No Chill for Netflix, Holcim Mulls Exit, and $ Index Hits 101 | Weekly Market Wrapup 22 Apr.

In this article

- News

- What to expect from the markets

- Market Outlook

- Stock Recommendation

- Key Results

- Quick Bites

- IPO Corner

- Sustainability Corner

Market Commentary

After witnessing a stellar performance in 2020 and 2021 by adding at least 36 and 18 million subscribers in a year, Netflix sent shockwaves in the market this week. It has declared that it has lost over 2,00,000 subscribers in 1 quarter. Was it due to return-to-work, rising inflation, or password sharing? What do you think?

Holcim, a Singapore-based, global cement giant has now declared that it will be selling off its stake in Ambuja and ACC cement. It owns 63% of Ambuja Cements, and Ambuja owns 50% of ACC. Additionally, Holcim holds 5% in ACC. The news will have a ripple effect on several sectoral players. The dollar index hits 101 for the first time in 2 years.

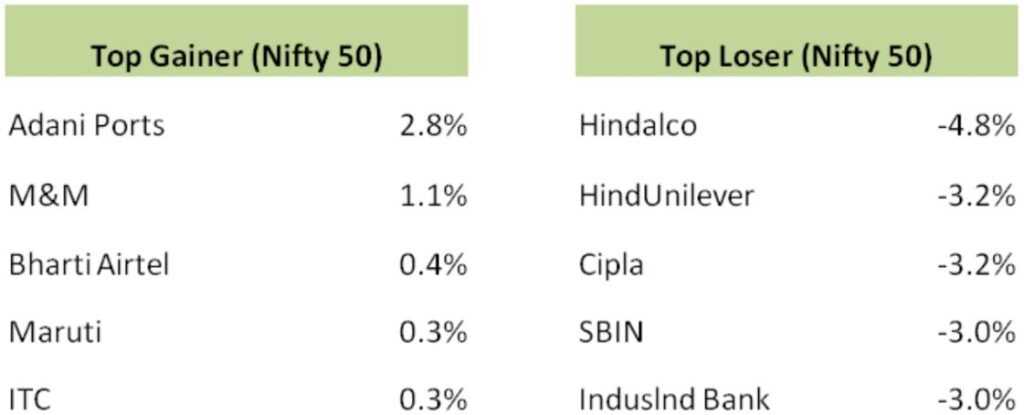

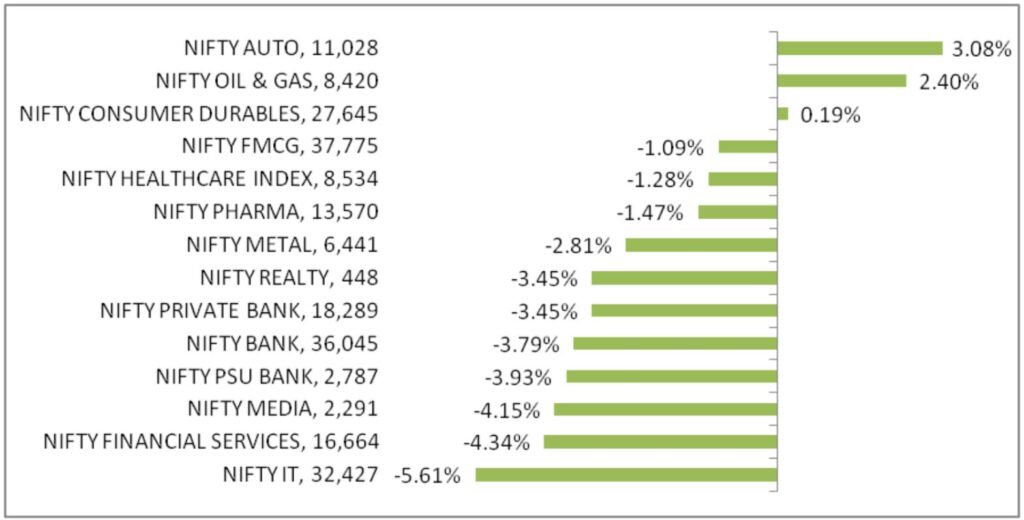

Nifty closed the week with a 1.74% loss and ended at 17,172, losing 304 points. BSE Sensex ended the week at 57,197 and Bank Nifty lost 3.79% during the week, ending at 36,045.

Most sectoral indices were down in the week, with the Nifty

IT and Financial Services leading the pack at 5.6% and 4.3%. Nifty Auto and Oil and Gas were the only gainers with 3.08% and 2.4%.

