Chinese Whispers, RBI’s Repo Relay | Weekly Market Wrap-up 7 Aug

Let us look back at the week that was, and catch up with all things stock markets before Monday hits us again in Arihant Capital’s Weekly Market Newsletter.

In this article

The Commonwealth Games 2022 are ongoing, and India has already started its medal tally and gained the 5th spot. Meanwhile, nations are playing their own set of games in politics and economics, let’s have a look.

Chinese Whispers: The Chinese dragon conducted its largest life fire drill in Taiwan Strait, leading to several whispers about its true intentions. US and Japan have condemned Beijing’s move.

Repo Relay Race: All eyes were on the MPC meeting this week in which RBI announced a 50-bps hike in repo rate. With these progressive increases over the past few weeks, the policy rate has reached near pre-pandemic levels.

Musical chairs: West Bengal cabinet gets a musical rejig with an entry of Babul Supriyo as a newly elected cabinet member.

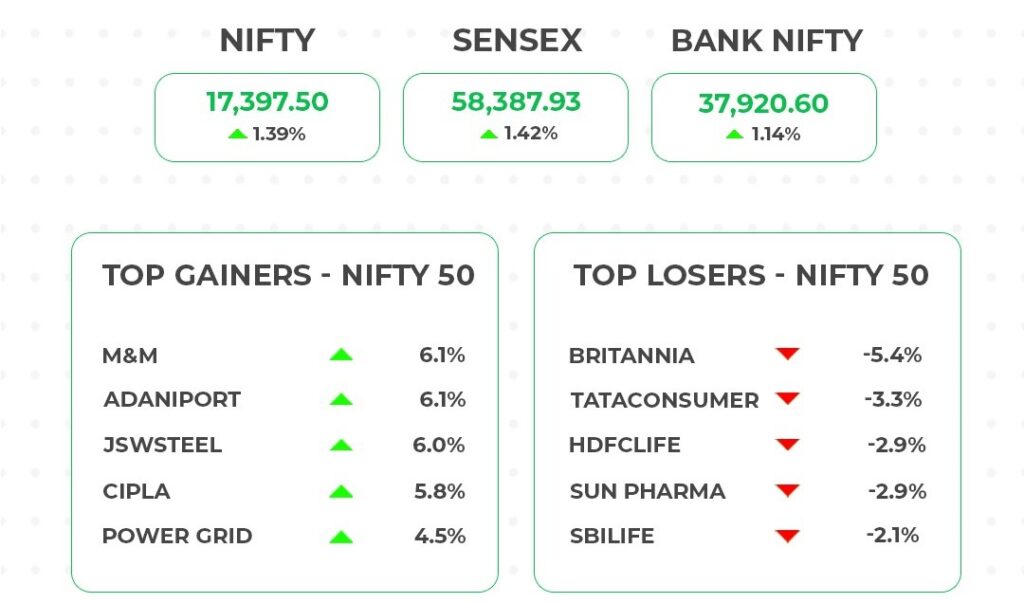

China’s show of force in Taiwan and the imposition of a windfall tax on fuel exports also impacted the sentiments in the markets along with the MPC meeting. Nifty closed the week with an increase of 1.39% at 17,398 with 239 pts gains while BSE Sensex ended the week at 58,388 a 1.42% increase from the last week. Bank Nifty was up by 1.14% during the week, ending at 37,921.

