectors faced downward pressure, impacting the overall market performance.

The Nifty, one of the key indices, displayed strong growth throughout the week. It recorded notable gains, closing at the 18,485 level by the end of the week. The Sensex, another prominent index, also witnessed an impressive increase of 1.19%, reaching 62,467. Additionally, the Nifty Bank observed a rise of 24% and concluded the week at 43,994.

In summary, it was a positive week for Indian equities, with the major indices showing consistent growth. While certain sectors outperform others, the overall market sentiment remained optimistic. The Nifty and Sensex concluded the week on a higher note, reflecting the positive momentum driven by key companies and sectors.

🔐KEY RESULTS Q4FY23

- BPCL: Net profit fell 82%YoY to 2,131 crore. Sales rose to ₹5.33 lakh crore, compared with ₹4.32 lakh crore in the previous fiscal year.

- Shree Cements: Profit drops 15%YoY to ₹546 crore. Sales for the quarter rose 17% YoY to ₹4,785 crore.

- JSW Steel: Sales for the quarter rose 17% YoY to ₹4,785 crore. Sales up by 9.4% to ₹2,670 crore.

- Ashok Leyland: Net profit dropped 17%YoY to ₹751.41 crore. Total revenue from operations increased nearly 33% YoY to ₹11,626 crore.

- Linde India: Net Sales is up 17.96% at ₹630.24 crore. Net Profit rose 50.43%YoY to ₹ 99.25.

- NMDC: Net profit at ₹2,277 crore against ₹1,862 crore in the year-ago period. Revenue from operations, however, fell by 13.8% to ₹5,851 crore.

- Hindalco Ltd: Net profit at ₹ 832 crore against ₹1,601 crore in the same quarter of last year. Revenue increased 5% to ₹19,995 crore.

- LIC: Net Sales reported at ₹13,428 crore. PAT stood at ₹13,190.79 crore, rising by a whooping 447.47% or 5.5 fold year-on-year.

- FSN E-Commerce Ventures Ltd: FSN ECommerce Ventures Ltd revenue jumped 33.22% to ₹1311.46 crore. Net profit fell -71.85% to ₹2.41Cr.

*YoY is an acronym used for year-on-year

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of the Nifty, we are observing an upward gap area and breakout of consolidation, and on the weekly chart, we are observing trading above short-term moving averages. If we analyze both charts, it indicates that positive momentum can continue, and we should maintain a buy on dips approach. If Nifty starts trading above the 18,550 level, then it can touch the 18,750–18,880 level, while on the downside, support is at 18,400, and if it starts to trade below, then it can test the levels of 18,320 and 18,200.

Bank Nifty

If we look at the daily chart of the Bank Nifty, we are observing consolidation, and on the weekly chart, “Doji” candlestick formation. It indicates that Banknifty is still in a consolidation mood, but momentum will remain positive. In the coming week, if it trades above 44,100, then it can touch 44,300 and 44,500 levels. However, downside support comes at 43,850, and below that, we can see 43,600 and 43,450 levels.

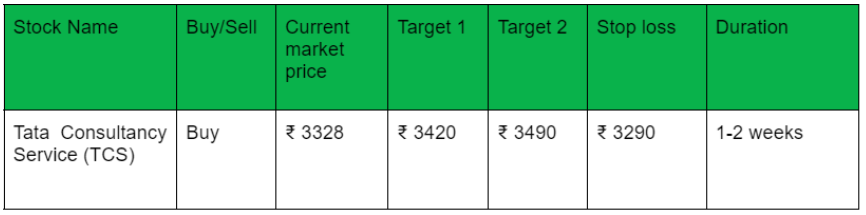

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

🔎Quick Bites

- Nvidia, an American software giant, is set to hit $1 trillion in market cap after a record-breaking stock surge.

- Bengaluru has emerged as the city offering the highest salaries in India, according to a recent report by TeamLease Services.

- The WHO has issued a stark warning, urging global preparedness for the next pandemic.

- China’s industrial profits tumbled 18% in April as demand sputtered.

- The government is attempting to link tax collected at source(TCS) with TDS.

- FPIs inflow hit a 9-month high to ₹37,317 crore in May.

🏗️Corporate Actions 29th May – 3rd June 2023

| Stock Split Alert | ||

| Company | Ratio | Ex-Date |

| SYLPH TECHNOLOGIES LTD | 1:10 | 31 May 2023 |

| Rights Issue Alert | ||

| Company | Ratio | Ex-Date |

| PRAXIS HOME RETAIL LTD | 13:20 | 30 May 2023 |

| SHREE RAMA MULTITECH LTD | 11:10 | 30 May 2023 |

| BHAKTI GEMS AND JEWELLERY LTD | 1:2 | 31 May 2023 |

| NORTH EASTERN CARRYING CORPORATION LTD | 9:10 | 02 Jun 2023 |

| Buyback Alert | |||

| Company | Start Date | End Date | Offer Price |

| AXITA COTTON LTD | – | – | 56.00 |

| HINDUJA GLOBAL SOLUTIONS LTD | 22-05-2023 | 02-06-2023 | 1700.00 |

| Dividend Alert | |||

| Company | Type of dividend | Dividend | Ex-Date |

| Anand Rathi Wealth Ltd | Final | ₹ 7 | 29 May 23 |

| IRB INFRA DEVELOPERS LTD. | Interim | ₹ 0.075 | 29 May 23 |

| M.M.FORGINGS LTD. | Interim | ₹ 6 | 29 May 2023 |

| ITC LTD. | Final | ₹ 6.75 | 30 May 2023 |

| ITC LTD. | Special | ₹ 2.75 | 30 May 2023 |

| RALLIS INDIA LTD | Final | ₹ 2.5 | 30 May 2023 |

| Vedanta Limited | Interim | ₹ 18.5 | 30 May 2023 |

| ADVANI HOTELS & RESORTS LTD. | Interim | ₹ 1.4 | 31 May 2023 |

| D B Corp Ltd | Interim | ₹ 3 | 31 May 2023 |

| STATE BANK OF INDIA | Interim | ₹ 11.3 | 31 May 2023 |

🔌Sustainability Corner

- Tata Motors aims to capture the CNG vehicle market in India, targeting sales of 150,000 cars per year with models like Tiago, Tigor, Altroz, and the upcoming Punch CNG.

