Everything you need to know about KIMS Hospitals IPO

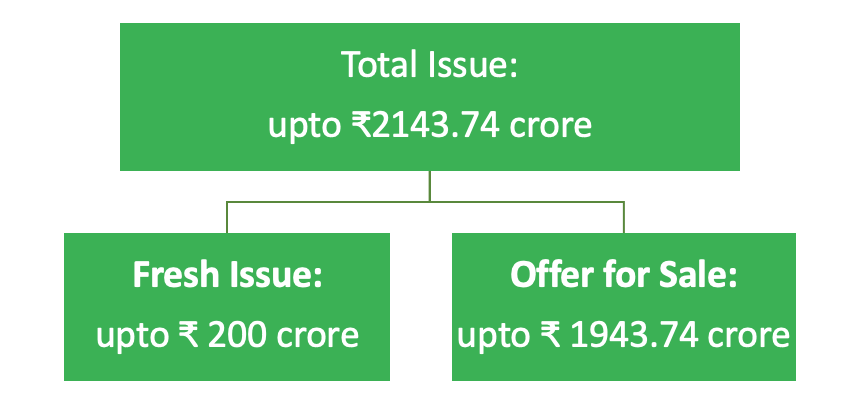

Krishna Institute of Medical Sciences Limited (KIMs Hospital), one of the largest healthcare groups in Andhra Pradesh and Telangana, plans to raise ₹2,143.74 Cr of equity shares through their Initial Public Offering (IPO), as the multi-disciplinary healthcare service provider seeks to repay debt. The 2-day long IPO that opened on Wednesday, 16th June 2021 is due to close on 18th June 2021.

The IPO comprises a fresh issue of shares worth upto ₹200 crore and an offer for sale (OFS) of over 2.35 crore equity shares by the promoters and existing shareholders.

KIMS Hospitals provides multi-disciplinary integrated healthcare services, with a focus on primary secondary & tertiary care in Tier 2-3 cities and primary, secondary, tertiary and quaternary healthcare in Tier 1 cities.

With 9 multi-specialty hospitals, a total of 3,064-bed capacity, and 2,500 operational beds, the company operates with 2.2 times more beds than the second-largest provider in the region, according to the CRISIL Report.

The southern-India-focused healthcare group has also witnessed impressive growth over the past few years, with around one-third of their 3,064 beds being launched in the past 4 years, and over 940 beds in the past 2 years. Overall bed occupancy rates have improved over 2019-2020 from 71.83% to 80.49% and the company generated a profit of ₹ 205.479 cr for the period ended Mar 31st, 2021.

IPO Offer Details

- IPO issue date: June 16th – June 18th 2021

- Face value: ₹10

- Price Band: ₹ 815 – 825

- Minimum Bid Size: 18 shares

- Listing on: BSE and NSE

- Fresh Equity Issue: up to ₹200cr

- Offer for sale: up to ₹ 1,943.74 cr

- Total issue: up to ₹ 2,143.74 cr

- Promoters: Dr. Bhaskara Rao Bollineni, Rajyasri Bollineni, Dr. Abhinay Bollineni, Adwik Bollineni and Bollineni Ramanaiah Memorial Hospitals (BRMH) Private Limited

- Book running lead managers: Kotak Mahindra Capital Company Ltd, Axis Capital Ltd, Credit Suisse Securities (India) Pvt Ltd, IIFL Securities Ltd.

- Registrar: KFin Technologies Pvt Ltd.

After the successful 2-day stake sale, the promoters’ shareholding will drop from 46.81% to 38.84%, and the rest will be held by the public.

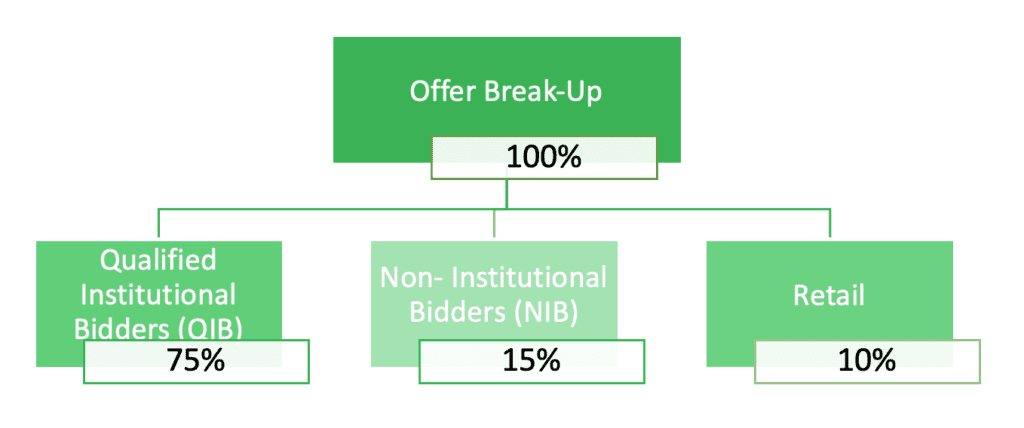

Offer Break-up

The offer is broken up into the following investor classes:

Utilization of Raised Funds

The company announced that all proceeds from the offer for sale, which is worth up to ₹1,943.74 cr, will be received by the selling shareholders and not the company.

