Should you Invest in Syrma SGS Technology Ltd IPO?

Syrma SGS Technology IPO is live now. Should you apply? Find out here.

In this article

About Syrma SGS Technology

- Incorporated in 2004, Syrma SGS Technology Limited is a Chennai-based engineering and design company engaged in turnkey electronics manufacturing services (“EMS”).

- It specializes in precision manufacturing for diverse end-use industries, including industrial appliances, automotive, healthcare, consumer products and IT industries.

- According to F&S Report, Syrma SGS is one of the fastest growing Indian-headquartered ESDM companies, among a large bouquet of EMS players in India.

- It has a track record of technical innovation in collaboration with engineering teams of marquee customers.

- It provides integrated services and solutions to OEMs, from the initial product concept stage to volume production through concept co-creation and product realization.

- Its manufacturing infrastructure enables it to undertake a high mix of products with flexible production volume requirements.

- It is a leader in high-mix low volume product management and is present in most industrial verticals.

- It is one of the leading PCBA manufacturers in India, supplying various OEMs and assemblers in the market.

- It is also amongst the top vital global manufacturers of custom RFID tags.

- The company operates through eleven manufacturing facilities in north India (i.e. Himachal Pradesh, Haryana, and Uttar Pradesh) and in south India (i.e. Tamil Nadu and Karnataka).

- The manufacturing facilities in Tamil Nadu are in a special economic zone. The manufacturing facility in Haryana has been set up under the Electronic Hardware Technology Park scheme, which allows the company to avail tax and other benefits.

Product Portfolio

- Printed circuit board assemblies (PCBA)

- Radiofrequency identification (RFID) products

- Electromagnetic and electromechanical parts

- Motherboards

💰Issue Details of Syrma SGS Technology IPO

- IPO open from Aug12th – Aug18th 2022

- Face value: ₹10

- Price band: ₹209-₹220

- Market lot: 68 shares

- Minimum investment: ₹14,960

- Listing on: BSE and NSE

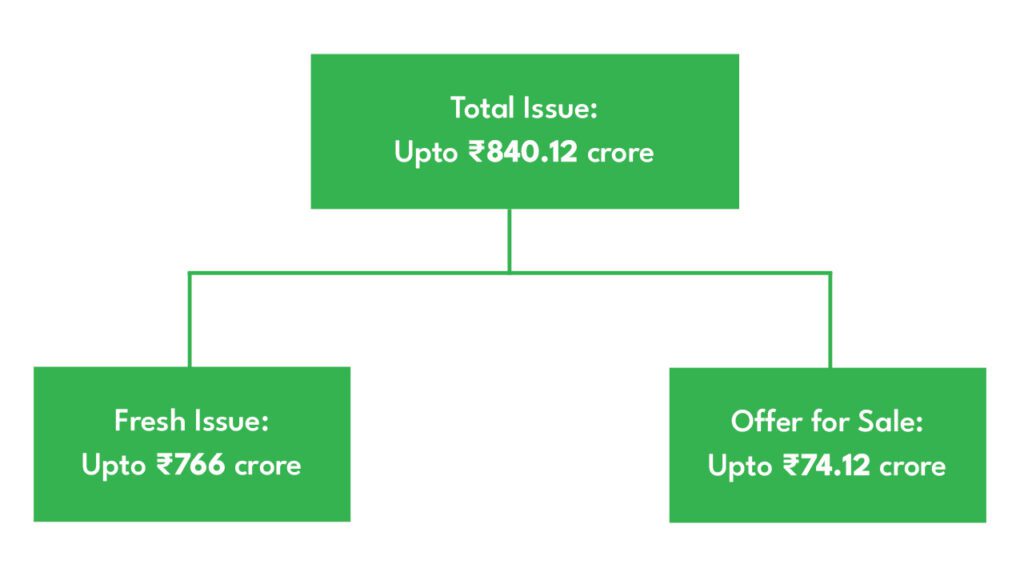

- Total issue size: up to ₹840.12 crores

- Fresh equity issue: up to ₹766.00 crores

- Offer for sale: up to ₹74.12 crores

- Promoters: Veena Kumari Tandon

- Registrar: Link Intime India Private Ltd

What is an IPO and should you invest in them?