- Ola Electric plans to go public by the end of the year and has appointed Kotak and Goldman Sachs to manage its IPO.

- Electric vehicles accounted for 13% of new car sales in Europe in April, with SUVs capturing a 51% market share. The Dacia Sandero led the overall model ranking with a 44% YoY increase.

- Atlas E-Mobility, an Anglo-Moroccan start-up, plans to launch a premium electric SUV by 2026, initially targeting the European, African, and Middle Eastern markets.

- Maruti Suzuki India is set to launch the Jimny SUV on June 7, already receiving nearly 30,000 bookings. It aims to tap into the growing lifestyle SUV segment and potential supply to the armed forces.

- Tata Motors secures an order for 50 Magna buses powered by Cummins’ 6-cylinder diesel engine from Vijayanand Travels for inter-city transport operations.

- Ashok Leyland plans to increase its capex in FY 2024, investing between INR 600 crore and INR 750 crore primarily for manufacturing capacity expansion.

- Lumax Auto Technologies enters the lubricant and coolant aftermarket in India, targeting various vehicle segments including cars, SUVs, two-wheelers, three-wheelers, commercial vehicles, and farm equipment.

- Varroc Engineering wins new business worth 5,178 crore in FY 2023, with 35% coming from leading EV makers and the majority from 4-wheeler OEMs.

- Simple Energy plans to invest over US$100 million in its EV two-wheeler business and aims to enter the 4-wheeler electric vehicle market in the future.

- Sona Comstar signs a technology licensing agreement with the UK’s Equipmake to manufacture and sell electric powertrains, sub-systems, and components for cars, buses, and commercial vehicles in India, Thailand, and select South Asian markets.

Result Calendar for 29th May – 3rd June 2023

| 29th May | |||

| Sobha Ltd. | NBCC (India) Ltd. | Privi Speciality Chemicals Ltd. | Nocil Ltd. |

| Heidelberg Cement India Ltd. | Jamna Auto Industries Ltd. | HLE Glascoat Ltd. | KNR Constructions Ltd. |

| Rail Vikas Nigam Ltd. | Eureka Forbes Ltd. | La Opala RG Ltd. | NHPC Ltd. |

| Hikal Ltd. | Jubilant Pharma Ltd. | Ipca Laboratories Ltd. | Natco Pharma Ltd. |

| TCNS Clothing Co. Ltd. | ITI Ltd. | Torrent Power Ltd. | Adani Transmission Ltd. |

| IRCTC | NIACL Ltd. | Campus Activewear Ltd. | |

| 30th May | |||

| Graphite India Ltd. | Suzlon Energy Ltd. | V-Guard Industries Ltd. | 3M India Ltd. |

| Rajesh Exports Ltd. | KRBL Ltd. | Indiabulls Real Estate Ltd. | Prestige Estates Projects Ltd. |

| Rashtriya Chem and Fert Ltd. | Aegis Logistics Ltd. | Brightcom Group Ltd. | Lemon Tree Hotels Ltd. |

| Apollo Hospitals Ltd. | Astrazeneca Pharma India Ltd. | Uflex Ltd. | Torrent Pharmaceuticals Ltd. |

| Aegis Logistics Ltd. | KIOCL Ltd. | Welspun Corp Ltd. | RHI Magnesita India Ltd. |

| Adani Port Ltd. | MMTC Ltd. | Mazagon Dock Shipbuilders Ltd. | Patanjali Foods Ltd. |

Knowledge Candy 🍬📚

Hold on to your seats, investors! This week’s Knowledge Candy 🍬📚 something tasty! 🥳

The Indian markets have taken off like a rocket, soaring past the 18,500 milestone on the Nifty50 index. It’s like witnessing your favorite team scoring a winning goal in the final minutes of a thrilling match. But what’s behind this exhilarating rally?

Let’s dive into the reasons in a way that will pique your interest and make you feel like you’re part of the action.

Foreign Investor Confidence

Foreign investors have been investing heavily in India, with net purchases of shares totaling ₹20,256 crore in May. This trend of increased foreign institutional investment has been consistent in the previous months as well.

Strong Earnings

Indian companies have shown robust earnings performance in the March quarter. Sectors like banking, automobile, and cement, which rely on the domestic market, have reported satisfactory results, attracting foreign investors.

Tech Sector Growth

India’s tech companies, which were trailing behind, are now seeing their stock prices rise. This is influenced by the US markets, as these companies generate a significant portion of their revenue from the US. Positive developments in US debt talks and stable interest rates are driving this growth.

Declining Prices and Inflation

Inflation rates are falling in both India and the US, suggesting that interest rates may have peaked. Retail inflation in India hit an 18-month low of 4.7% in April. With falling crude oil prices due to global recession concerns and a slowdown in China, we may see further price reductions and increased demand.

With these factors influencing the Indian markets, investor sentiment remains positive, contributing to the overall buoyancy in the Indian market.

📬Also Read: Sustainable Investing in India: ESG Investments