Thus, the company plans on utilizing funds worth up to ₹200 cr raised through the fresh issue in the following way:

- The company plans to exempt itself from debt by utilizing ₹150 cr for debt repayment, in an attempt to reduce the company’s outstanding indebtedness and debt servicing costs, maintain a favourable debt to equity ratio and allow utilisation of internal accruals for further investment in business growth and expansion.

- Up to 25% (i.e. ₹50 cr) of the fresh issue will be dedicated to general corporate purposes, such as capital expenditure, joint ventures and acquisitions and business-related expenses.

Business

Originally incorporated in 1973 as ‘Jagjit Singh and Sons Private Limited’, in Mumbai, the company name was changed to ‘Krishna Institute of Medical Sciences Limited’, incorporated in 2004 and was converted to a public limited company and its registered office was changed to AP.

With over 20 years of experience in the field, and record revenues in the region in FY20, “KIMs Hospitals” stands to be a leading, well-recognized company in the region. The company sustains affordable pricing while still generating strong returns by optimizing on costs., a big positive for the company.

One of the largest corporate healthcare groups in AP and Telangana in terms of patients treated and treatments offered, the company focuses on primary, secondary & tertiary care in Tier 2-3 cities and primary, secondary, tertiary and quaternary healthcare in Tier 1 cities. KIMs specializes over a wide range of healthcare services, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopedics, organ transplantation, renal sciences, and mother & childcare.

From a single hospital established in Nellore, AP in 2000, the company grew to a chain of 9 multi-specialty hospitals spread across 9 cities over 2 decades, through organic growth and strategic acquisitions guided by the founder and MD Dr. Bhaskara Rao Bollineni, and CEO Dr. Abhinay Bollineni.

The company has its flagship hospital in Secundarabad – the largest private hospital in India at a single location with a capacity of 1,000 beds. KIMs Secundarabd is the only hospital in AP and Telangana to have an emergency department complying with NABH standards. KIMS Secunderabad was also the second hospital in Hyderabad to install the robotic surgical system, which facilitates complex yet virtually scarless surgeries.

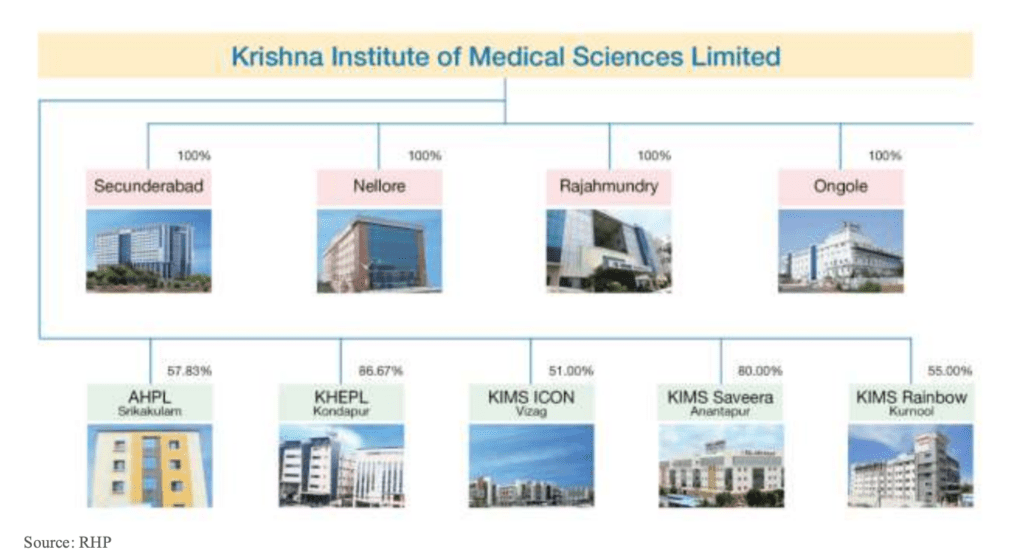

In recent years, the company acquired hospitals in Ongole, Vizag, Anantapur and Kurnool, accelerating the company’s network expansion. The following chart summarizes the corporate structure of the company:

According to the RHP, the company strategically focuses on the southern India healthcare market where they have a strong understanding of regional nuances, customer culture and the mindset of medical professionals and where there is significant and growing need for quality and affordable healthcare services. Each hospital also has integrated diagnostic services and pharmacies that cater to patients.

