IdeaForge Technology IPO Rockets to the Sky! 🛰️🎮|Stock Market Weekly Update July 8

IdeaForge Technology IPO | Stock Market Weekly Update

Hello Readers!

Get ready for a drone industry feast with IdeaForge’s IPO skyrocketing a whopping 94% above its price! This reading diet has all the juicy details.

In a remarkable feat, IdeaForge, a leading Indian drone manufacturer, has made a soaring debut on the stock market. The company’s initial public offering (IPO) took flight at a staggering 94% above its issue price, causing a stir in the investment landscape.

As per reports from The Economic Times, the IPO opened at ₹1,650 per share, a substantial premium to its issue price of Rs. 900. This phenomenal response from investors is a testament to the confidence and excitement surrounding IdeaForge’s future prospects in the fast-growing drone industry. 🌐

IdeaForge has carved a niche for itself by developing cutting-edge unmanned aerial vehicles (UAVs) that cater to diverse sectors such as defence, homeland security, and industrial applications. Their state-of-the-art drones are renowned for their high performance, reliability, and precision, making them a preferred choice among customers. 💡

The successful listing of IdeaForge highlights the tremendous potential and investor appetite for innovative technology companies in India. It also underscores the growing recognition of drones as a transformative tool for various industries, from surveillance and mapping to delivery services and beyond. 📡

With this exceptional market debut, IdeaForge is poised to further expand its operations, and invest in research and development, and enhance its production capabilities. The company’s strategic vision coupled with the market’s positive response positions it strongly for future growth and success.

This milestone is not only a significant achievement for IdeaForge but also a testament to India’s thriving startup ecosystem, where pioneering ventures are attracting both domestic and international investors. It serves as an inspiring example for other innovative companies, encouraging them to aim high and pursue their dreams with confidence.

🧾In this Article

🔍Analyst Corner

– Mrs Anita Gandhi, Whole Time Director at Arihant Capital

Why are FPIs and DIIs moving in opposite directions?

When it comes to investing, there’s an interesting story happening with FPIs and DIIs. Domestic institutions in India mainly focus on their own country’s markets. They’ve made some good investments in the past and have earned profits. As their profits grow, they start having more stocks in their balanced funds compared to debts.

To balance things out, they need to reduce their stock holdings, which means selling some of their stocks. On the other hand, foreign investors, called FPIs, have many investment options worldwide. Lately, India’s economy has improved a lot, and it’s expected to keep growing. That’s why FPIs are still investing in India. So, we have these two groups of investors going in different directions, and it adds an exciting twist to the ever-changing investment world.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