What to expect from the Markets

What to expect from the Markets

-Mr. Abhishek Jain, Head Research, Arihant Capital

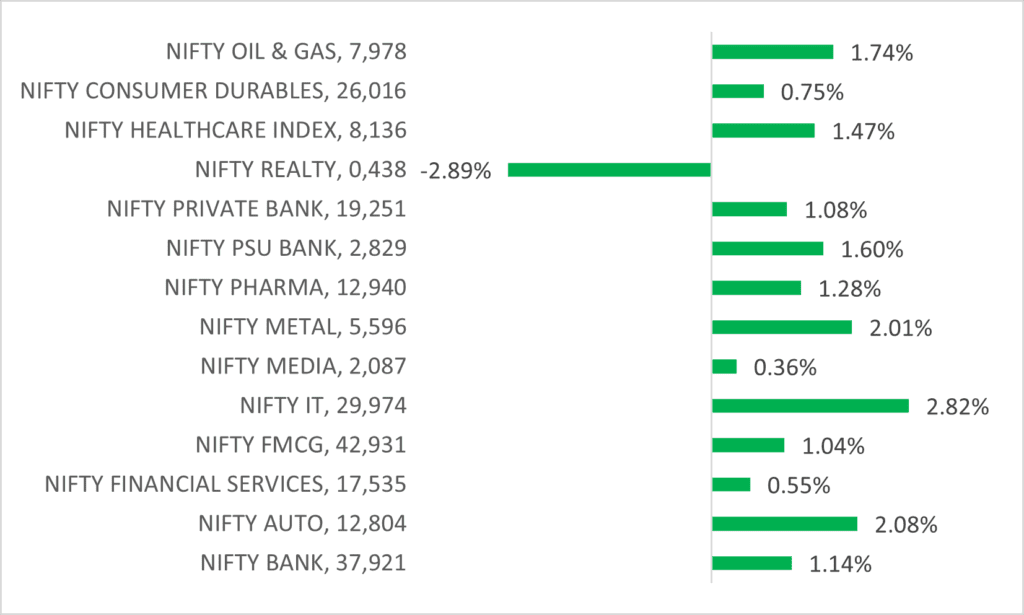

India’s stocks gained for the third week in a row led by information technology, telecom, banking and metal stocks. On the sectoral front, Nifty I.T, Nifty, Power, Nifty Metal, and Nifty Auto indices surged the most. Realty closed on negative sentiment. There has been profit booking at higher levels in markets as investors are cautious about global events. Some economists are now talking about a 75 bps hike by the fed in September. SBI has posted a mixed set of numbers for the June quarter. We believe this may impact the market sentiment towards banking stocks.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart of Nifty, we observe the “Doji” candlestick formation. A breakout of the “Triangle pattern” is visible on the weekly chart. It seems that the market may consolidate here, but stock-specific action may continue. Nifty can face resistance around 17,550 levels, if it starts to trade above then it can touch 17,700-17,850 levels. On the downside support is 17,350. If it starts to trade below then it can test 17,200 and 17,050 levels.

Bank Nifty

On the daily chart of Bank Nifty, a “shooting star” candle formation is visible. On the weekly chart, the index has given a breakout of the “Triangle pattern”. Both charts together indicate that Bank Nifty may also consolidate. In the coming trading sessions, if it trades above 38,200 then it can touch 38,550 and 38,700 levels. However, the downside support comes at 37,750 below that, it may touch 37,400-37,100 levels.

💰Stock Picks

From the Fundamental Desk

-Mr. Abhishek Jain, Head Research, Arihant Capital

In the next week purely on the trade side, traders can add Campus shoes at current levels with a price objective of ₹460. We are advising investors to increase cash exposure for the time being.

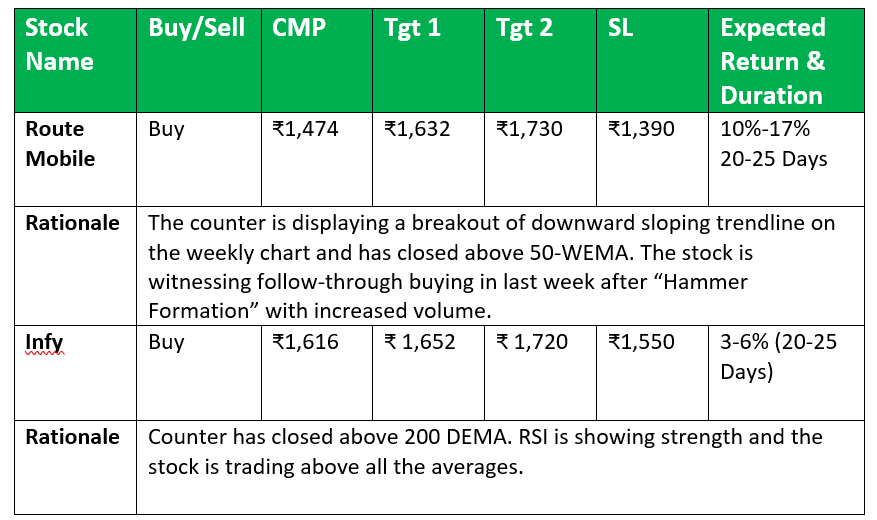

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

🔎Quick Bites

Global

- Bank of England hikes interest rates by 50 bps, its biggest increase in 27 years.

