Should you invest in GR Infraprojects IPO?

Gujarat-based GR Infraprojects is cashing in on the IPO frenzy in the market, the question is should you invest?

In this article

- IPO Details

- Utilization of raised funds

- Company and Business Overview

- Company Strengths

- Key Risks

- Peer Comparison

- Valuation and View

2021 is the year of initial public offerings (IPOs). So far 22 companies have raised ₹26,000 crores in the first half of the calendar year 2021 and the latest company to go public is GR Infraprojects Ltd (GRIL).

An integrated road engineering, procurement, and construction (EPC) company from the business capital of India – Gujarat, GR Infraprojects’s IPO is set to hit the market on 7th July and will close for subscription on 9th July 2021.

The public issue will be entirely an offer for sale (OFS) of up to 1.15 crore equity shares by existing promoters and shareholders making the IPO size close to ₹963.28 crores.

With experience in the design and construction of road/highway projects and their recent diversification into the railway sector, the company has had projects across 15 states in India.

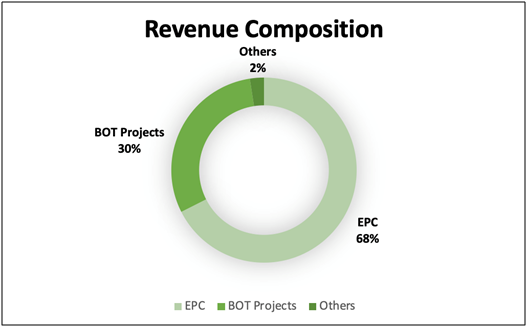

As of March 2021, GRIL had an order book of ₹19,025.81 crores comprising of 16 EPC projects, 10 HAM projects, and 3 other projects. For the year ended March 2021, the company generated a profit of ₹ 953.221 cr, with income and profit growing at 21.85% and 15.33% CAGR respectively between fiscal 2019 and 2021. For fiscal 2021, the company derived their revenue from their business segments with the following composition:

IPO Details

- IPO open from: July 7th – July 9th 2021

- Face value: ₹5

- Price Band: ₹ 828 – 837

- Minimum Bid Size: 17 shares (investment ₹14,229)

- Listing on: BSE and NSE

- Fresh Equity Issue: Nil

- Offer for sale: up to ₹963.28cr

- Total issue: up to ₹963.28 cr

- Promoters: Vinod Kumar Agarwal, Ajendra Kumar Agarwal, Purshottam Agarwal and Lokesh Builders Private Limited

- Book running lead managers: HDFC Bank Ltd, ICICI Securities Ltd, Motilal Oswal Investment Advisors Ltd, Kotak Mahindra Capital Company Ltd, SBI Capital Markets Ltd, Equirus Capital Pvt Ltd.

- Registrar:KFin Technologies Pvt Ltd.

Promoter Holding

The following will be the change in the promoter holding pattern after the 2-day IPO:

| Pre-Offer Promoter Holding | 88.04% |

| Post-Offer Promoter Holding | 86.54% |

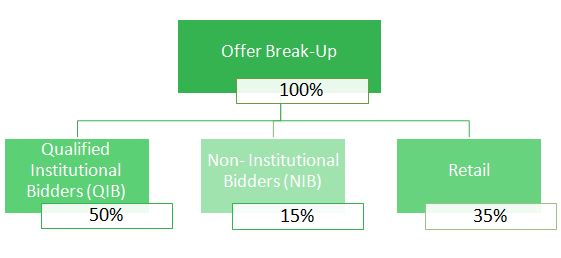

Offer Break-up

The offer is broken up into the following investor classes:

Utilization of raised funds

The entire issue constitutes an offer for sale, which means that the company will not receive any proceeds from the IPO sale. All proceeds will go to the selling shareholders.

The company believes that by listing itself on the Indian stock market (BSE and NSE), it will get enhanced visibility and help in brand building, alongside providing liquidity to its existing shareholders.

Company and Business Overview

Originally incorporated as ‘G. R. Agarwal Builders and Developers Limited’ in 1995, the company went on to acquire the business of M/s Gumani Ram Agarwal, a partnership firm, in the following year. Later in 2007, the Company name was changed to ‘G R Infraprojects Limited.

The company’s key business operations are split into 3 categories:

- Civil and construction activities, that include the EPC services

- Development of roads and highways on a “Build Operate Transfer” BOT basis, including the “Hybrid Annuity Model” (HAM)

- Manufacturing activities – thermoplastic road-marking paint, electric poles, road signage and fabricate and galvanize metal crash barriers.

GRIL primarily focuses on EPC and BOT projects in the road sector and has executed over 100 road construction projects since 2006. As of this date, out of all their BOT projects, the company has one operational road project and 14 road projects awarded under HAM. The company also has experience in constructing state and national highways, bridges, culverts, flyovers, airport runways, tunnels, and rail over-bridges.

The integrated EPC company supports its road construction business with a competent design and engineering team, three manufacturing units at Udaipur, Guwahati, and Sandila for processing bitumen, thermoplastic road-marking paint, road signage, and a fabrication and galvanization unit at Ahmedabad for manufacturing metal crash barriers and electric poles. As of March 31, 2021, their equipment base comprised over 7,000 construction equipment and vehicles, and the aggregate gross block value of the company’s property, plant, and equipment was ₹1,999.92 cr.

