Gold, Silver, Bronze at India’s Platinum Jubilee | Weekly Market Wrap-up 14 Aug

Let us look back at the week that was, and catch up with all things stock markets before Monday hits us again in Arihant Capital’s Weekly Market Wrap-up.

In this article

As the nation gears up to celebrate the Platinum Jubilee of its Independence with the “Har Ghar Tiranga” campaign; the Indian contingent at the Commonwealth Games decided to bring home a different tricolour. India stood 4th in the total medal tally after securing 61 medals with 22 gold, 16 silver and 23 bronze.

While we are in the competitive spirit: a price war is all set to happen among the various airlines. Why you ask? The govt has removed the cap on airline prices. The US has also signed a key $280 billion bill aimed at bolstering U.S. chip manufacturing. This will surely make the Chinese dragon have a chip on its shoulder. Sit tight and grab some chips (pun intended).

Even though the markets showed a bullish streak while ending on Friday, the week ended on a sombre note with the passing away of Mr Rakesh Jhunjhunwala, a firm proponent of the Indian market’s growth story. A man who started his stock market journey with ₹5,000 and went on to become one of India’s richest people, was an inspiration for many.

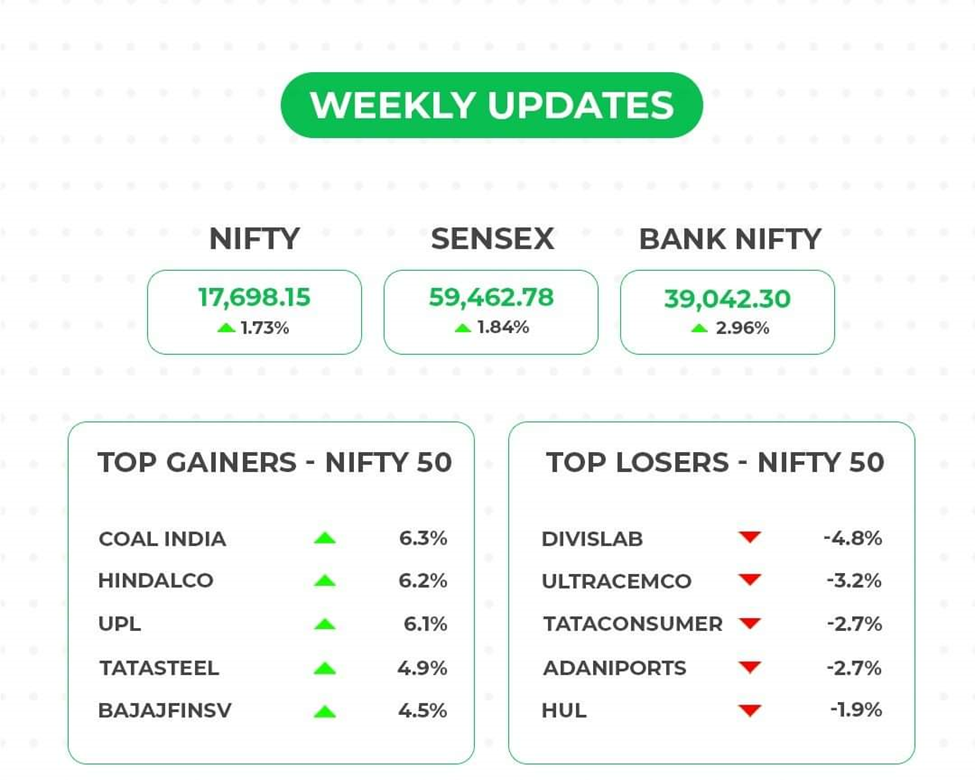

Indian stock markets flirted with the bulls for the fourth week in a row. Nifty closed the week with an increase of 1.73% at 17,698 while BSE Sensex ended the week at 59,462 points up by 1.84%. Bank Nifty was up by 2.96% during the week, ending at 39,042.

