Fed rate hike, 5G battle| Weekly Market Wrap-up | 31 July

Arihant Capital’s Weekly Stock Market Wrap-up – catch up on all that’s happened in the stock markets this week before Monday hits us again.

In this article

Late Wednesday, the US Federal Reserve announced a 75-bp rate hike, taking its benchmark policy rates to 2.25-2.50 per cent. The latest move takes the total tally of rate hikes announced by the US central bank so far in 2022 to 225 bps. The good news is that this indicated that future policy tightening may occur at a slower pace in the world’s largest economy.

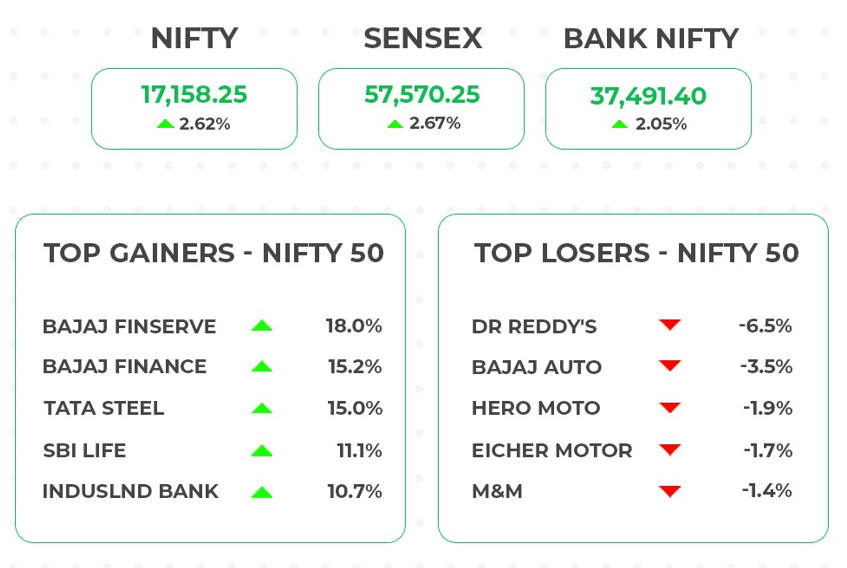

The Indian stock markets seemed overjoyed after this development. The benchmark indices ended the week with gains Nifty closed the week at 17,158 up 2.62%, and Sensex closed the week 2.67% up at 57,570 points. The Bank Nifty was up 752 points and ended at 37,491 points.

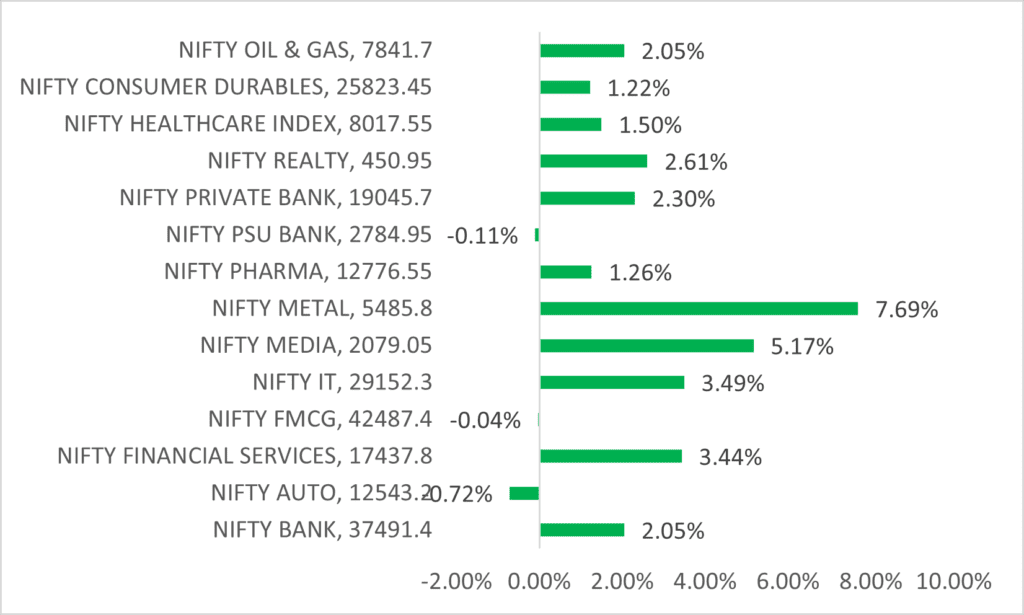

Most sectoral indices ended in the green with Nifty Metals(7.7%) and Media (5.2%) leading the pack. Only Nifty Auto and FMCG PSU bank were raining on the party.