📊What to Expect from the Markets

-Mr. Abhishek Jain, Research Head, Arihant Capital

Global markets continue to face pressure, selling accelerated after Jereme Powell’s announced a 50 bps hike from May. Globally, investors have been withdrawing funds from equity regularly. Indian markets closed with negative momentum dragged by losses in information technology, banking, and reality. This is a reaction to global sentiments and March quarter earnings. The market declined for three out of the five sessions, weighed down by inflation concerns and the lowering of growth estimates by IMF. Geopolitical tensions and supply issues caused by volatility in crude oil prices also weighed in on sentiment.

Most of the sectoral indices ended on a negative note. We witnessed selling in banking stocks amid concerns about higher interest rates (which can put pressure on NIMs). Selling continues in IT stocks over concerns about their growth and margins.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst

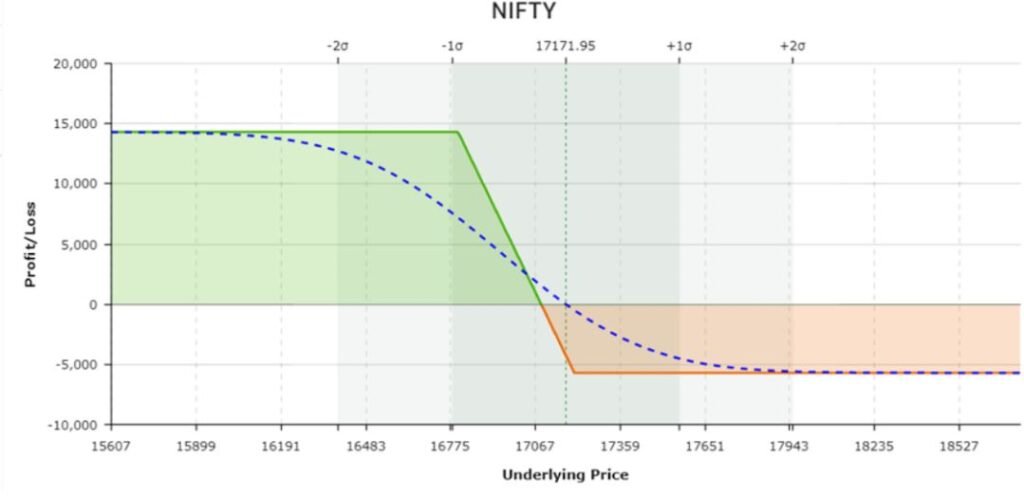

Nifty

The daily chart of the Nifty closed below 200 SMA, and the weekly chart shows a “Doji” formation. Looking at this, we feel the market may consolidate with some pressure from a higher level. If it crosses the 17,250 level, it may bounce towards 17,400 and 17,550. But, if it crosses below the 17,025 level, it can test 16,900 and 16,700 levels.

Bank Nifty

Bank Nifty’s daily chart shows a supply area near the 200 SMA and the weekly chart shows a breakdown of a lower channel line. The technical chart of Bank Nifty looks weak, and traders need to be cautious from higher levels. This week, Bank Nifty futures closed at 36,039 levels. In the coming trading sessions, if it holds below 35,800, then weakness could take it to 35,500 and 35,200 levels. Minor resistance on the upside is capped around 36,500-36,800 levels.

💰Stock Picks

From the Fundamental Desk

-Mr. Abhishek Jain, Research Head, Arihant Capital

Investors can do bottom fishing in insurance and power stocks. Power demand has been robust and is expected to remain strong in the near term. One can add power generation & distribution companies’ stocks in tranches. Stocks like NTPC look interesting in weakness. On the banking front, we are positive about the Micro Finance Institutions space and advice buying in Bandhan Bank, Equitas Holdings, Ujjivan Financials, Credit access Gramin & Spandna.

A small-cap stock Hari Om Industries, which recently got listed on the market, can also be added in tranches. The company has a good capacity expansion, backward integration & product profile. We are estimated company to post PAT of ₹90 crores by FY25. And currently, the stock is available at 6x its FY25 valuations.