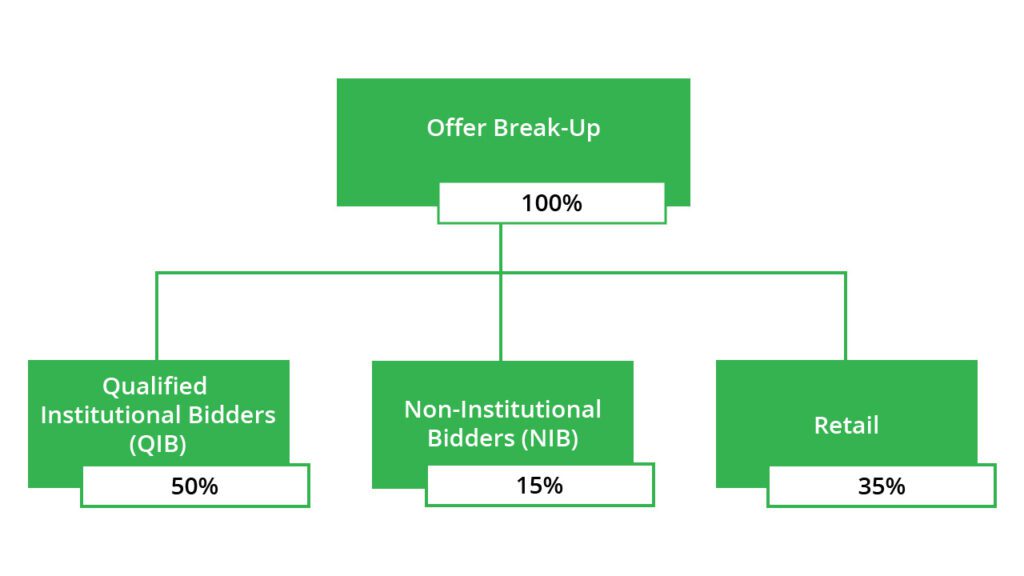

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

Syrma SGS Technology Ltd’s IPO size is ₹840.12 crores and below are the objects of the IPO:

1) Offer for Sale (OFS) ₹74.12 crores: The company would not receive any part of the IPO proceeds.

2) Fresh issue of ₹766.00 crores: Fresh issue would be done for the following purposes:

- Funding capital expenditure requirements for the development of an R&D facility and expansion / setting up of manufacturing facilities.

- Funding long-term working capital requirements.

- General corporate purposes.

📊IPO Timeline

| IPO open date | Aug 12th 22 | Initiation of refunds | Aug 24th 22 |

| IPO close date | Aug 18th 22 | The credit of shares to the Demat account | Aug 25th 22 |

| Basis of allotment date | Aug 23rd 22 | IPO listing date | Aug 26th 22 |

🔭IPO Strengths

- One of the leading design and electronic manufacturing services companies in terms of revenue in FY2021, driven by a focus on quality and customer relationships.

- Consistent financial performance track record.

- Diversified, continuously evolving, and expanding product portfolio and service offerings catering to customers across various industries, backed by strong R&D capabilities.

- Established relationships with marquee customers across various countries.

- State-of-the-art manufacturing capabilities are supported by a global supplier network, focusing on vertical integration.

- Experienced promoters supported by a senior management team with a proven track record of performance.

PEER COMPANIES

- Dixon Technologies Limited,

- Amber Enterprises India Limited

🔎IPO Risks

- The company’s customers do not make long-term commitments and may cancel or change their production requirements. Such cancellations or changes may adversely affect our financial condition, cash flows and results of operations.

- The need to comply with strict quality requirements causes the company to incur significant expenses to maintain product quality.

- The global nature of its operations exposes us to numerous risks.

- The company depends on third parties for the supply of raw materials and imports most of its raw materials, and delivery of products and such providers could fail to meet their obligations.

🚀Financial Data

| Particulars | For the year (₹ in Cr) | ||

| 2021 | 2020 | 2019 | |

| Total Revenue | 444.48 | 404.88 | 357.4 |

| Total Assets | 460.01 | 346.7 | 286.42 |

| Profit After Tax | 28.62 | 43.88 | 20.97 |

Post Views: 3,254

Tags

best ipo

BSE

BSE IPO

invest in ipo

INVESTING IN IPO

investment

investment idea

ipo

ipo alert

IPO Investment

Ipo list

latest ipo

latest ipo news

Money

money investment

NSE

NSE IPO

Ongoing IPO

Syrma IPO

Syrma SGS

Syrma SGS IPO

Syrma SGS Technology

Syrma SGS Technology IPO

Syrma SGS Technology Ltd

Syrma SGS Technology Ltd IPO

Syrma Technology IPO

Syrma Technology Ltd IPO

upcoming ipo