Russian Bear Makes the Markets Plunge; Bulls Awaken as the Week Ends

In this Weekly Market Newsletter:

- Market wrap-up

- What to expect next week

- Market Outlook: Technical Nifty & Bank Nifty Outlook

- Stock Recommendations

- Quick Bites: Key headlines of the week

- IPO Corner

- Sustainability Corner

Phew! What a week! When we started this week, the Russian bear was all set to attack Ukraine, while experts all over the world were speculating what it will do next. In a remarkable move, Russia declared a “special military operation” in Ukraine & started the biggest war in Europe since World War II.

The threat of a looming war had caused stock markets to remain volatile through the past weeks. As the war has begun, the benchmark indices plunged to a deep low however they made a sharp recovery on Friday.After a week of volatility Nifty ended the week 618 points lower (-3.58%) at 16,658.40. Sensex had plunged to a low of 54,439 points only to end the week at 55,858 1,974 points lower (- 3.41%) than the last Friday’s close. Bank Nifty ended the week at 36,430 down 1,168 points from last week’s closing a net fall of 3.11% after recovering from a dip below 35,000 points.

All sectoral indices ended on a negative, Nifty Media and Nifty Oil & Gas faced the most pressure with the Nifty Media index being the biggest sectoral laggard facing the highest loss of -7.68% followed by Nifty Oil & Gas (-6.29%) and Nifty PSU Bank (-5.71%).

The top gainer of the week was Kotak Bank up by 30.15 points (1.7%) followed by Cipla (1.6%), Power Grid, and Hindalco both up by 0.8%. Top Losers were BPCL (-9.9%); UPL (-9.7%); Grasim (-9.0%) HDFC Life (-8.8%) and SBI Life (-8.2%)

What to Expect From the Markets?

Mr. Abhishek Jain, Arihant Capital’s Research Head

Like domestic markets, global markets have also witnessed smart recovery in the latter part of the week as an indication from world leaders that the Russia – Ukraine crisis won’t escalate. This is due to the hesitation of European countries to engage in direct war with Russia.

We have witnessed in the past also, “buy the fear” has done wonders for investors and we continue to believe in this strategy. Investors should avoid leverage at current levels.

We believe one needs to have a stock-specific approach and use weakness to add stocks that are available at an attractive valuation. 16000-16500 levels are a good level to enter for selective stocks. We continue to like divestment, FMCG, financials, and infrastructure themes. Selective buying can also be done in the hospitality sector. Among the midcaps, one can add Ujjivan Financial Services with a price objective of 300 in the next 18 months.

The market would also be looking at events like the UP elections next month, which would act as an acid test for the current government.

🔭Market Outlook

Mr. Ratnesh Goyal, Senior Research Analyst

Nifty Outlook

In the daily chart of Nifty, it is trading below 200 SMA and giving a breakdown of the “descending triangle” pattern. It formed the “rising wedge” formation in its weekly chart. Analyzing them together, the Nifty may show the sell on rising movement and investors still need to be cautious from higher levels. If Nifty Futures crosses the 16,850 level it may see a bounce towards 17,050 and 17,200 levels, while on the downside support if it crosses below 16,400 then it can test 16,100 and 15,700 levels.

Bank Nifty

Bank Nifty is trading below 200 SMA in its daily chart. The weekly chart, it has given a breakdown of “lower trendline” candle formation. Analyzing them together we conclude that Bank Nifty may also follow the sell-on-rising movement and still we need to be cautious from a higher level. This week Bank Nifty Futures closed at 36,476 levels. In the coming trading session, if it holds below 36,200 then weakness could take it to 35,800 and 35,500 levels whereas minor resistance on the upside is capped around 38,050-38,200 levels.

From the Technical Desk

Technical Stock Picks from Sr. Equity Research Analyst Kavita Jain’s Desk

BUY GNFC TGT 575/580 SL 530

The counter is moving above all its important moving averages on the weekly chart and has formed Pin Bar candlesticks formation. On the daily chart, it has regained its shorter moving average and is witnessing island cluster form.

💰Options Hub

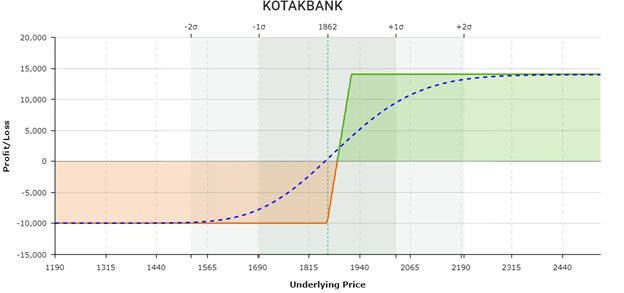

A. BULL SPREAD STRATEGY KOTAK MAHINDRA BANK –

For Moderate Risk Appetite Traders

| Buy 1,860 CE @60.55 | Sell 1,920 CE @35.70 |

| Max Profit | 14,060 |

| Max Loss | 9,940 |

| BEP | 1,885 |

| Risk Reward | 1:1.41 |

B. NAKED CALL OPTION :

For High-Risk Appetite Traders

Buy 1,900 CE CMP 43.20 TGT 55/67 SL 20

📺Quick Bites

Few Headlines That Should Be on Your Radar

- Niti Aayog chief says “At 9.2% India is among the fastest growing large economies”.