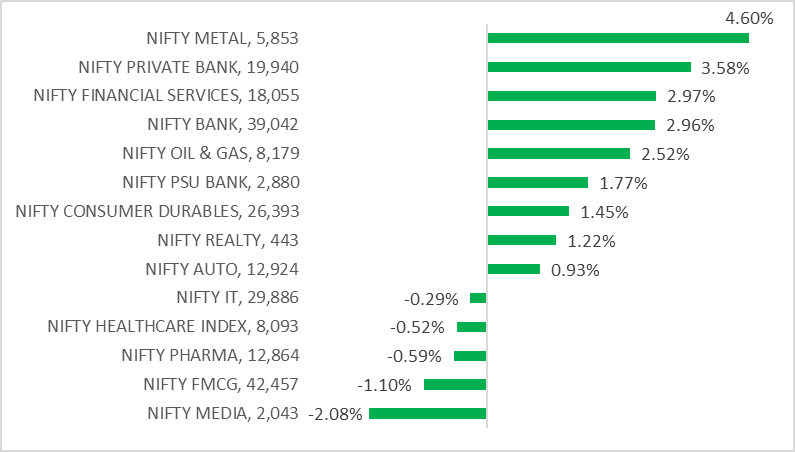

On the sectoral front, Nifty Metal, Nifty Bank, PSU Bank, and Nifty Auto indices surged most, while, Nifty I.T, and Nifty Pharma closed on negative sentiment.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart of Nifty, we observe a series of narrow range body formations whereas, on the weekly chart a breakout of the Triangle pattern is visible. Nifty has started trading above all the important short-term moving averages. We believe that the market may consolidate here, but stocks specific action may continue. Nifty can face resistance around 17,800 levels. If it starts to trade above it then it can touch 18,050-18,300 levels, while on the downside support is 17,600 if it starts to trade below then it can test 17,400 and 17,300 levels.

Bank Nifty

On the daily chart of Bank Nifty, we observe a higher high formation; on the weekly chart, the index has given a Triangle pattern breakout. We believe that Bank Nifty may outperform Nifty in the upcoming weeks. In the coming trading session if it trades above 39,200 then it can touch 39,600 and 40,000 levels, however, the downside support comes at 38,800 below that it can reach 38,500-38,200 levels.

💰IPO Corner

- The IPO of electronic components maker Syrma SGS was subscribed 37% on day 1. Retail investors showed strong interest, applying for more than 60% of the shares reserved for them. The company had also raised ₹252 crores from anchor investors on Thursday. Click here to apply for the IPO.

- 28 firms get SEBI’s nod between April and July 2022 to raise funds totalling ₹45,000 crores through initial public offerings.

- Avalon Technologies has filed draft papers for IPO.

🔎Quick Bites

Global

- 🙁 UK economy closes in on recession as it shrinks for a second quarter.

- Biden signed The “CHIPS and Science act” to boost domestic chip manufacturing and bolster competition with China.

- 😊US inflation number soften 8.5% YoY in July vs 9.1% in June.

Economy

- India’s trade deficit hits a record $30 billion as exports struggle.

- The barometer of industrial performance (IIP) fell to 12.3% in June from 19.6% in May.

- Inflation woes in the clear: CPI eased to 6.71% in July from 7.01% in June.

- ‘India could be 2nd most crucial driver of global growth after China’: RBI deputy governor.

- India’s Q1 GDP is set to jump between 12.5 and 15% in Q1FY23.

Automobile

- Leaving chip shortage woes in the rear-view mirror. Passenger vehicle sales soar: dispatches to dealers increased by 11% YoY in July. PV Sales in 2022 are set to beat record estimates.

- Tata Motors to acquire Ford’s Gujarat plant.

Energy and Infrastructure

- Oil ministry to divert gas from industries after CNG, piped gas prices jump 70 pc in a year.

- Adani Properties mops up ₹800cr via zero-coupon bonds.

- Keppel Land to acquire 1 million sqft in Piramal Project for over ₹1.2k crores.

- Godrej Properties to add ₹15K-crore projects in FY23.

