CDSL’s Rise, Market Size: A Stock Surprise!🎉Weekly Update November 25

Hello Readers!

We hope you had a great week!

Central Depository Services Limited (CDSL), India’s only listed depository, has achieved a remarkable milestone by amassing 10 crore demat accounts, a significant jump from 2020. CDSL’s success is intricately linked to the thriving Indian stock market, which has seen a substantial bull run in recent years.

A key player in the stock market infrastructure, CDSL plays a crucial role in the dematerialization of shares, transitioning from physical certificates to digital entries. This shift, initiated in the 1990s, revolutionised stock market investing in India, making transactions more secure and efficient. CDSL, established in 1999 as a rival to the first depository NSDL, has gradually captured a dominant market share, now commanding 73% of demat accounts.

CDSL’s growth can be attributed to its strong alliances with new-age discount brokers like Zerodha, which cater to a burgeoning retail investor base. This partnership has been instrumental in the company’s substantial increase in new demat accounts.

The company generates revenue through a diverse range of services. These include recurring fees from companies for managing electronic shares and annual demat charges through broker partnerships, transaction fees from stock sales and IPOs, and value-added services like e-voting for corporate decisions.

Moreover, CDSL has diversified its operations, venturing into areas like KYC verification through its subsidiary CDSL Venture Ltd and providing digital storage solutions for insurance policies. This diversification, combined with a low-cost IT business model, has contributed to its robust financial performance, with a significant EBITDA margin.

Despite these achievements, it’s crucial to note the cyclical nature of CDSL’s revenue, which is heavily dependent on market trends. A bear market could significantly impact its revenue streams, given that a large portion of its income is market-linked. Additionally, being a highly regulated industry, any regulatory changes in pricing could affect profitability.

In summary, while CDSL is benefiting from the stock market boom, potential investors should be mindful of its business model’s inherent risks and market dependencies.