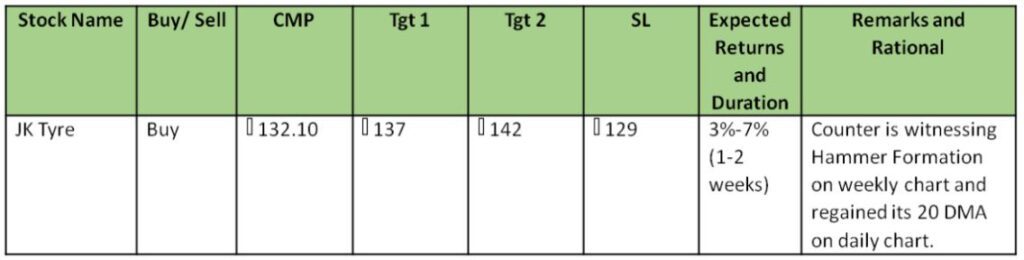

From the Technical Desk

-Kavita Jain, Head Learning and Senior Research Analyst

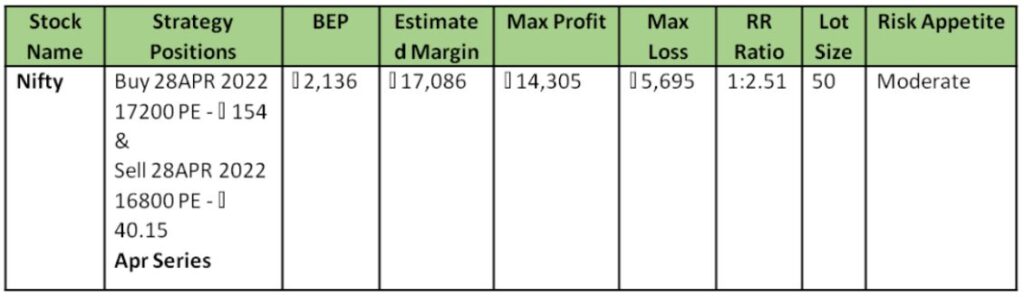

🏷️Options Hub

-Kavita Jain, Head Learning and Senior Research Analyst

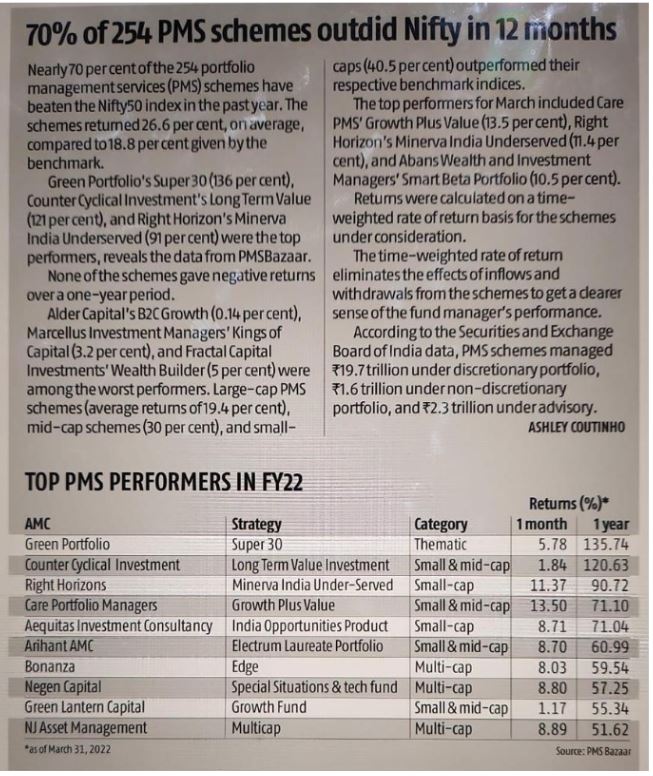

Want to invest and generate exceptional returns? Explore our PMS proposition now.

📝Key Results

- Infosys 4Q Net Income rose 12% Y/y to ₹56.9b, Misses estimated ₹60b. Revenue rose 23% Y/y to ₹322.8b.

- HCL Tech reported a consolidated net profit of ₹3,593 crores for Q4’22, up 226% from Q4’21. Consolidated revenue rose 15% to ₹22,597 crores against the year-ago period. The board has declared an interim dividend of ₹18 per equity share for FY 2022-23.

- L&T Technology Services reported a consolidated (PAT) of ₹262 crores for Q4’22, an increase of 34.7% from Q4’21.

- ICICI Lombard General Insurance Company reported a 10% decline in net profit at ₹313 crores for Q4’22.

- L&T Infotech’s net profit rose 17% year on year to ₹637.5 crores for the quarter ended March 2022.

- ACC posted a 29.5% yearly fall in consolidated net profit to ₹396.33 crores for Q4’22.

- Nestle India’s net profit fell 1.25% YoY to ₹594.71 crores in Q4. Revenue from operations increased 10.24% to ₹3,980.70 crores over Q4’21.

