TCS Q1 Results: Should you invest?

TCS declared its quarter 1 results on Friday, July 8th. Here are the key highlights of the TCS Q1 results for the financial year 2022-23.

In this article

- Why do TCS results matter?

- Key highlights of Q1 results

- Analyst meet

- Sustainability

- Outlook and valuation

Holding the title of the biggest IT company by market cap and the biggest private-sector employer in India – TCS needs no introduction. The Mumbai-headquartered IT and consulting services multinational posted its Q1 results on 8th July for the Financial Year 2022-23

Why do TCS results matter?

If you are new to investing, you will know that company revenues and profits matter. This is why investors closely monitor result announcements. These reports have the capacity to cause great fluctuations in stock prices. But, you may not know that TCS results not only reflect the company’s performance (TCS) but also set the stage for the IT sector results.

Check out the key highlights of the TCS Q1 Results

Hits:

- TCS workforce hits the 6-lakh mark. The headcount shows net addition of 14 thousand associates during Q1 which is much lower than 35,209 employees in the previous quarter due to high employee churn. Attrition in the last 12 months stood at 19.7% in IT Services.

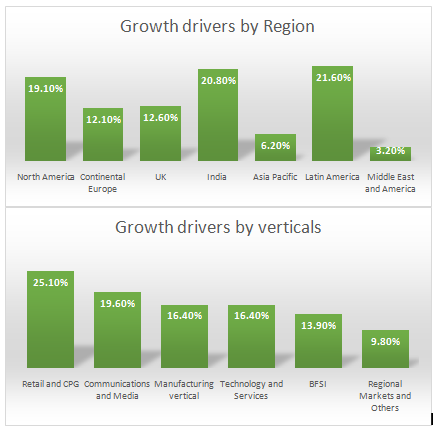

- 😊Revenue for the company increased by 16.2% YoY to ₹52,758 crores. USD revenue growth is up by 10.2% as compared to the last quarter of the previous year (YoY) at $6,780 million.

- 😊Consolidated PAT increased by 5.4% YoY to ₹9,519 crores a 4.5% decline over the previous quarter against our estimate of ₹9,724 crores.

- 🎉TCS has declared a dividend of ₹8 per equity share which will be credited by August 3, 2022. The record date for the same is July 16, 2022.

- There was strong, broad-based demand across the different services, led by Cloud, Consulting & Service Integration, Cognitive Business Operations and Enterprise Application Services. Key themes driving G&T demand in Q1 were customer experience, cloud transformation and sustainability.

Misses

- 🤝 Even though TCS reported a strong order book at $8.2 bn and book-to-bill at 1.2x. But, the IT services major saw a decline from last quarter — from $11.3 billion to $8.2 billion.

- 📉Operating margin contracted by 2.4% year over year to 23.1% against our estimates of 23.75% due to annual salary increase, the elevated cost of managing the talent churn and gradually normalizing travel expenses.

TCS Q1 Results Reflect Continued Growth Momentum

We are starting the new fiscal year on a strong note, with all-round growth and strong deal wins across all our segments. Pipeline velocity and deal closures continue to be strong, but we remain vigilant given the macro-level uncertainties. Looking ahead, we remain confident in the resilience of technology spending and the secular tailwinds driving our growth.

Rajesh Gopinathan, Chief Executive Officer and Managing Director, TCS.

Analyst meet TCS Q1 results: key takeaways

- The company did an onsite salary hike of around 4-5%. Wage hike and increase in travel-related costs, and supply-side constraints led to a dip in EBIT margin in the quarter.

- Sub-contract cost has been high over the last few quarters due to high attrition. The company expects attrition to come down after Q2FY23.

- The company’s demand environment remains strong backed by a twin engine of deals related to Optimization, Growth & Transformation projects as more clients are looking to leverage next-generation technologies for enterprise-wide transformation.

- Clients are looking to reduce the number of service providers; i.e vendor consolidation and it should benefit TCS. Even in the current macro situation, the company is not seeing any budget deferment by clients.

- High confidence in the demand outlook in the US than in the European markets.

- Deal booking of $8.2bn and a robust deal pipeline offer strong near-term visibility. So, the company’s target to hire 40k freshers for FY23 remains intact. The company also said that the newer deals are seeing a price increase.

- The company expects operating margin to improve sequentially over coming quarters and touch around 25% by Q4FY23.

Sustainability

- TCS aimed at being a diverse and inclusive workplace, with women comprising 35.5% of the workforce spanning 153 nationalities.

- TCS’ Technologies for Earth Regeneration & Rejuvenating the Atmosphere (TERRA) won the Excellence in Smart Tech Award under the established IT and technology services companies’ category at the IMC Digital Technology Awards 2021

- TCS’ Food Digital Twin won the 2022 Vivekananda Sustainability Award for ‘Innovative Use of Technology for Environmental Improvement’

- Won first place at the Celonis Ecosystem Hackathon for Smart Metering for Utilities to Reduce CO2 Emissions under the Use Case Ideation category

- Named as one of the top 50 community-minded companies in the United States; recognized as the Information Technology Sector Lead for the fourth year and honoured with the Strategic Volunteer Award for aligning employee volunteer time and talent with its strategic CSR programs.

- Won the Gold award in the WASH Initiative category at the 6th CSR Health Impact Awards for TCS’ IoT-based smart water management solution in support of the Government of India’s Jal Jeevan Mission.

Outlook and valuation: should you buy or hold TCS?

TCS USD revenue slightly above our estimate in Q1FY23,

The company’s deal booking of $8.2bn and robust deal pipeline offers strong

near-term visibility led by strong growth across all the segment and clients

continue to spend on digital services. We believe the demand environment to

remain strong over the medium term. However, we remain constructive on TCS

from medium to long term with its ability to engage with large clients (TCV

$8.2bn). At a CMP of ₹3,265, TCS is trading at a P/E of ~25x to its FY24E EPS

of ~₹133. We value TCS at a P/E of 28x to its FY24E EPS of ~₹133 and

maintain our target price of ₹3,720 per share. We upgraded our rating to

Accumulate from Neutral earlier