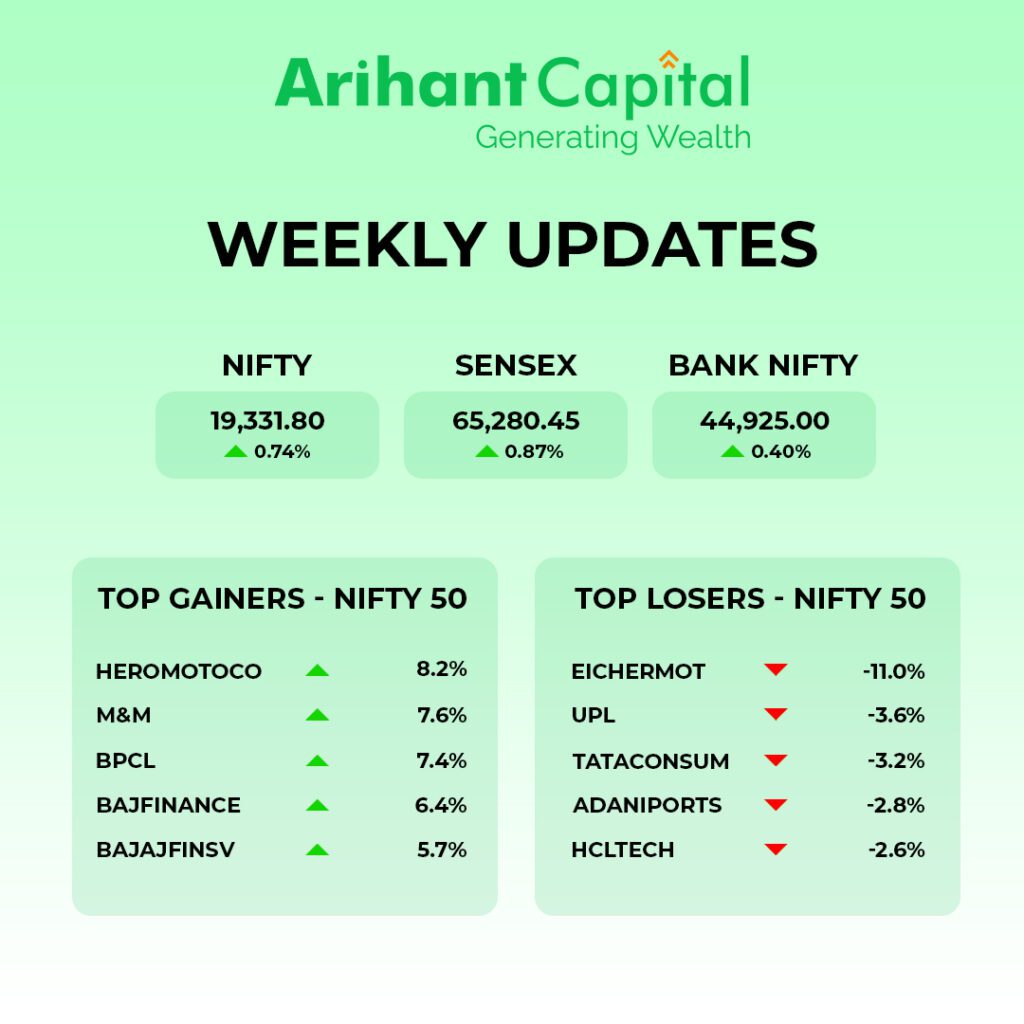

Nifty

If we look at the daily chart of Nifty, we are observing prices trading far above the short-term moving averages. On the weekly chart, we are observing a “Doji” candlestick formation, which suggests the market may consolidate here. If Nifty starts trading above the 19,380 level, then it can touch the 19,480–19,550 level, while on the downside, support is at 19,250, and if it starts to trade below, then it can test the levels of 19,100 and 18,950.

Bank Nifty

If we look at the daily chart of Bank-Nifty, Prices start trading below the lower trend line, and on the weekly chart, there is also a “Doji” candlestick, which indicates that we may see some consolidation in Bank-Nifty as well. In the coming week, if it trades above 45,100, it can touch 45,350 and 45,600 levels. However, downside support comes at 44,750, and below that, we can see 44,600 and 44,450 levels.

📊Stocks in News

🔸 Indian Oil: will form a joint venture with Praj Industries Ltd for biofuel production.

🔸 Olectra Greentech: got a Letter of Intent (LoI) from the Maharashtra government for the supply of electric buses.

🔸 Tata Motors: Jaguar Land Rover reported a 29% year-on-year rise in retail sales in the April-June quarter at 1.02 lakh units.

🔸 Samvardhana Motherson: will acquire a 100% stake in Rollon Hydraulics for ₹103 cr.

🔸 Piramal Enterprises: SmallCap World Fund sold shares worth ₹575 cr of Piramal Enterprises through open market transactions.

🔸 Tata Steel: consolidated production fell to 7.08 Million Tonnes (MT) in the April-June quarter vs 7.67 MT in the same quarter last year.

🔸 Bank of India: paid a dividend of ₹668 cr to the government.

🔸 Tata Motors: has sold over 5 lakh Tata Tiago cars so far.

🔸 Puravankara: doubled sales to ₹1,126 cr in the April-June quarter vs ₹513 cr year-on-year.

🔸 BSE: will buy back 45.93 lacks of its own shares (3.39% stake).

🔸 Hindustan Zinc: the board will meet on 8 July to consider and approve an interim dividend.

🔸 Adani Green: planning to raise up to ₹12,300 cr through qualified institutional placement (QIP).

🔸 Maruti Suzuki: launched its costliest car Invicto SUV.

🔸 HDFC: will get delisted from stock exchanges on 13 July because of its merger with HDFC Bank.

🔸 JSW Steel: will replace HDFC on Sensex from 13 July.