The company is one of the only 3 hospitals in India to be rated AA by CRISIL.

Growth Outlook

With commendable growth and expansion in the past, the company continues to have a forward-looking growth strategy, targeting potential markets adjacent to the core AP and Telagana markets, including Karnataka (Bangalore and greater Karnataka), Odisha (Bhubaneswar), Tamil Nadu (Chennai) and Central India (Indore, Aurangabad, Nagpur and Raipur).

The company backs expansion by prudent capital investments, with capital expenditure per bed at ₹ 69.1 lakhs for hospitals in Tier 1 cities and ₹ 22.1 lakhs for hospitals in Tier 2-3 cities in FY21. The company plans to remain disciplined with their expansion outlook.

Key Concerns

- High dependence on certain healthcare professionals – the operations and financial results of the company could be adversely affected in case of failure to attract and retain such healthcare professionals.

- High dependence on hospitals in Hyderabad (Telangana) and key specialties that generate majority revenue – any impact on these revenues from these hospitals/specialties can adversely affect business operations and performance.

- Company indebtedness and financing restrictions may limit the company’s ability to grow.

Covid -19 Impact on the Company

An outbreak of the COVID-19 pandemic has led to a substantial decrease in inpatient and outpatient volumes due to the nationwide lockdown implemented on March 25, 2020, quarantines, and other travel-related restrictions. There was also a reluctance to seek healthcare services in hospitals due to a perception of an increased risk of infection when in close contact with healthcare professionals. Medical tourism also stagnated. As a result, the company’s monthly inpatient volume decreased in each month from February to April 2020, reaching 5,460 in April 2020, as compared to 11,653 in January, 2020 – a decrease of 53.15%.

While revenue derived from COVID19 patients have helped to offset the decline in patient volumes in fiscal year 2021, there is no certainty that the business will not be adversely affected if the pandemic were to worsen or last for an extended period of time.

The company is expected to see some adverse impact on business operations in Q1 FY22.

Valuation and Financials

Strong patient volumes, cost efficiency and diversified revenue streams (not more than 25% from a single specialty in past 3 years) have been key to the company’s strong financial performance. High margin services in Tier 1 markets, including organ transplants, oncology and neuro-critical care have driven higher Average Revenue Per Occupied Bed (ARPOB) and Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA).

The company experienced a negative CAGR of 3.96% for their outpatient volume traveling to the hospitals between 2019 and 2020, due to covid 19 travel restrictions. However, this was offset by a 2.31% growth of inpatient volumes, seeking pandemic-related healthcare services, which resulted in overall growth in total income.

At the upper price band of ₹825, and adjusted EPS of ₹ 25.68 for FY21, the P/E ratio is 32.13x. This is relatively cheaper, compared to peers, namely Apollo Hospitals which is trading at a P/E of 238x.

With one of the lowest debt-equity ratios amongst peers and one of the best ROE and ROCE at 23.8% and 24.8% respectively, the company stands out amongst its peers. The company also revealed that, between FY18 and FY21, revenues rose 20.4% annually to ₹132.92 cr, EBITDA rose 114% annually to ₹370.9 cr and PAT rose 105% annually to ₹205.5 cr between FY18 and FY21.

Furthermore, considering FY24 EV/EBITDA of 17x at the upper price band, the stock is valued at ₹1275. This points out to a potential upside gain of 55% from the upper IPO price of Rs 825 per share over the next 24 months.

Recommendation

We believe the company’s diverse revenue composition, strong cultural understanding of their key southern-India market and a good track record of retaining quality healthcare professionals, are key in building KIMs brand image and fueling their growth going forward. Well-equipped with high quality medical infrastructure, the company has already undertaken a significant infrastructure set up cost.

Their expansion plans in Chennai and Bangalore can be financed through internal accruals with minimum debt, however, investors are warned that strong competition in other geographies can potentially depress the company’s financials.

Keeping in mind the expected growth of India’s healthcare sector by 17-18% annually to ₹7.1 lakh cr by FY 24, led by the renewed impetus on Pradhan Mantri Jan Arogya Yojana (PMJAY), we expect a bright future for the company in the coming years. Moreover, changing demographics, increasing health awareness, medical tourism, health insurance coverage and rising income levels will bode well for the company.

Given the forward-looking expansion plans of the company, strong valuations compared to industry peers, and healthy financials, we recommend a subscribe for long-term investing. Investors looking to gain listing benefits can also subscribe (its a high-risk proposition though).