- The world’s food supply faces a new threat from the lack of rain in India.

- Russian oil is now cheaper than Saudi oil for India.

Economy

- The trade deficit scales a record high of $31 billion in July, and exports fell 12%.

- Forex reserves rose $2.4 billion during the week after a four-week fall.

- India expected to be the fastest growing economy in FY23: RBI Governor.

- Windfall tax hiked on petroleum crude lowered on diesel, ATF exports

- India’s FY23 fiscal deficit may come to around 6.5%: SBI Ecowrap.

- GST collection rises to Rs 1.49 lakh crore in July, up 28% YoY.

Automobile

- Indians are bored of entry-level vehicles (35% of PV sales in FY23 as yet).

- Ashok Leyland strengthens the AVTR product portfolio.

- Auto retail sales dip 8% in July on lower registrations.

Energy and Infrastructure

- India pushes to complete trilateral highway from northeast to Cambodia early.

- Reliance Infrastructure to raise $400 million through FCCBs.

- REC board okays subscribing 50% equity in asset management firm PFC.

- Russia becomes India’s third-largest coal supplier in July.

- India plans contentious law to boost competition and cut $75 billion utility debt in power cos.

- By 2024, road infrastructure in India will be similar to that of the US: Nitin Gadkari.

- NIIF buys Shapoorji Pallonji’s SP Jammu Udhampur Highway.

- India’s power consumption grows 3.8% to 128.38 billion units in July.

Banking and Finance

- HDFC raises a $1.1-billion loan to finance affordable housing.

- IIFL Finance files draft shelf prospectus for public issue of NCDs up to ₹5,000 crores.

- HDFC files for the merger of HDFC Investments, HDFC Holdings with HDFC Bank.

IT and Telecom

- DOT issues payment demand notices to Jio, Airtel, VIL, and Adani.

- Vi enhances network capacity to cater to growing data demand.

- Indian Army plans to use 5G to boost frontline troops’ communication.

- Telecom Minister gives ultimatum to BSNL employees to shed their Sarkari attitude.

Key Results

Key Results

- Manappuram Finance (MFL) reported mixed performance during Q1FY23 with profit de-growth of 35% YoY and an increase of 8% QoQ at ₹282 crores

- Mahindra and Mahindra’s standalone revenue stood at ₹19,612 crores registering a growth of 14.5% QoQ, 66.7% YoY.

- Voltas Ltd Q1FY23 revenue stood at ₹2,768 crores up 55% YoY, driven by Unitary Cooling Products. The company has shown market share gain at the cost of margins.

- SBI India’s largest PSU bank reported a miss on the operating performance front due to a sharp decline in other income on account of treasury loss and a decline in margins. The bank has reported profit de-growth of 33% YoY/6.7% QoQ to end the quarter at ₹6,068 crores.

🔌Sustainability Corner

- Inox Wind gets a 200 MW project from the NTPC arm in Gujarat.

- SJVN bags 200 MW solar project worth ₹1,200 crores in Maharashtra.

- India is planning a carbon credit market for energy, steel and cement.

- Intel India is net water-positive now.

- BorgWarner acquires Rhombus Energy Solutions to expand its EV portfolio.

- Jaguar Land Rover opens new facilities to test electrified and connected cars of the future.

- India’s fast-growing EV market sees tyre makers develop EV-specific tyres.

- Apollo Tyres has introduced EV-specific tyres under two new brands: Amperion and WAV for passenger cars, and 2 W respectively.

- JK Tyres has unveiled a range of EV-specific smart radial tyres for all categories of buses, trucks, LCVs and passenger vehicles in India.

- CEAT has launched a range of tyres specifically designed using CALM technology to reduce noise in four-wheeler EVs.

What to expect from the Markets

What to expect from the Markets Key Results

Key Results