- FDI shrunk by 44% in Oct-Dec quarter.

- Vodafone raises ₹1,443 crore by selling 2.4% in Indus Towers. Bharti Airtel all set to acquire 4.7% stake in the cell tower firm.

- Ministry of Defense & Bharat Electronics sign deal of ₹1,075 crore for the commander sight of battle tanks-T-90.

- Apollo Hospitals to replace Indian Oil Corporation in benchmark Nifty 50. Zomato, Paytm, Nykaa to be included in Nifty Next 50 index from March 31.

- IndianOil becomes retail business partners for Dabur; LPG distributors to sell FMCG products

- Airtel likely to raise upto ₹5,000 crores via Rupee Bonds to refinance debt and strengthen balance sheet ahead of 5G spectrum auction.

- Airtel acquires strategic stake in Aqiliz, Blockchain-as-a-Service (BaaS) company to enhance its adtech, digital entertainment and digital marketing offerings.

- Central government and Panacea Biotec to jointly develop new Covid-19 vaccines.

- Cipla gets nod Central Drugs Standard Control Organization to conduct local trials on Paxlovid – oral antiviral covid-19 medication.

- Hinduja Global bagged a contract worth ₹2,100 crore by the UK Health Security Agency to provide critical customer support to UK citizens.

- JSW Ispat has completed acquisition of 100% equity share capital of Mivaan Steels Ltd.

- Minda has acquired stakes in four partnership firms including YA Auto Industries (87.5%), Auto Components (95%), Samaira Engineering (87.5%) and S.M. Auto Industries (87.5%).

- IFCI approves allotment of preferential shares to government to infuse ₹100 crore.

- Bharat Forge along with BF Industrial Solutions to acquire JS Autocast Foundry India.

- LIC looks to make IDBI an agent for LIC Housing Finance.

- Mahindra & Mahindra Financial Services Ltd (MMFSL) is looking to double the assets of its Sri Lankan subsidiary Ideal Finance Ltd to Rs 16 billion over three-five years.

- SC rules Rajasthan discoms must pay $405 mn compensatory tariff to Adani Power

- Wipro invests in Palo-Alto based startup vFunction, which has developed a scalable, AI-based technology platform for modernizing Java applications and accelerating migration to the cloud. It will invest $1 billion over the next three years.

- Deutsche Bank has moved the National Company Law Tribunal to block ArcelorMittal’s ₹4,000-crore takeover of Uttam Galva Steels under the Insolvency and Bankruptcy Code.

- Ujjivan SFB ties up with Hero MotoCorp for two-wheeler financing.

🚀IPO Corner

- LIC is holding 7-8 roadshows daily for potential investors. It is going ahead with the IPO despite the market turmoil. The government is reportedly looking to woo around 180 institutional investors for the LIC IPO and is also considering FDI in the IPO.

- Yummilicious IPO on the cards – Bikaji Foods International files DRHP for ₹1,000 crore IPO.

- Swiggy eyes $800 million IPO early next year.

- Archean Chemicals, a leading specialty marine chemical manufacturer files DRHP for ₹2,000 crore IPO

🔌Sustainability Corner

- Aaditya Thackeray and BMC launch dedicated EV cell in Mumbai, with target of 1,500 EV charging stations and increase EV penetration by 10%.

- Hero Motocorp and BPCL tie up to set up charging infrastructure for 2 Wheelers ahead .

- Tata power ranks among top 20 companies under the Indian corporate governance scorecard 2021 which is built around the G20/OECD Principles of Corporate Governance.

- Hero Electric partners with IDFC First Bank for vehicle finance

- IIFL Home Finance has signed a $68 million loan with Asian Development Bank (ADB) to improve funding for affordable green housing for lower-income groups in India.

- Ashok Leyland mulls separate plant for EVs; lines up ₹500 cr investment for powertrains and alternative fuel technology for its commercial vehicles range

- Ola Electric plans 50Gwh India battery plant in EV push to produce 10 M electric scooters.

- Tata Power’s subsidiary PPGCL signs MOU with ZaaK Technologies GmbH to jointly establish India’s first Lypors pilot manufacturing plant. Lypors will be a game-changer in turning thermal power ash into a useful and sustainable product.

- Tata Power to explore joint development of offshore wind projects in India with Germany-based RWE Renewable GmbH.

- Adani Enterprises signs MoU with Ballard Power Systems to evaluate a joint investment case for the commercialization of hydrogen fuel cells in various mobility and industrial applications in India.

That’s all for now folks! We will be back with new market insights next week!