🔸 LTI Mindtree: will replace HDFC on Nifty from 13 July.

🔸 KEC International: won ₹1,042 cr orders.

🔸 IEX: achieved 25,125 MU volume across all segments in the first quarter, a growth of 8% year-on-year.

🔸 Macrotech Developers: sales bookings in April-June rose 17% to Rs 3,350 crore.

🔸 Samvardhana Motherson: will acquire a majority stake of 81% in Yachiyo Industry’s four-wheeler business.

🔸 IDFC First Bank: will merge with IDFC. IDFC shareholders will get 155 shares of IDFC First Bank for every 100 shares.

🔸 Hero MotoCorp: launched co-developed motorcycle Harley-Davidson X440 in India.

🔸 Adani Ports: handled 101.4 million metric tons of cargo during the April-June period, an 11.5% increase.

🔸 Bank of Maharashtra: gave 24.93% more loans in the April-June quarter at ₹1.75 lakh cr.

🔸 Tanla Platforms: acquired ValueFirst Digital Media Pvt.

🍟 Quick Bites

📊HMA Agro Industries is listed at a premium of 6.18% at ₹625 per piece on NSE. On BSE, it is listed at a 5.13% premium.

⛽️ Retail price of a 19 kg commercial LPG cylinder has been increased from ₹1,773 to ₹1,780 (in Delhi).

🏭 India’s total coal production rose 8.40% to 222.93 million tonnes in the April-June quarter.

🏘 The residential sector recorded sales of 1.57 lakh housing units in the first 6 months of 2023. Sales in Hyderabad rose by 5%. Mumbai and Bengaluru saw a decline of 8% and 2%: Knight Frank.

💰 Murugappa Group posted total revenue of ₹74,220 cr for the financial year 2023, a growth of 36%.

🚆 A 17-km-long stretch of RAPIDX (India’s first regional train service) will start operations this month. This portion will operate on 5 stations – Sahibabad, Ghaziabad, Guldhar, Duhai, and Duhai Depot.

🏭 Manufacturing sector growth (PMI) stood at 57.8 in June vs 58.7 in May.

📈 PKH Ventures IPO has been subscribed 0.30 times so far. Retail investors have subscribed to the issue 0.45 times.

📈 HMA Agro Industries will list on BSE and NSE tomorrow.

📊 SGX Nifty futures contracts have been rebranded as Gift Nifty starting 3 July.

💸 RBI has started a 2-day variable rate reverse repo (VRRR) auction for a notified amount of Rs 1 lakh cr.

🥛 Amul is planning to invest around Rs 4,000-5,000 cr over the next 2 to 3 years to set up milk processing plants.

💵 So far, around 76% of the total Rs 2,000 notes in circulation have been returned to banks: RBI.

✈️ SpiceJet has repaid a Rs 100 cr loan to City Union Bank.

⛽️ Diesel sales fell 3.7% year-on-year in June, and petrol sales rose 3.4%.

💡Knowledge Candy🍬:

💊💥 Pharma Stocks Surge: Key Factors Driving Growth

💰 Pharma stocks have been grabbing investor attention in the current financial year. The NIFTY Pharma index has outperformed the broader NIFTY50, rising by 14.3% compared to 11.1% in the latter. This growth is driven by key factors worth exploring.

📜 Firstly, recent drug approvals by the US Food and Drug Administration (USFDA) have given a significant boost to the pharma sector. Companies like Lupin and Zydus Lifescience have received approvals for high-value generic drugs, expected to drive revenue growth in the coming quarters.

💹 Additionally, there has been a reduction in price erosion in the US market. The oversupply of medicines during the pandemic impacted pharma companies’ pricing power and margins. However, strict actions by the USFDA to curb price erosion have provided relief, leading to improved profitability.

💼 Moreover, the pharma sector is set to benefit from upcoming business opportunities. Several drugs with a combined value of $75 billion are scheduled to lose patent protection in the next four years. This opens doors for major players, especially those with a strong presence in the US market, to explore new revenue streams.

⚠️ While pharma stocks are currently thriving, it’s important for investors to stay informed about USFDA actions, especially warnings related to specific manufacturing facilities. Negative developments in this regard could impact the sector adversely.

Also Read: Understanding ESG Investing & Its Emergence in India