8 Billion Strong | Weekly Stock Market Wrap-up 20 Nov

Weekly Stock Market Wrap-up. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team.

In this article

We are 8 billion strong! Yes, the world population hit the 8 billion mark this week. This obviously led to a laughing riot on Twitter. Let’s check out some hilarious tweets before we get to our Weekly Stock Market update.

8 billion strong and you are still looking for the right investment advice? It’s high time you follow Arihant Capital on Facebook, Instagram or Twitter join our free Telegram channel for advice you can truly count on.

Let’s get started with this Weekly Stock Market update. Tech companies after being the flag bearer of growth, are now in trouble. There are massive layoffs in big tech with Amazon being the latest in announcing layoffs after Meta and Twitter.

Twitter’s birds leaving the nest is more due to a leadership change, are the rest of the companies this foreshadowing recessionary trends ahead? The head of WTO certainly believes that some major economies will face a ‘real’ recession after the chaotic turn of events following the “Russia-Ukraine war“.

Meanwhile in India, the Indian benchmark indices ended the week with small losses. Nifty closed at 18,307 down 42 points (or 0.23%), whereas Sensex closed 0.21% down at 61,663 after briefly touching its all-time high as speculated last week. We talked in detail about the resilience of the Indian markets here, and it seems the growing demographics and consumer sentiments are furthering our belief in India’s resilience. Even FPIs have invested more than ₹30,000 cr in Indian equities in Nov so far.

Recession or no recession, it’s time to keep investing for the uncertain times ahead. But be careful who you listen to for financial advice: SEBI is planning to bring all “influencers” under its lens. If you need research-backed advice on where to invest, you know you can always count on us. Check out this article to see where Mr Arpit Agarwal (Co-founder of our top-performing PMS arm) suggests you can park your money.

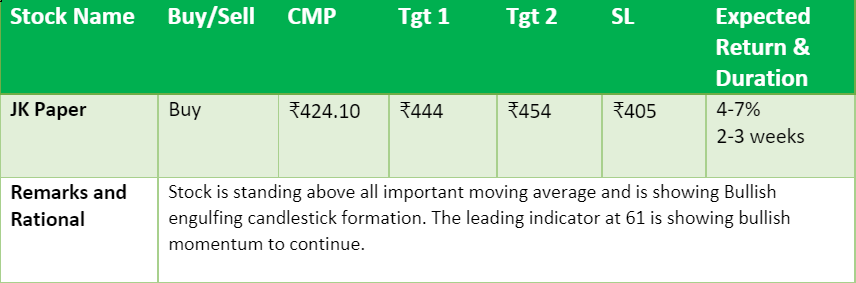

💰Stock Picks

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the technical chart of Nifty, we observe the price filled its previous upward gap area. On the weekly chart, we observe the Doji candlestick pattern. It seems that stock-specific action will continue and we will maintain buy on dips strategy. Nifty can face resistance around the 18,350 level on crossing it, it can touch 18,500-18,650 levels, while on the downside, support is 18,250. A dip below this, Nifty can test the 18,050 and 17,900 levels.

Bank Nifty

On both the daily and the weekly chart of Bank Nifty we observe a Doji candlestick pattern. It seems that Bank Nifty may remain in consolidation mode. In the coming trading sessions if it trades above 42,650 then it can touch 42,800 and 43,100 levels, however, the downside support comes at 42,300 below that we can see 41,900-41,500 levels.

🔎Quick Bites

Global

- Musk’s ultimatum triggers employee exodus at Twitter.

- Amazon begins mass layoffs among its corporate workforce

- Japan’s inflation rose to a 40-year high.

Economy

- RBI asks Indian banks to be vigilant about evolving macroeconomic situations, and take steps to minimise risks.

- India’s exports contract for the first time in 2 years (by 17%). Imports moderated to the lowest level in eight months, growing at 5.7%.

- India and the Gulf Cooperation Council (GCC) are expected to launch negotiations for a free trade agreement.

- India’s forex reserves rise to $544.72 billion, registering the fastest pace since August 2021.

- India’s retail inflation stood at 6.77%, while wholesale inflation eased to 8.39%

Automobile

- Maruti Suzuki joins hands with IIT Bombay to drive innovation programmes for startups

- Tata Motors bags an order of 1,000 buses from the Haryana government.

