Mankind Pharma Limited IPO is live. Should you Invest?

Mankind Pharma Limited IPO is live. Should you Invest? Find out here.

In this article

📃About Mankind Pharma Limited IPO

Incorporated in 1991, Mankind Pharma Limited develops, manufactures, and markets pharmaceutical formulations across various acute and chronic therapeutic areas and several consumer healthcare products. In India, the business is active in a number of acute and chronic therapeutic fields, including anti-infectives, cardiovascular, gastrointestinal, anti-diabetic, neuro/CNS, vitamins/minerals/nutrients, and respiratory.

It has over 36 brands, including Manforce (Rx), Moxikind-CV, Amlokind-AT, Unwanted-Kit, Candiforce, Gudcef, Glimestar-M, Prega News, Dydroboon, Codistar, Nurokind-Gold, Nurokind Plus-RF, Nurokind-LC, Asthakind-DX, Cefakind, Monticope, Telmikind-H, Telmikind, Gudcef-CV, and Unwanted-72, among them. Mankind Pharma has one of the largest distribution networks of medical representatives in the Indian pharmaceutical market. Over 80% of doctors in India prescribed their formulations and has been ranked number 4th in terms of domestic sales during the Financial Year 2022.

The company has earned numerous awards and recognitions and including The Best of Bharat Awards 2022 by exchange4media in the year 2022, and Silver Medal from National Awards for Manufacturing Competitiveness Assessment 2021 instituted by International Research Institute for Manufacturing.

Mankind has a pan-India marketing presence, with a field force of 11,691 medical representatives and 3,561 field managers, as of December 31, 2022. They operate 25 manufacturing facilities across India and had 4,121 manufacturing personnel as of December 31, 2022.

As of December 31, 2022, the Company had a team of over 600 scientists and a dedicated in-house R&D center with four units located in IMT Manesar, Gurugram, Haryana and Thane, Maharashtra.

💰Issue Details of Mankind Pharma IPO

- IPO open from 25 April 2023 – 27 April 2023

- Face value: ₹1 per equity share

- Price band: ₹1026 to ₹1080 per share

- Market lot: 13 shares

- Minimum Investment: ₹14,040

- Listing on: BSE and NSE

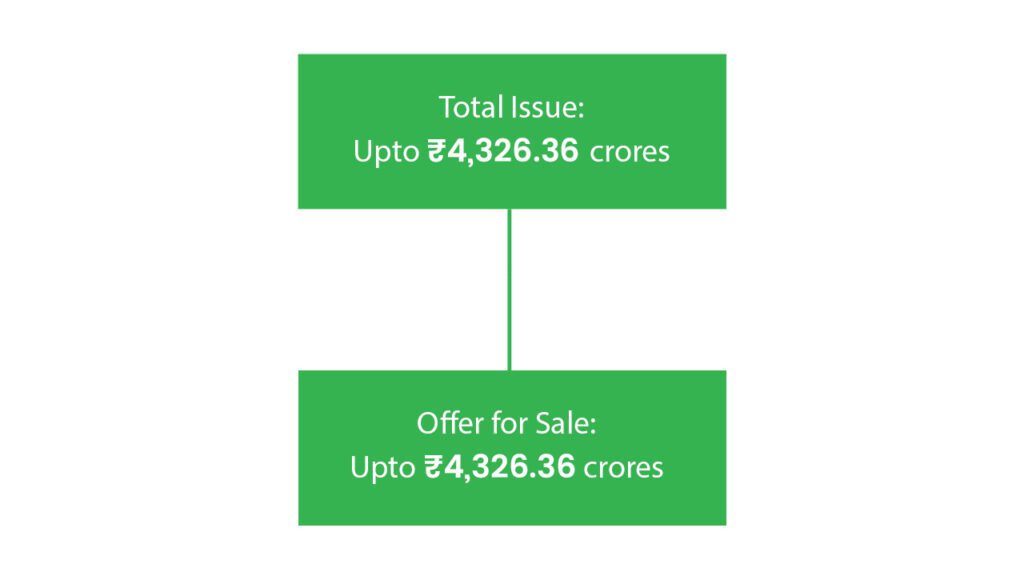

- Offer for sale: Fresh Issue ₹4326.36 Cr (OFS of Rs.4326.36 Cr)