🧾In this Article

📈 Weekly Update

– Mr Abhishek Jain, Head of Research, Arihant Capital

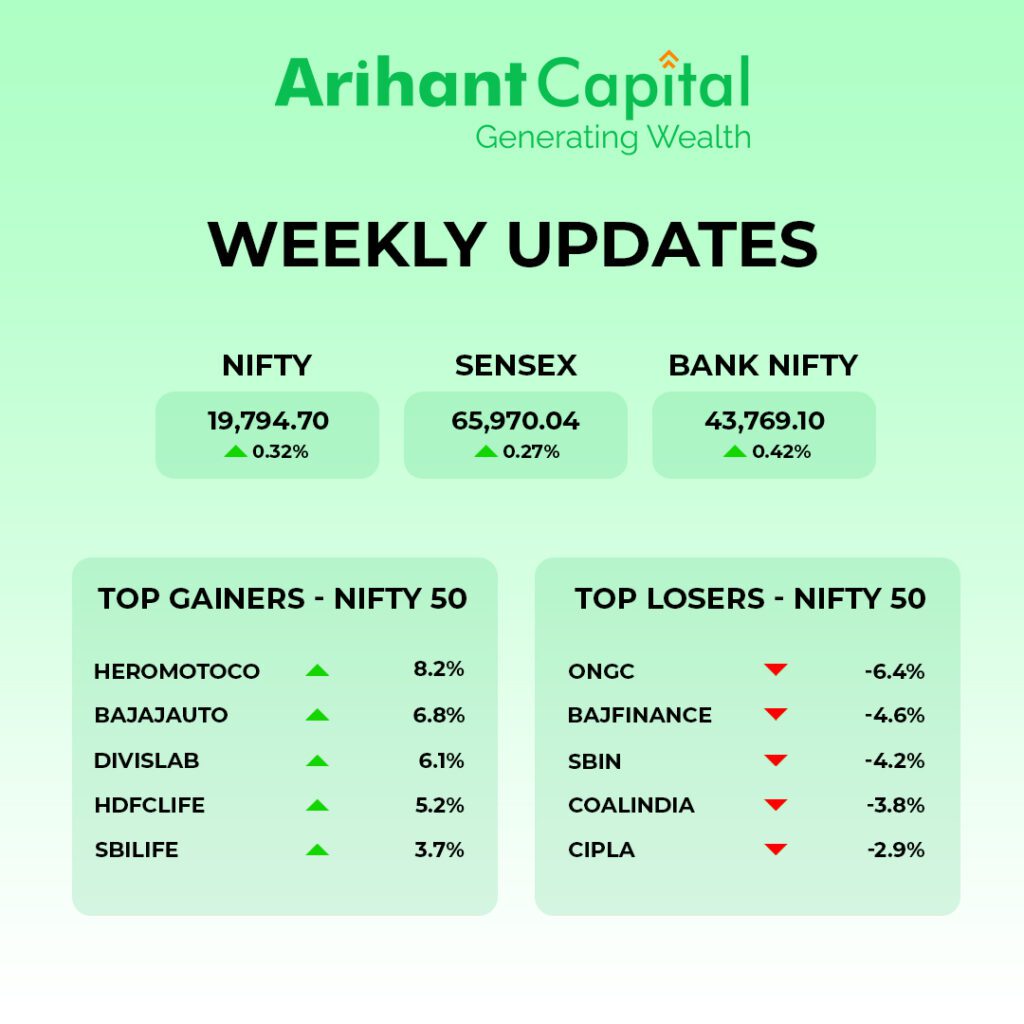

India’s benchmark stock indices ended lower for the second day on Friday. Pharma and healthcare sectors advanced while the IT sector was under pressure. The headline indices gained for the fourth week this Friday, the longest stretch of gains since July 21, 2023. Nifty ended down by 0.037% at 19,795 level. Sensex was down 0.072% at 65,970, and Nifty Bank flat was down 0.44% at 43,769.

📈 Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we are observing a “Series of Narrow range body formation”, and on the weekly chart, we observe a “Doji” candlestick formation; if we analyse both chart patterns, it indicates we can still see some stock specific move with consolidation. If Nifty starts trading above the 19,850 level, then it can touch the 19,950-20100 level, while on the downside, support is 19,700, and if it starts to trade below, it can test the level 19,500 and 19,350 levels.

Bank Nifty

If we look at the daily chart of Bank-Nifty, we observe prices taking support at 200DMA & on the weekly chart, we observe “Doji” candlestick formation. If we analyse both chart patterns, it indicates if the bank-nifty holds the 200DMA level. We can see some bounce from the current level. Bank-nifty starts trading above 43,880, then can touch 44,300 and 44,500 levels. However, downside support comes at 43,600; below that, we can see 43,350 and 43,100 levels.

🔎Stocks in News

💸 L&T (Larsen & Toubro): Signed a financing agreement with the Asian Development Bank for $125 million.

💊 Gland Pharma: USFDA has completed the inspection of its Pashamylaram facility in Hyderabad.

🏗️ JSW Steel: Completed its ₹750 crore investment in JSW Paints.

📑 Siemens: Received a tax demand of around ₹24 crore.

🚗 Maruti Suzuki: The Board has approved the allotment of over 1.23 crore shares to Suzuki Motor Corporation.

🌱 GAIL (Gas Authority of India Limited): The Punjab Energy Development Agency has signed an agreement with GAIL to set up 10 compressed biogas projects and other new and renewable energy projects in the state.

🚛 Tata Motors: Appointed Inchcape Plc as its distributor for commercial vehicles in Thailand.

🔧 CG Power: Has filed an application with the government to set up an Outsourced Semiconductor Assembly and Test facility (OSAT).

🔌 Power Finance: Subsidiary PFC Consulting has started a new Special Purpose Vehicle (SPV) for developing an intra-state transmission system.

💼 Jio Financial: Submitted an application to RBI to convert the company into a Core Investment Company (CIC) from a Non-Banking Financial Company (NBFC).

⛽ BPCL (Bharat Petroleum Corporation Limited): The board of directors will meet on 29 Nov to discuss whether they should declare a dividend.

📣 Jio Financial: Clarified that it is not planning to raise money.

🛍️ Adani Enterprises: Mumbai Travel Retail Pvt., a subsidiary of Adani Enterprises, has incorporated a wholly-owned subsidiary, MTRPL Macau.

🚚 Hindustan Zinc: Partnered with Inland EV Green Services to get 10 electric vehicle trucks.

🚆 Titagarh Rail Systems: Partnered with ABB India.

💊 Cipla: Received a warning letter from the USFDA after an inspection at the company’s Pithampur facility.

🏡 Macrotech Developers: Planning to invest about ₹800 crore to construct 2 housing projects in Bengaluru.

💼 L&T (Larsen & Toubro): The company’s hydrocarbon business has gotten an order valued between ₹10,000-15,000 crore from a client in the Middle East.

🚄 IRCTC (Indian Railway Catering and Tourism Corporation): The Ministry of Railways has allowed IRCTC to go for long-term tenders for 7 years.

💉 Aurobindo Pharma: USFDA completed an inspection at APL Healthcare’s manufacturing plant with zero observations. APL Healthcare is a wholly-owned subsidiary of Aurobindo Pharma.

📰 Quick Bites

✈️ India’s Domestic Air Traffic: Recorded an all-time high with airlines carrying around 4.57 lakh passengers on 19 Nov.