- M&M opened a new plant in Pithampur for the farm equipment business.

Banking and Finance

- Japanese investment giant SoftBank cut its 4.5% stake in Paytm.

- NSE is likely to introduce Electronic Gold Receipt shortly.

- DSP gets RBI nod to pick 10% stake in Equitas SFB.

- Federal Bank ties up with JCB to finance heavy equipment buyers.

- Digital Rupee is coming soon for retail.

- IndusInd bank partners with the Uttarakhand government to offer banking services to 600+ Nyaya panchayats.

- HDFC raised up to ₹5,500 crores via bonds.

Industry

- Vedanta is looking to sell its subsidiary Electrosteel Steels.

- Indian refiners becoming wary of buying Russian oil as EU sanctions loom: Sources

Energy and Infrastructure

- Housing prices across the top eight cities in India (Delhi-NCR, MMR, Kolkata, Pune, Hyderabad, Chennai, Bengaluru, and Ahmedabad) continue to head northwards at 6% YoY

IT and Telecom

- L&T Tech to open a new office in the US and hire more than 500 engineers.

- Airtel launches 5 G services at Lohegaon airport (Pune). Jio 5G services are now available across Delhi NCR.

- L&T Infotech and Mindtree get NCLT nod for merger. Mindtree will be delisted from stock exchanges and LTI will be rebranded as LTIMindtree effective 24 November.

- Zomato to shut down in UAE.

- Wipro becomes the first Indian company to set up European Work Council

- TAP Air Portugal has selected TCS as a strategic partner.

Other

- A jet cuts the salaries of some staffers by up to 50%.

- Welspun’s set to acquire 70% debt of Sintex BAPL.

- Tata Group is planning to open at least 20 “beauty tech” stores

- Sun Pharma gets USFDA nod for medicine to cure neonatal seizures.

- Aditya Birla Fashion and Retail inked a pact with Galeries Lafayette to open luxury department stores and a dedicated e-Commerce platform in India.

- Adani’s open offer to acquire an additional 26% stake in NDTV will be open for subscription from November 22 to December 5.

🚀IPO Corner

- Fairfax weighing Bangalore Airport IPO at ₹300 billion $3.7 billion.

- Keystone Realtors IPO subscribed 2.01 times.

- Bikaji Foods is listed on NSE at ₹322.80 a premium of 7.60% over its issue price.

- Global Healthcare (Medanta) is listed on NSE at ₹401, a premium of 19.35%. On BSE it is listed at a premium of 18.5%.

- Fusion Microfinance is listed on the bourses with a discount of more than 2% from the issue price of ₹368.

- KFintech gets SEBI nod for ₹2,400 crore IPO.

- Inox Green IPO subscribed 1.55 times.

🔌Sustainability Corner

- Housing societies will need norms for EV charging.

- Tata Power solar systems have partnered with the Union Bank of India to help MSME solar companies switch to solar energy.

- Tata Motors and Cummins collaborated to develop low and zero-emission propulsion technology solutions.

- The overall EV sales in October increased month-on-month by 28.1% to reach 1,19,889 units.

- Kinetic Green launches ‘Zing HSS Electric Scooter’ aims for revenue of ₹500 crores from electric 2Wheelers.

- VIDA opens its first experience centre in Bengaluru.

- PMV Electric launches its EV ‘EaS-E’ microcar.

- Ather Energy partners with IDFC Bank to offer EV financing to its customers.

- Kia plans to bring more EV6 units to India.

- MT Autocraft partners with Korea’s EMTC to produce an EV Powertrain.

- BYD inaugurates its second passenger vehicle showroom in Hyderabad.

- Hero Electric enters into a partnership with NIDEC Japan.

- Indian Air Force deploys 12 electric vehicles to reduce carbon footprint.

- Altigreen opens its brand centre for retail customers in Pune.

- TVS Motor company delivers 200 TVS iQube electric scooters to customers In Delhi in a day.

- India has the potential to become a world leader in the production of electric vehicles: Berkeley Research.

- Ather Energy has drawn up plans to set up 150 fast-charging grids in Tamil Nadu by the end of the current financial year.

- Green energy open access portal launched, consumers with 100Kw sanctioned load to get renewables supply.

- Serentica Renewables partners with Greenko for 1500 MWhr of storage capacity.

Also read: ESG Investing & Its Emergence in India