GRIL has gradually increased execution capabilities in terms of the size of projects. One of their first projects had a bid cost of ₹ 2.650 cr, while their latest project had a bid cost of ₹2,747.000 cr.

Company Strengths

- Focused EPC player with road projects focus

- Established track record of timely execution

- In-house integrated model – delivery of project from conceptualization until completion with in house key competencies and resources.

- Robust financial performance and credit rating – EBITDA has grown at a CAGR of 20.08% from Fiscal 2019 to Fiscal 2021.

The company also holds a top rank among key EPC players for the following

- fastest growth in operating income over a period of 5-years from Fiscal 2015 to 2020 at a CAGR of 47%

- highest increase in EBITDA over a period of 5-years from Fiscal 2015 to 2020 at a CAGR of 63%

- highest net profit of ₹ 6,887 million in FY 20

- highest return on capital employed (ROCE) of 32.2% in FY 20

- highest Return on Equity (ROE) at 27.8% in FY 20

- Experienced Promoters with strong management team – promoters have over 25 years of experience in the construction industry.

- CRISIL upgraded GRIL’s long-term rating from CRISIL AA-/Positive to CRISIL AA/Stable.

Business Strategies

- Continued focus on the road EPC business.

- Pursue other segments within the EPC space.

- Leverage core competencies with enhanced in-house integration.

- Strengthen internal systems and continue to focus on technology and operational efficiency.

- Financial discipline coupled with strategy to monetise assets.

Key Risks

- High debt can put the company under stress – The company has taken large amounts loans to finance their capital-intensive projects. Failure to meet any obligations or conditions of these financial agreements could adversely affect their ability to conduct business and operations.

- Major revenues come from civil construction contracts – Failure to obtain new contracts on termination of current contracts could adversely affect their financial condition.

- Major revenue derived from a limited number of government entities – The company is primarily dependent on road projects in India undertaken or awarded by governmental authorities and other entities funded by the GoI or state governments. Any changes in government policies may lead to our contracts being foreclosed, terminatedor renegotiated, which may have adverse effects on their business and operations.

- Competitive bidding process – The company’s projects are awarded through a competitive bidding process. While so far it received a fair amount of projects, but there’s no guarantee it would qualify and win future projects, which could adversely affect their business operations.

- Capital-intensive and leveraged business model – Insufficient cashflows to meet required obligations on debt contracts and working capital requirements could adversely affect their business and operations.

Covid-19 impact on business

The continuing effect of Covid-19 on the company’s business and operations remains highly uncertain. Covid-19 could potentially affect the business based on various factors:

- Ability of various parties involved like contractors, manpower and raw material suppliers to carry out their work effectively in a timely manner or at all.

- Ability of the government to contain the pandemic, thereby allowing economic activity and accordingly allowingthe company to continue with construction projects.

- Ability to ensure the safety of workforce and continuity of operations while conforming with measures implemented by the Government, which may result in increased costs.

- Temporary shutdown of manufacturing facilities due to government restrictions in connection with COVID-19.

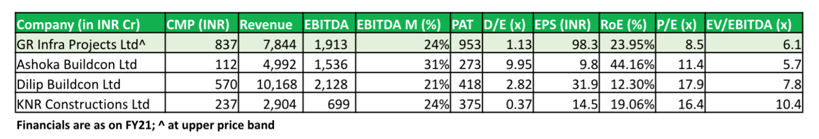

Peer Comparison

Here is a comprehensive comparison of GR Infra to industry peers to provide a better understanding of the company’s financials and returns in a wider context.

Valuation and View

At the upper price band of ₹837, the stock is trading at an EV/EBIDTA multiple of 6.1(x) to its FY21 EBIDTA of ₹1913 cr.

We believe the company has a strong order book and good execution supported by its balance sheet. The cost competitiveness backed by strong ratios is a key component of their success. They have low execution costs, which is partly attributable to their integrated operations and investment in technology. Further, the scale of their operations provides them with a significant advantage in reducing costs and sustaining their cost advantage which helped them in developing a superior ratio than peers. We are expecting the company to trade at a premium to its peer’s post listing.

Moreover, the roads sector accounted for 49% of total investments in the infra industry over 2015-2019. According to the CRISIL report, private construction investments in national highways are expected to increase 2x to ₹ 1.5 trillion (₹150,000 cr) over fiscal 2021-25 compared with the previous five years. Keeping this in mind, we believe the Road EPC industry and GR Infra have an optimistic future up ahead.

Since there are limited government entities, who also account for the majority of their clients, it is crucial for GR Infra to maintain long-term relationships with their clients to consistently acquire projects going ahead. Indeed, the company strives to form and maintain long-standing relationships with clients including the National Highways Authority of India, Ministry of Road Transport and Highways, Public Works Department, Government of Rajasthan, and Rajasthan State Road Development Corporation, and we expect this to stand in favor of the company in the long term.

Considering the long-term, forward-looking outlook of the company and the bullish future of the construction industry, we recommend a SUBSCRIBE for long-term investing.

Investors with an appetite for risk can also consider this IPO for seeking listing gains, although we believe it’s a gamble and investors should look to invest in fundamentally strong companies with a long-term outlook.