Dharmaj Crop Guard Ltd. IPO is being live. Should you invest?

Dharmaj Crop Guard Limited IPO is Being live. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Dharmaj Crop Guard Limited Financials

📃About Dharmaj Crop Guard Ltd IPO

Incorporated in 2015, Dharmaj Crop Guard Limited is an agrochemical company. The company is engaged in the business of manufacturing, distributing, and marketing a wide range of agrochemical formulations such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilizers and antibiotics to the B2C and B2B customers.

The company also provides crop protection solutions to farmers to assist them to maximize productivity and profitability. Dharmaj Crop Guard Limited export products to more than 20 countries in Latin America, East African Countries, the Middle East and Far East Asia.

As of November 30, 2021, Dharmaj Crop Guard, Limited had more than 196 institutional products that they sold to more than 600 customers based in India and the international markets. As of November 30, 2021, the company exported its products to more than 60 customers across 20 countries.

The company’s manufacturing facility is located in Ahmedabad, Gujarat, India. Dharmaj Crop Guard Limited also has a research and development (“R&D”) centre at the manufacturing facility.

The company’s branded products are sold in 12 states through a network comprising over 3,700 dealers having access to 8 stock depots in India, as of November 30, 2021.

The revenue from operations for Fiscals 2019, 2020 and 2021 and seven months period ended on October 31, 2021, was ₹1,393.56 million, ₹1,982.22 million, ₹3,024.10 million and ₹2,272.62 million, respectively.

💰Issue Details of Dharmaj Crop Guard Ltd IPO

- IPO open from 28 Nov – 30 Nov 2022

- Face value: ₹10 per equity share

- Price band: ₹216 to ₹236 Per Share

- Market lot: 60 shares

- Minimum investment: ₹14,220

- Listing on: BSE and NSE

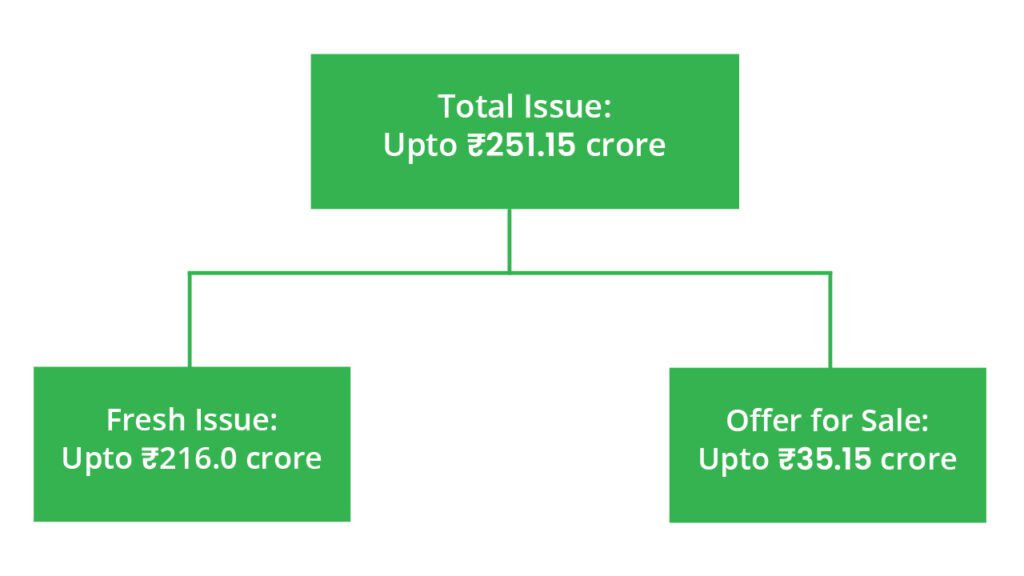

- Offer for sale: ₹251.15 Cr (Fresh Issue of ₹216 Cr + OFS of ₹35.15 Cr)

- Registrar: Link Intime India Private Ltd

- Promoters:

- Rameshbhai Ravajibhai Talavia

- Jamankumar Hansarajbhai Talavia

- Jagdishbhai Ravjibhai Savaliya

- Vishal Domadia.