- Registrar: KFin Technologies Limited

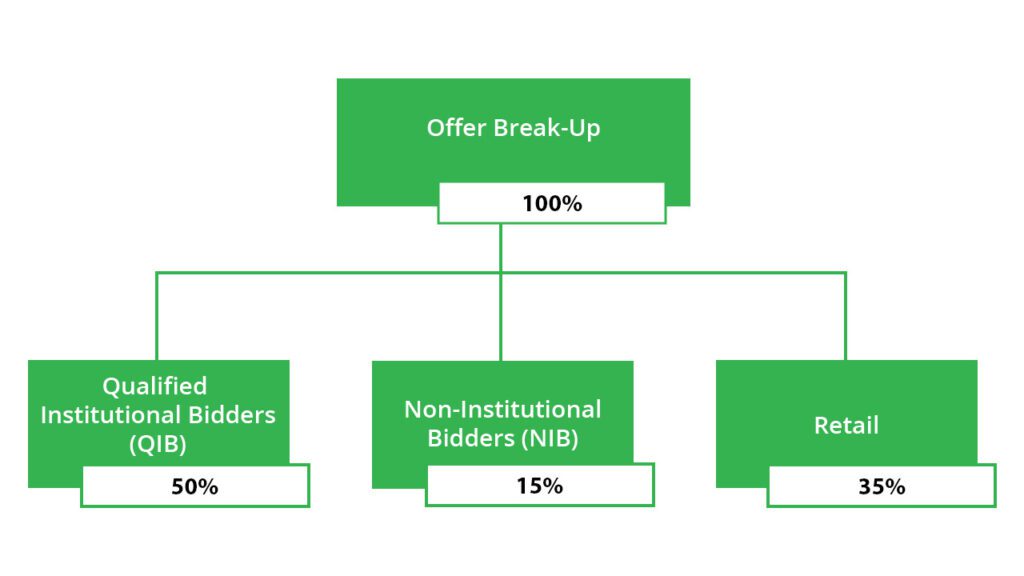

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the net proceeds from the fresh issue towards the following objects:

- The company will not receive any proceeds from the Offer and all the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- Scaled domestic-focused business with potential for further growth

- Diversified portfolio with market-leading rankings across key therapeutic areas

- Experienced and professional management team backed by private equity investors

- Established and growing consumer healthcare franchise with brand recall

🧨IPO Risk

- They are dependent on third-party transportation providers for the transportation of raw materials and outsourced finished formulations and delivery of their products.

- They derive a significant portion of their revenue from operations from a limited number of markets

- Fluctuations in interest rates, and the exchange rate could adversely affect their results of operations.

- They are subject to extensive government regulations which are also subject to change. If they fail to comply with the applicable regulations prescribed by the governments and the relevant regulatory agencies, their business, financial condition, cash flows and results of operations will be adversely affected.

⚖️Peer Companies

- Sun Pharmaceuticals Industries Limited

- Cipla Limited

- Zydus Lifesciences Limited

- Torrent Pharmaceutical Limited

- Alkem Laboratories

- JB Chemicals & Pharmaceuticals Limited

- Eris Lifesciences Limited

- Ipca Laboratories Limited

- Abbott India Limited

- GlaxoSmithKline Pharmaceuticals Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹5073.29 | ₹5975.65 | ₹1056.15 |

| 31-Mar-21 | ₹6372.63 | ₹6385.38 | ₹1293.03 |

| 31-Mar-22 | ₹9147.74 | ₹7977.58 | ₹1452.96 |

📬Also Read: Sustainable Investing in India: ESG Investments