US-China Currency Spree: A Global Market Key 🔑| Weekly Update November 18

Hello Readers!

Right now, there’s a quiet time in the money problems between the US and China, but things could get shaky again. The US dollar has become stronger in the last few years because the American economy is doing better and the interest rates are higher. This is like the dollar being a strong runner who’s ahead in a race.

On the other side, the money from China and Japan, the renminbi and the yen, aren’t doing as well. They’re weaker compared to the dollar than they have been in a long time.

Even though the US and China are big deals in the world’s economy, when their leaders, Joe Biden and Xi Jinping, met, they didn’t really talk much about this money issue. It seems like they’re thinking about other things right now.

The US isn’t too worried about China’s money or how it trades. A strong dollar is good for them because it helps keep prices from going up too much. But China has to decide what to do: they can either focus on getting their own people to buy more things, or try to sell more things to other countries. If they decide to sell more to other countries, this might start the money problems again.

So, even though it’s quiet now, there’s a chance that the money issues between the US and China could start up again. It’s like watching a mostly sunny sky and wondering if a storm might come.

🧾In this Article

📈 Weekly Update

– Mr Abhishek Jain, Head of Research, Arihant Capital

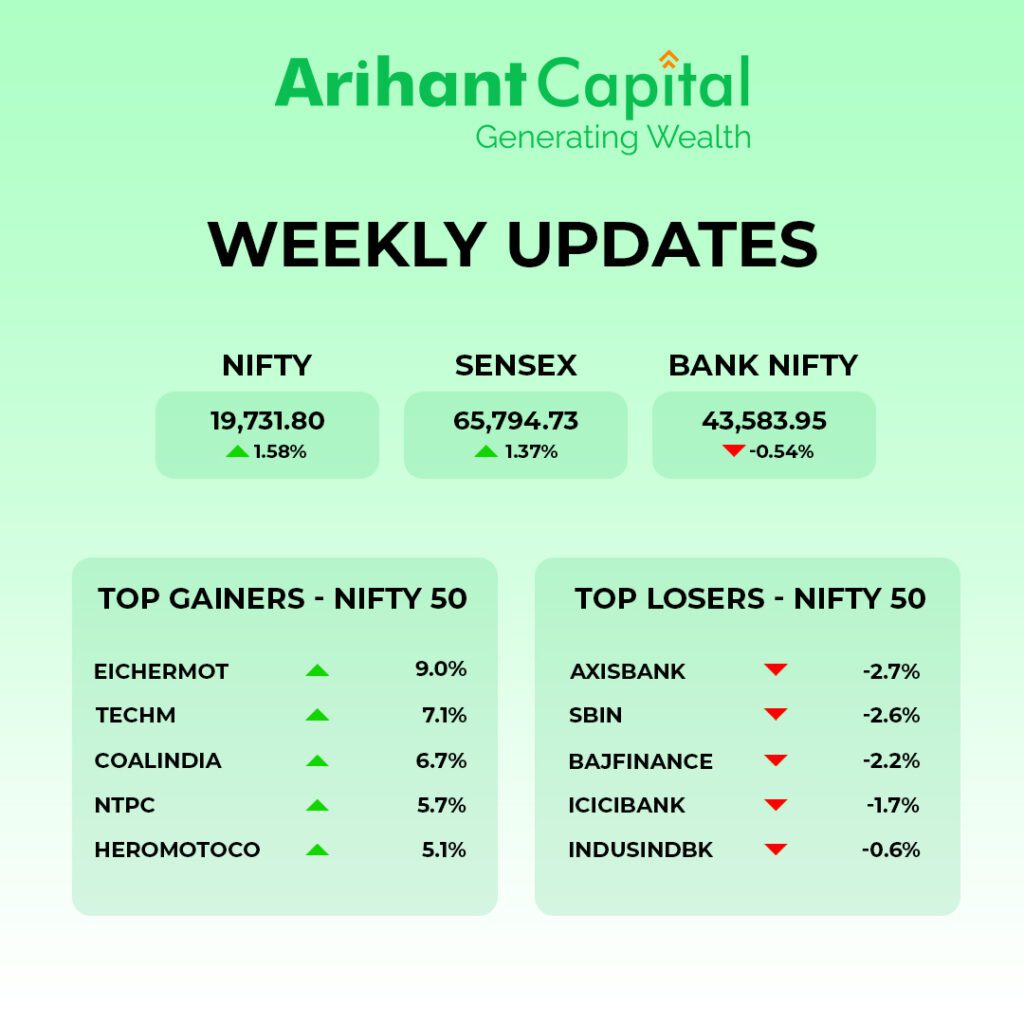

India’s benchmark stock indices swung between gains and losses through Friday following a mixed U.S. close on Thursday. Banks, NBFCs and energy sectors dragged, whereas fast-moving consumer goods and auto rose. Nifty Bank and Nifty Financial Services constituents took a hit on Friday after RBI’s action on rising consumer loans worries investors. Overseas investors turned net sellers on Friday after being net buyers in the last two sessions. According to provisional data from the National Stock Exchange, foreign portfolio investors sold stocks worth INR 477.76 crore. The NSE data showed domestic institutional investors who have been buyers since Oct. 14 also turned sellers and sold equities worth INR 565.48 crore. Nifty ended down by 0.71% at 19,732 level. Sensex was down 0.28%, at 65,795, and Nifty Bank at 1.31% at 43,584.

📈 Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we are observing an “Upward gap area” and trading above key moving averages & on the weekly chart, we observe trading above short-term moving averages, If we analyse both chart patterns, it indicates still we can see some stock specific move & can maintain buy on deep strategy. if Nifty starts trading above the 19,750 level, then it can touch the 19,850-19,980 level, while on the downside, support is 19,600, and if it starts to trade below, then it can test the level 19,500 and 19,350 levels.

Bank Nifty