💰Stock Picks

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Head Learning, Arihant Capital

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart Nifty, it is trading above the 200 SMA and on the weekly chart, a breakout of the “Triangle pattern” is visible. We believe that the market is bullish and traders need to follow the “buy on dips” strategy. Nifty can face resistance around 17,120 level if it starts to trade above then it can touch 17,350-175,00 levels, while on the downside support is 16 880 if it starts to trade below then it can test 16,700 and 16,550 levels.

Bank Nifty

On the daily chart of Bank Nifty “spinning top” candle formation is visible and on the weekly chart, the index has given a breakout of the “Triangle pattern”. Bank Nifty is likely to show outperformance. In the coming trading session if it trades above 37,650 then it can touch 38000 and 38,300 levels, however, downside support comes at 37,300 below that we can see 36800-36,500 levels.

🔎Quick Bites

Global

- Fed raises rates by 75 bps to tame inflation, flags weakening economic data.

- Sri Lanka’s inflation surged over 60% in July.

- China’s supply chain woes may divert export production to India, says Fitch.

- Logging off: Russian space agency Roscosmos will delink from the International Space Station after 2024.

Economy

- India’s FDI inflow hits an all-time high of over ₹6 lakh crore in FY22. FPIs return to Indian equities with a Rs 5,000-cr investment in July.

- FDI equity inflow in manufacturing sectors increased to more than ₹1.58 lakh crore in FY22, as compared to ₹89,766 crores clocked in the previous fiscal.

- India International Bullion exchange got launched!

- Core sector output was 12.7% up from 9.4% last year.

- India’s fiscal deficit stood at ₹3.52 trillion.

- Retail inflation for industrial workers moderates to 6.16% in June

- PM Launches NSE IFSC-SGX Connect in GIFT City

- Forex Reserves Down $1.15b to $571.56b

- India receives a record high FDI inflow of Rs 6,31,050 crore in FY22

- The International Monetary Fund (IMF) has lowered its growth projection for India by 0.8 percentage points to 7.4% in 2022-23. This could throw the country’s fiscal and current account positions further out of balance.

- The International Monetary Fund (IMF) has cut India’s growth outlook for FY23 to 7.4%. In April, the IMF had pegged India’s growth at 8.2%, down from its earlier projection of 9%. Even the Indian central bank has been hiking interest rates to combat inflation.

- More good news: India has Zero Probability of slipping into recession according to a survey.

Banking and Finance

- Advent, Carlyle to invest ₹8,898 crores in Yes Bank.

- Reliance Capital bidders seek an extension of the deadline to submit a resolution plan.

- HDFC Life board approves issuance of over 3.5 cr shares to parent HDFC for ₹2,000 cr.

- The Adani Group is planning a $188 million (₹1,500 crores) IPO of its non-banking financial arm Adani Capital in early 2024.

- RBI may raise the repo rate by 35 bps in next week’s policy review: S&P.

- Piramal gets RBI nod for NBFC arm.

- Axis-Citi acquisition gets the green light from CCI.

Energy and Infrastructure

- India’s power deficit stood at 0.6% in June.

- PM urges states to expedite clearing ₹2.5Lcr power dues.

- IOC sold petrol at ₹10 a litre loss, diesel at ₹14, and record quarterly loss

- BPCL to make the big investment ($1.6 billion or ₹12,738 crores) in a Brazilian oil block. The company already owns a 40% stake in the oil block, which will start production from 2026-27.

- Urban Infra VC Fund looks to exit JV with Lodha, and recover ₹900 crores.

- Ahluwalia secured three new orders worth over ₹1,129 crores.

