DCX Systems Limited IPO is live now. Should you invest?

DCX Systems Limited IPO is live now. Should you apply? Find out here.

In this article

About DCX Systems Limited IPO

DCX Systems Limited is among the leading Indian players in the manufacture of electronic sub-systems and cable harnesses. The company commenced operations in 2011 and has been a preferred Indian Offset Partner (“IOP”) for foreign original equipment manufacturers (“OEMs”) for executing aerospace and defence manufacturing projects.

In 2020, the company commissioned a new manufacturing facility at the Hi-Tech Defence and Aerospace Park SEZ in Bengaluru, Karnataka.

As of June 30, 2022, DCX Systems had 26 customers in Israel, the United States, Korea and India, including certain Fortune 500 companies, multinational corporations and start-ups. The company’s customers include domestic and international OEMs, private companies and public sector undertakings in India across different sectors, ranging from defence and aerospace to space ventures and railways.

DCX System’s key customers include Elta Systems Limited, Israel Aerospace Industries Limited – System Missiles and Space Division, Bharat Electronics Limited, and Astra Rafael Comsys Private Limited, among others

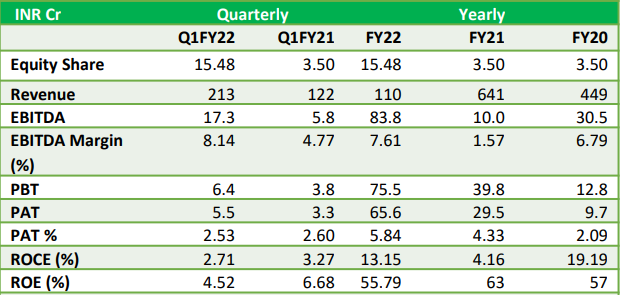

In Fiscal 2020, 2021 and 2022 and in the three months ended June 30, 2021, and June 30, 2022, DCX Systems’ revenue from operations was ₹4,492.62 million, ₹6,411.63 million ₹11,022.73 million, ₹1,229.14 million and ₹2,132.54 million, respectively.

Issue Details of DCX Systems Limited IPO

- IPO open from 31 Oct – 02 Nov

- Face value: ₹2

- Price band: ₹197 to 207

- Market lot: 68 shares

- Minimum investment: ₹14,960

- Listing on: BSE and NSE

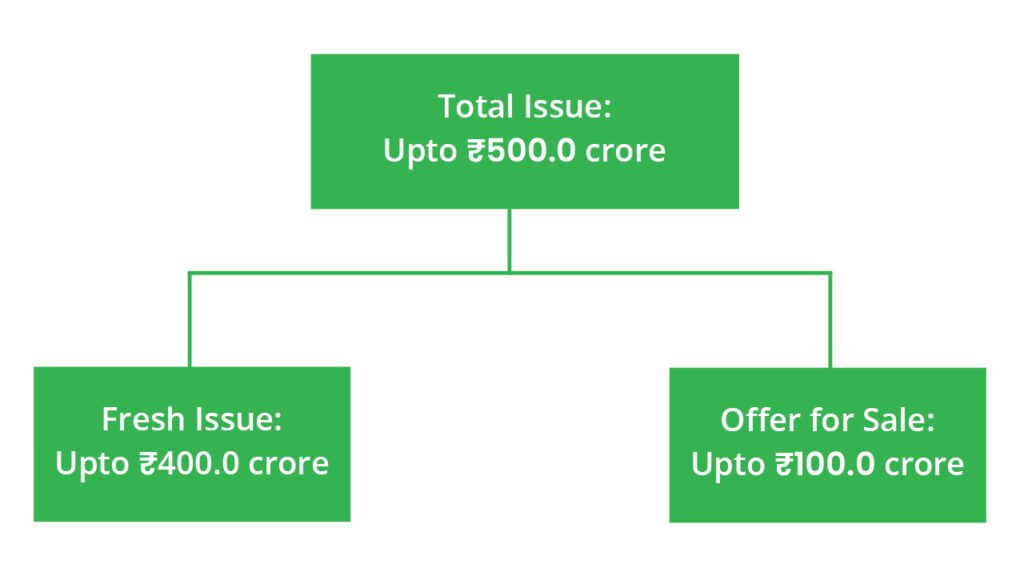

- Offer for sale: ₹500 Cr (Fresh Issue of ₹400 Cr + OFS of ₹100 Cr)

- Registrar: Link Intime India Private Ltd

- Promoters:

- Dr H.S. Raghavendra Rao (M.D) (Individual Promoter)

- NCBG Holdings Inc. (Corporate Promoter)

- VNG Technology Private Limited (Corporate Promoter)

The company’s business verticals:

- Cable and Wire Harness Assemblies: The company manufactures cables

and wire harnesses assemblies such as radio frequency cables, co-axial,

mixed signal, power, and data cables for a variety of uses including

communication systems, sensors, surveillance systems, missile systems,

military armoured vehicles, and other electronic warfare systems for

the aerospace and defence industries as per customers’ requirements,

- System Integration: The company provides product assembly and

system integration services in areas of radar systems, sensors, electronic

warfare, missiles, and communication systems. - Kitting: The company sources ready kits of electronic and electro-mechanical parts along with a ‘Certificate of Compliance’ for traceability, controlled storage of moisture sensitive devices to ensure that customers receive complete, assembly-ready kits when required when they are needed for production