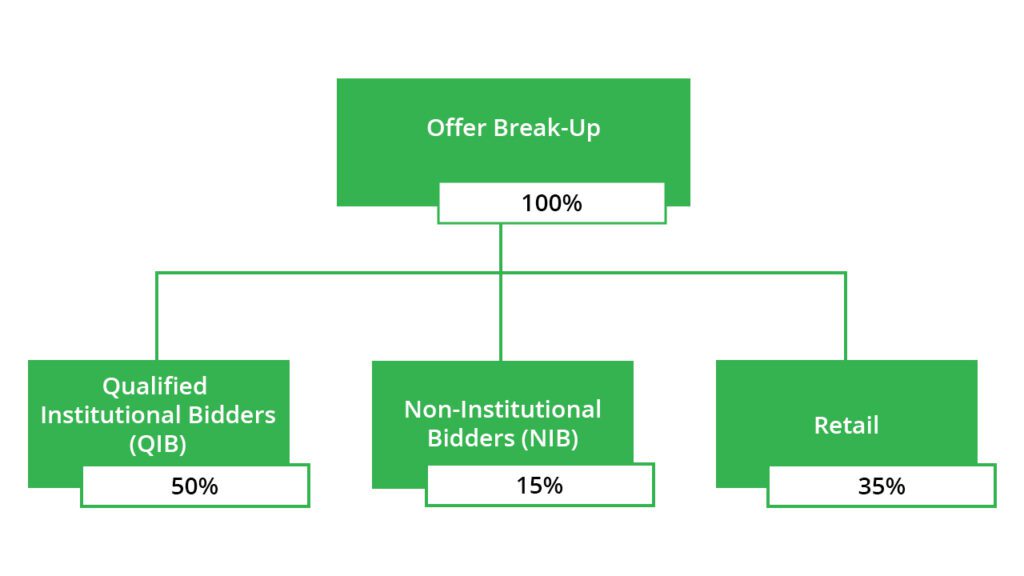

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Funding capital expenditure towards setting up of a manufacturing facility at Saykha, Bharuch, Gujarat.

- Funding incremental working capital requirements of the company.

- Repayment and/or pre-payment, in full and/or part, of certain borrowings of the company.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and the strengths that form the basis for computing the offer price are:

- The diversified portfolio of its products and consistent focus on quality and innovation

- Established a distribution network with strong branded products and stable relationships with its institutional customers

- Track record of strong operational and financial performance.

- Expanding the company’s public health and animal health product segment

- Targeting new customers, expanding existing customer business and increasing its market share in domestic and international markets

- Experienced promoters and management team.

🧨IPO Risk

- Failure to successfully obtain required registrations or maintain statutory and regulatory permits and approvals required to operate would affect the business and manufacturing facility operations.

- Failure to comply with the quality standards, technical specifications, regular inspections and audits prescribed by customers may lead to loss of business from such customers.

- The company does not generally enter into long-term agreements with the majority of its customers.

- Inability to identify and understand evolving industry trends, technological advancements, and customer preferences and develop new products to meet customers’ demands.

- The business is subject to climatic conditions and is cyclical in nature, thus, seasonal variations and unfavourable local and global weather patterns may have an adverse effect on the business.

- If the company fails to meet the standard norms laid by governments locally or globally, then the products are at risk of being banned or suspended or becoming subject to significant compliance costs.

⚖️Peer Companies

- Rallis India

- India Pesticides

- Punjab Chemical & Crop Protection

- Bharat Rasayan

- Astec Lifesciences

- Heranba Industries

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹92.58 | ₹199.16 | ₹10.76 |

| 31-Mar-21 | ₹128.87 | ₹303.56 | ₹20.96 |

| 31-Mar-22 | ₹219.54 | ₹396.29 | ₹28.69 |

📬Also Read: Sustainable Investing in India: ESG Investments

8 Billion Strong | Weekly Stock Market Wrap-up 20 Nov