- L&T to sell 8 roads, and transmission project to Edelweiss Fund

IT and Telecommunications

- The 5 G battle: India’s first-ever 5G spectrum auction beat the government’s internal estimates, fetching a record number of bids amounting to nearly ₹1.55 lakh crore ($19.5 billion).

- Airtel and Reliance lock horns, UP-East in demand.

- Adani purchased a high-frequency 26 GHz band for 20 circles. Jio spent ₹84,300 crore and edged rival Bharti Airtel for the much-coveted 700 MHz spectrum.

- Airtel, Jio selected 5G gear partners and Voda Idea is still in talks.

- The government has approved the merger of BBNL and BSNL and a revival package of ₹1.64 lakh crores for BSNL.

- Infosys to Hire 300 Hands in Singapore in 3 yrs.

- BEL has signed a contract of ₹250 crores with the Ministry of Defence (MoD) for the supply of integrated anti-submarine warfare systems for surface ships.

Industry

- Tata Steel to roll out the ‘First in India’ seating system for Vande Bharat; to spend ₹3,000 cr on R&D.

- The manufacturing sector gets USD 21 billion in FDI in FY22.

Other

- Alembic Pharma receives USFDA approval to market the drug for skin treatment.

- CWG 2022: 19-year-old Jeremy Lalrinnunga wins a gold medal in men’s 67 kg weightlifting. Weightlifter Sanket Sargar bags silver at CWG 2022.

- The DGCA ordered SpiceJet to cut down operations by 50% for the next eight weeks after a spate of technical malfunctions. The airline has maintained that flights will operate as per schedule.

- RIL, CP Group, and Lightspeed are in the fray for Metro’s India business.

Key Results

Key Results

- Sun Pharma’s profit surges 43% YoY rise in consolidated net profit to ₹2,061 crores. Total sales rose 10% to ₹10,643 crores, driven by sustained scale-up of its speciality business and an all-around growth across markets.

- SBI Life reported an 18% year-on-year (YoY) rise in its net profit to ₹262 crores in Q1FY23. The value of the new business (VNB), a key metric of profitability, more than doubled to ₹880 crores in the quarter. VNB margins increased to 30.4% from 23.7% a year ago.

- Chalet Hotels posted consolidated revenue of ₹253 crores, up 275% YoY. It was back in the black with a net profit of ₹28 crores, after facing losses for eight consecutive quarters. The hotel bagged a contract to develop and operate a 5-star deluxe hotel at Terminal 3 of the Delhi International Airport.

- NTPC Q1 results show profit rises 16% YoY to ₹3,978 crores.

- Bajaj Auto reported an 11% YoY rise in its net profit to ₹1,173 crore its revenue also rose by 8%

- Tech Mahindra reported a 24.8% QoQ drop in its net profits to ₹1,132 crores. Revenues were up by a tepid 4.9% to ₹12,708 crores. The company’s total expenses rose due to a spike in employee benefit expenses. However, the attrition rate fell to 22% from 24% in the previous quarter.

- Public sector lender Canara Bank posted a 71% YoY rise in its standalone net profit at ₹2,022 crores. NII jumped 10% YoY to ₹6,784 crores. The bank’s asset quality improved as GNPA stood at 6.98% as compared to 8.5% in Q1 FY22.

- Infosys profits were up 3.2% in Q1; Revenue jumped 23.6%.

🔌Sustainability Corner

- JK Tyre unveils the complete range of EV-specific Smart Radial Tyres.

- Reliance, Ola & Rajesh Exports sign program agreement under PLI scheme for battery manufacturing.

- India wants to open up for lithium mining in batteries quest.

- Ola Electric suspends production and cites annual maintenance as the reason.

- CESL to set up 810 EV charging stations across 16 highways, and expressways pan India.

- Adani Group will invest $70 billion in green energy transition and infrastructure projects.

- The Indian government is creating a $5 billion (about ₹40,000 crores) fund to back EV adoption in the country. This fund will reportedly aim to reduce the high upfront costs associated with EV ownership. The US Agency for International Development (USAID) will provide technical assistance in setting up the fund.

That’s all for now folks! See you next week! To get the latest updates in the markets, follow us on Facebook, Instagram, and Twitter.

Key Results

Key Results