- Infra assets worth over ₹1.62 lakh crore to be monetised this fiscal: Finance ministry.

Banking and Finance

- SBI drags Simbhaoli Sugars to bankruptcy over ₹395-crore loan.

- New RBI norms for digital lending: keep 3rd parties out of the digital lending process.

- Competition Commission of India okays merger of HDFC Bank, HDFC Ltd.

- Bob looks to raise up to ₹1,000 crores via the maiden Infra bond sale.

- Abu Dhabi Investment Authority to invest ₹665 crores in Aditya Birla Health Insurance to get a 9.99% stake.

IT and Telecom

- Jio completed 5G coverage planning in the top 1,000 cities. Airtel aims to roll out 5G pan-India by March 2024.

- Microsoft has become the first global tech major to join the Open Network for Digital Commerce (ONDC), which will unify digital commerce platforms and logistics providers.

- CSC stops BharatNet fibre maintenance as dues mount.

- TechM buys 2 South African JVs for ₹30 crores: Tech Mahindra South (Pty) Limited and Tech Mahindra Holdco Pty Ltd.

Other

- India is likely to record 827 million air passenger traffic by 2032-33. Talking about airlines, Rakesh Jhunjhunwala’s pet project Akasa Air took flight. And other airline stocks are partying as the government lifted the price cap on ticket prices from August 31.

- Inox Leisure opened a 10-screen multiplex in Lucknow.

- Drug makers Glenmark, Sun Pharma, and Dr Reddy recall products in the US.

- Banks put SpiceJet’s loans in the high-risk category; the airline refutes ‘baseless’ claims.

Key Results

Key Results

- 🙂 Bharti Airtel Q1 profit zooms 467% YoY to ₹1,607 crores; ARPU improves to ₹183.

- 🙂 Hero MotoCorp Q1 profit surges 71% YoY to ₹625 crores; revenue rises 53%.

- 🙂 Divi’s Labs Q1 profit rises 26% to ₹702 crores.

- 🙂 Hindalco posts highest ever quarterly profit in Q1 at ₹4,119 cr, up 48%.

- 🙁 Apollo Hospitals reported a 35% year-on-year fall in net profit to ₹317 crores.

- 😀 ONGC profit more than triples to ₹15,206 crores in Q1.

- 😀 LIC posts ₹683-cr profit in Q1, premium income jumps 20%.

- 🙁 Adani Ports Q1 profit falls 17% to ₹1,092 crores.

🔌Sustainability Corner

- Tata Motors looks to accelerate EV sales – partners with State Bank of India to offer EV inventory finance to its dealers.

- Tata has retailed 9,876 EVs in April-July & is driving towards its 50,000 EVs target for FY2023.

- Switch Mobility, the next-generation carbon neutral electric bus and light commercial vehicle company, and Chalo, the transport technology company, collaborate to deploy 5,000 state-of-the-art electric buses across India.

- Continental wins 300 OE approvals for its EV-specific tyres; 7 of the top 10 EV manufacturers worldwide currently use Continental tyres for their eco-friendly vehicles.

- Marelli has expanded its range of battery management technologies for electric vehicles with a new state-of-the-art Wireless Distributed Battery Management System (wBMS).

- JSW Group join forces with ElectricPe for EV charging.

- Greenko to set up 100mw clean power project for Hindalco.

- Lok Sabha passes a bill to promote non-fossil fuels. The bill provides for penalties for violations by industrial units or vessels, and on manufacturers, if a vehicle fails to comply with fuel consumption norms.

- JSW Energy to acquire a 1.7GW renewable portfolio from Mytrah Energy

- Shell acquires Indian renewables firm Spring Energy for $1.55bn

- Coal Units highly profitable: commodities giant Glencore Plc reported core earnings from its coal unit surged almost 900% to $8.9 billion in the first half. Coal India Ltd’s profit nearly tripled, also to a record, while the Chinese companies that produce more than half the world’s coal saw first-half earnings more than double to a combined $80 billion.

Key Results

Key Results