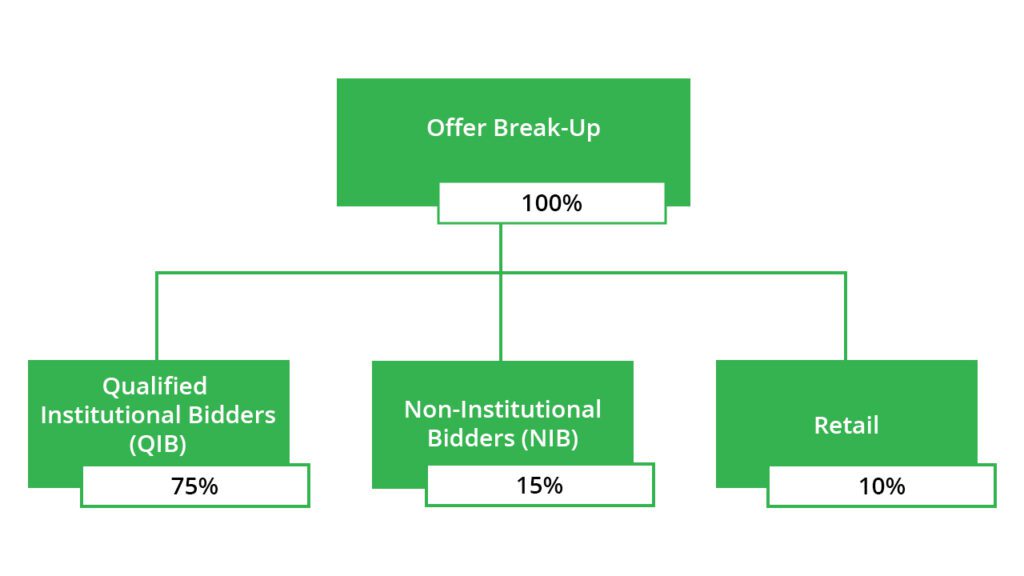

Offer Breakup

IPO Object

The company proposes to utilise the net proceeds of the fresh issue towards funding the following objects:

- Repayment/ prepayment, in full or part, of certain borrowings availed of by the company.

- Funding working capital requirements of the company.

- Investment in its wholly owned subsidiary, Raneal Advanced Systems Private Limited, to fund its capital expenditure expenses.

- General corporate purposes.

IPO Strength

- It is among the preferred Indian Offset Partners for the defence and aerospace industry with global accreditations.

- The company has capability to manufacture products as per specific requirements and quality expectations of customers maintaining the required quality standards.

- The company has manufacturing capabilities which are obsolescence-proof.

- The manufacturing facility is strategically located in aerospace Special Economic Zone and is located in the same city as company’s key domestic customers which ensures shorter delivery times.

- Technology-enabled and scalable end-to-end capabilities.

- The business model has visibility of cash flows and ability to mitigate operational and technology risk.

- Well-positioned to capitalize on industry tailwinds.

- DCX order book has grown from 45 orders worth INR 19413 mn in FY20 to 48 orders worth INR 25636 mn in FY22. The company’s order book is growing YoY with repeat orders from existing customers.

IPO Risk

- The company was dependant on top 3 customers for 85.7% of sales in FY22, any loss to these customers will adversely affect the business.

- Any changes in offset defence policy or a decline or reprioritization of funding in the Indian defence budget, or delays in the budget processcould adversely affect ability to grow or maintain sales, earnings, and cash flow.

- Any significant shortages of, or delay or disruption in the supply of raw materials could affect the estimated costs, expenditures and timelines.

- Any adverse changes in the conditions affecting the electronic subsystems market can adversely impact the business

- Unable to obtain furnished equipment required for testing and qualifying the products from the customers which may have a material adverse effect.

- The company’s performance depends on electronic subsystems market, any adverse changes can adversely affect the business.

- The company does not own the brand name ‘DCX’, they use the brand name ‘DCX’ pursuant to a no objection letter received from DCX-Chol Enterprises, Inc. In the event that they have to discontinue the use of the brand name ‘DCX’ or the logo, it may adversely affect business and the financial condition of the company.

- The company deals in dollars and is exposed to foreign currency fluctuation risks.

Peer Companies

- DATAPATTNS(Data Patterns Limited)

- ASTRA MICRO (Astra Microwave Products Ltd)

- CENTRUM (Centum Electronics Ltd)

- PARAS (Paras Defence and Space Technologies Ltd)

- BEL (Bharat Electronics Limited)

Valuation and View

DCX systems is a leading and preferred Indian offset partners for the

aerospace and defense industry with clients globally. The company has

reported consistent financial performance over the years and is technology

enabled with capacity to scale further without incurring too much capital

expenditure. The company’s order book is growing with repeat orders from

existing customers. There is huge opportunity in offset business, where the

MOD has announced offset backlog of USD 13.4 bn which needs to be

completed in next 7 years , out of which 25% belongs to DCX category.

The company is valued at P/S multiple of 18.2x to its FY22 sales and we

recommend ‘Subscribe for long term’.

Financial Data

A new PM in the house | A bird freed | Weekly stock market newsletter 30 Oct