- Mindtree reported 49% Y/y growth in Q4 net profit at ₹473 crores.

- Wendt India has recommended a final dividend of ₹45 per share.

- Tata Communications posted a 22% growth in consolidated profit at ₹365 crores for Q4’22.

- ICICI Securities reported a 3% growth in PAT at ₹340 crores for Q4’22.

🔎Quick Bites

Global

- Powell says taming inflation is absolutely essential, a 50 basis point hike is possible in May.

- Covid curbs tightened in Shanghai, lockdown till April 26.

- World Bank estimates Ukraine infra damage at $60 B so far.

- World Bank cuts South Asia growth forecast on geopolitical risks.

- Indonesia to ban palm oil exports to curb the rise in domestic prices.

- Netflix stock sank 35% — wiping out $50B in market cap — a day after it reported a surprise subscriber loss.

- Sri Lankan inflation increased to 21.5% in March 2022. Frequent power cuts in Sri Lanka have disrupted the production of key exports.

Economy

- India’s WPI hit a four-month peak of 14.55% in March, mirroring the hike in global commodity prices.

- IMF cuts India’s GDP forecast for FY 2023 to 8.2% due to global setbacks from looming war fears.

- India’s diesel and gasoline sales sink as a result of price hikes.

Energy and Infrastructure

- Power cuts in India, and blackouts in several regions in TN.

- Indraprastha Gas Ltd to build a gas distribution network in 3 districts of Uttar Pradesh.

- RailTel Corporation of India has received a ₹11.57 crore work order from RVNL to install MPLS and VPNs at 33 locations.

- SJVN to get a loan of ₹500 crores for setting up a 66 MW hydroelectric project in Himachal Pradesh.

- Adani Harbour Services to acquire marine services provider Ocean Sparkle Ltd for ₹1,530 crores.

- NTPC has partnered with Delhi Jal Board to convert sludge produced in sewage treatment plants into energy.

- Coal inventories held by Indian power plants are very low and could result in power outages: Nomura.

- The Adani Group to invest ₹10,000 crores in West Bengal over the next decade.

- Inox Wind to raise ₹402 crores via preferential shares.

- Sterlite Power has acquired a 64.98% stake in Maharashtra Transmission Communication Infrastructure Limited (MTCIL).

- NBCC bagged orders worth ₹981.17 crores in March 2022.

- Man Infra has bagged an order worth ₹402 crores, from Bharat Mumbai Container Terminal Private Limited (BMCTPL).

- Reliance buys 15 million barrels of Russian oil.

- Motilal Oswal real estate lines up to over ₹2,000 crores for housing and office projects.

Industry

- Tata Steel to consider share split on May 3. Tata Steel has stopped sourcing raw material from Russia.

- JCB to invest ₹1,000 crores in setting up a dedicated exports facility in Vadodara, Gujarat.

- L&T to become a knowledge partner for the Indian Navy.

- SIDBI approves ₹600 crores for industrial cluster development in Maharashtra.

IT and Telecommunications

- ITC to acquire a 10.07% stake in Blupin Technologies Pvt Ltd.

- Airtel-backed OneWeb and New Space India Ltd., partner for satellite launch.

- Summit Digitel to provide its tower infrastructure for Airtel’s wireless network rollouts.

- Infosys acquires oddity, Germany-based digital marketing, experience, and commerce agency.

- TCS, Infosys, and HCL hired 198K employees amid robust growth and alarming attrition.

Automobile

- India’s March passenger vehicle sales fall 3.9% Y/y, SIAM.

- Jwalamukhi Investment has sold 3.3 million shares of TVS.

- TVS Motor Company invests ₹995 crores in Britain’s motorcycle brand Norton Motorcycles, which it acquired in April 2020. It also bought a 1.81% stake in Rapido.

- Tata motors hikes price (effective 23 Apr) in response to rising input costs.

- Nissan discontinues Datsun brand in India.

Banking and Finance

- RBI has Approved ₹1.76 mn on gold loan lender Manappuram Finance Ltd for non-compliance with the central bank’s norms.

- Dhanlaxmi Bank signs MoU with the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC) for tax collection.

- HDFC inks pact to sell 10% stake in HDFC Capital Advisors for around ₹184 crores.

- SBI has raised 3-year funds worth $500 million through a syndicated loan facility.

- Your EMIs got a little more pricey as SBI hikes MCLR by 10 bps. ☹

- Bank of Baroda to push to increase its digital share in new loans.

Other

- Holcim to exit India’s cement industry, it holds a 60%+ stake in Ambuja Cement and a significant stake in ACC. Its exit may narrow the imbalance in the cement market and aid pricing power.