💼 EPFO (Employees’ Provident Fund Organization): Recorded a net addition of 17.21 lakh new members in Sept, marking a growth of 21,475 members compared to August.

💹 Foreign Direct Investment (FDI) in India: Equity inflows fell by 24% YoY to $20.48 billion in April-Sept 2023.

🚗 Toyota’s Investment in India: Planning to invest ₹3,300 crore to build its 3rd manufacturing plant in India.

✈️ DGCA (Directorate General of Civil Aviation): Imposed a penalty of ₹10 lakh on Air India.

📊 Investments in Indian Capital Markets: Through participatory notes (P-notes) stood at ₹1.26 lakh crore during Oct-end, following a rising trend. It was ₹1.33 lakh crore during Sept-end.

🚌 Maharashtra State Road Transport Corporation: Has banned its drivers from using mobile phones while driving buses.

✈️ India’s Domestic Air Traffic (Repeated Point): Continued to reach new heights, with around 4.57 lakh passengers carried on 19 Nov.

💼 EPFO (Repeated Point): Recorded a net addition of 17.21 lakh new members in Sept, reflecting a growth of 21,475 members compared to August.

🌱 Sustainability Corner

🚗 BluSmart – EV Ride-Hailing Service: Celebrates 10 million emission-free rides in under 5 years, covering over 300 million clean kilometres in Delhi-NCR & Bengaluru, saving more than 23,000 tonnes of CO2 emissions.

🚚 SIAM – Automotive Sourcing Conclave: Hosts the Automotive Sourcing Conclave, emphasizing a resilient supply chain, addressing critical areas such as EV components, electronics, electricals, transmission systems, and metals.

🔄 Stellantis – Circular Economy Hub in Italy: Inaugurates its first Circular Economy Hub in Turin, Italy, primarily focusing on extending the life of parts and vehicles. Initiatives include engine, gearbox, high-voltage EV battery remanufacturing, vehicle reconditioning, and dismantling.

🔌 Webasto – New EV Charging Solutions: Unveils new EV charging solutions – TurboConnect and Turbo DX 2 Charging stations and Go Gen 2 High-Power Cordset – at the LA Auto Show.

🔋 SAE International – Wireless EV Charging Standard: Adopts MAHLE’s Differential Inductive Positioning System as the global standard solution for wireless EV charging. As an EV approaches, the system uses a magnetic field to automatically establish a connection with the charging point.

🌱 Tamil Nadu – Green Hydrogen Hub: Under the leadership of Dr TRB Rajaa, the Minister for Industries, Investment Promotion, and Commerce Department, is developing a green hydrogen hub. Aiming to increase installed energy capacity from 50% to 75%.

🔌 Tamil Nadu – EV Sector Investments: Anticipates a doubling of investments in its EV sector over the next two years, reaching ₹80,000 crore. Plans include launching an EV portal to integrate all charging stations.

🔌 Tata Power – EV Home Chargers: Adds 11,529 new EV home chargers in Q2 FY2024, bringing the total count of Tata Power EZ home chargers to over 62,000 units across India, including activation on the Chandigarh-Shimla highway.

🚗 Talbros Automotive – New Business Ventures: Secures new business worth ₹580 crore for gaskets, heat shields, forgings, chassis, and rubber hoses, with ₹270 crore dedicated to EV. The execution is planned over the next five years, starting FY2025.

💡🍬 Knowledge Candy: How has the recent wave of IPOs in India impacted the stock market and investor sentiment?

This week, India’s stock market witnessed an extraordinary surge in Initial Public Offerings (IPOs), with five public issues collectively amassing bids over Rs 2.5 lakh crore, excluding anchor investors.

Leading the pack, Tata Technologies’ IPO garnered over Rs 1.56 lakh crore and was oversubscribed by 69.43 times its issue size. This indicates a substantial appetite among investors for high-quality stocks in the primary market.

IPOs like the Indian Renewable Energy Development Agency, Gandhar Oil Refinery, Flair Writing Industries, and Fedbank Financial Services also received overwhelming responses, with subscriptions multiple times over their offer sizes. This frenzy reflects not just the improving sentiment in the secondary market, but also a robust confidence in new market entrants.

The strong response, especially in the case of Tata Technologies, suggests that investors, including high-net-worth individuals (HNIs), remain cautiously optimistic about Indian equities. Despite global uncertainties like the Israel-Palestine conflict, HNIs tend to buy on dips, indicating their readiness to invest more if market corrections occur.

This IPO fervour underscores a growing trend of bullishness in the Indian stock market, driven by a quest for quality investments in the primary sector.

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?