- Bank of India initiates insolvency process on Future Retail. Future Enterprises has defaulted on a payment of ₹29.33 crores as interest on non-convertible debentures (NCDs). Lenders rejected a proposal to sell its retail, wholesale, and logistics assets to Reliance Retail Ventures Ltd after the Reliance Industries Ltd unit cut the deal value.

- CBI Files case against S. Kumars over alleged fraud.

- Serum Institute of India stopped making fresh batches of vaccine shots after its stockpile grew to 200 million doses.

- Reliance Retail will launch a new format called “Swadesh” that will sell handmade textiles, handicrafts, agriculture items, and other products sourced directly from artisans.

- Burman Group has increased its holding in Eveready Industries to 20.18%.

- Reliance Brands wants to acquire a 51% stake in Abu Jani Sandeep Khosla.

- VRL Logistics partners with Ratna Cements for the transfer of Wind Power on a slump sale basis.

- Zomato has started testing its 10-minute food delivery in Gurugram, as per media reports.

- ITC to do partial price increases on its dairy products due to rising input costs.

- Cement prices may rise by ₹25-50 per bag due to the rising input costs caused by the Russia-Ukraine conflict.

- Pfizer’s game-changing Covid 19 pill paxlovid gets DCGI nod.

- Nykaa goes shopping, acquires a stake in Earth Rhythm 18.51% for ₹41 crores, 60% stake in Nudge Wellness for 3.6 crores; acquired KICA for 4.51 crores. It has also announced its plans to partner with Onesto Labs to create a new category of nutraceuticals.

- Reliance retail acquired an 89% stake in Clovia.

- ED attaches Amway assets worth ₹757 crores and says the company is running a pyramid fraud.

- Biocon Bio to raise $1.2 billion overseas loans for the Viatris deal.

🚀IPO Corner

- Prasol Chemicals, Senco Gold, and Kanye’s Technology India have filed their draft documents for IPO with SEBI.

- The size of the LIC IPO may be decreased to ₹21,000 crores. There may be a greenshoe option of ₹9,000 crores taking the total IPO size to ₹30,000 crores.

- Campus Activewear has set the IPO price band at ₹278-292 per share. The IPO will be open for subscription between April 26 and 28 and the total issue size is ₹1,400 crores.

- Rainbow Children’s Medicare IPO will be open for public subscription between April 27 and 29; Its price band is set between ₹516 and 542 and the total issue size is 1,595 crores.

- HealthifyMe mulls raising funds via IPO with a ₹200 million ARR.

🔌Sustainability Corner

- India seeks bids for building a 1GWh battery energy storage system.

- Dabur India to make 80-90% of their last-mile distribution fleet across India powered by EVs. It plans to become a carbon-neutral company by 2050.

- Tata renewable unit raises $525 million from overseas funds.

- Nykaa announced the acquisition of an 18.51% stake in clean beauty brand Earth Rhythm for ₹41.65 crores.

- Zomato announced 100% ‘plastic neutral deliveries’ from this month.

- NITI Aayog has released a draft battery swapping policy.

- Hero Electric has partnered with Bolt to set up 50,000 charging stations in the country in the next year.

- SJVN to get a loan of ₹500 crores to set up a 66 MW hydroelectric project in Himachal Pradesh.

- The water & effluent treatment business of L&T Construction has been awarded ‘significant’ contracts.

- OIL India commissions India’s first pure green hydrogen plant in Jorha

- Dousing the fire: Okinawa to recall over 3K praise Pro e-scooters, Ola Electric recalls 1441 electric 2 wheelers

- CESL steps up initiatives to drive EV adoption. 7 financial institutions will ease the distribution of loans for EVs

- Kia plans to make small electric SUV in India

- LML electric to form JV with Germany’s eROCKIT

- Kia forays into the Indian EV market with EV6, with bookings to open on May 26, The company currently sells models like Seltos and Sonet in India and plans to sell only 100 units of EV6 in the country. Honda to Maruti, carmakers eye strong mid-size hybrids to ease the switch to EVs.

- India’s largest scooter maker Honda two-wheelers plans to enter e-scooters, e-motorcycles

- Ashok Leyland’s arm Switch Mobility lines up £300-million in electric vehicle investment to develop its range of electric buses and light commercial vehicles.

- Tata Motors to launch 4 new electric cars, and SUVs in India by 2024. The company has announced to have 10 EVs in the portfolio by 2026.

That’s all for now folks! See you next week!