If we look at the daily chart of Bank-Nifty, we are observing a “Downward gap area” but prices trading above 200 DMA & the weekly chart observes a “Narrow range body formation, if we analyze both chart patterns, it indicates bank-nifty can consolidate in a range. Bank-nifty starts trades above 43,900 then it can touch 44,300 and 44,500 levels. However, downside support comes at 43,600, and below that, we can see 43,350 and 43,100 levels.

🔎Stocks in News

🌏 SBI: Planning to launch its banking mobile app Yono Global in Singapore and the US.

🏗️ JSW Infra: Emerged as the winning bidder for the development of a greenfield port at Keni, Karnataka on a Public-Private Partnership basis.

💳 AGS Transact: Secured a Rs 1,100 crore order for deploying over 2,500 ATMs for SBI over the next seven years.

✈️ GMR Infra: GMR Goa International Airport raised Rs 2,475 crore through 20-year non-convertible debenture (NCD) bonds.

🛫 IndiGo: Became the first Indian airline to record over 2000 planned flights daily.

📶 Airtel: Has rolled out its 5G Plus services across all 38 districts of Tamil Nadu.

🏍️ TVS Motor: Signed an import and distribution agreement with Emil Frey for the European market.

💊 Cipla: Its subsidiaries completed the sale of a 51.18% stake in Uganda-based Cipla Quality Chemical Industries.

📈 Paytm: Will be included in the MSCI India Index.

💉 Gland Pharma: Received US approval to market a generic product related to blood pressure.

✈️ PTC Industries: Announced a multi-year contract with Safran Aircraft Engines.

🚫 Bajaj Finance: RBI has instructed the company to halt loan sanctions and disbursements under its products ‘eCOM’ and ‘Insta EMI Card’ immediately.

🔋 Siemens: Siemens AG is planning to acquire an 18% stake in Siemens.

📰 Quick Bites

📈 India’s Trade: Exports rose by 6.21% to $33.57 billion in October, while imports stood at $65.03 billion, leading to a trade deficit of $31.46 billion.

💰 Direct Tax Collection: The government is on track to surpass the ₹18.23 lakh crore direct tax collection target for the current financial year, according to CBDT Chairman Nitin Gupta.

🔒 Cybersecurity: The Indian Computer Emergency Response Team (CERT-In) handled 13.91 lakh cybersecurity incidents in 2022.

✈️ Diwali Air Travel: Over 7.19 lakh passengers flew during the Diwali weekend (11-12 Nov) with over 11,700 flights operated.

⌚ Wearables Market: India’s wearables market (including smartwatches, fitbands, etc) shipped a record 4.81 crore units in the July-Sept quarter, marking a 29.2% year-on-year growth, as reported by the International Data Corporation.

🚆 Railway Passengers: Around 95.3% of the total 390.2 crore railway passengers from April to October 2023 travelled in general and sleeper classes, with 4.7% in AC coaches, according to Indian Railways.

⛽ Windfall Tax Reduction: The windfall tax on crude oil has been reduced from ₹9,800 per tonne to ₹6,300 per tonne, and the tax on diesel has been decreased from ₹2 to ₹1 per litter.

🌱 Sustainability Corner

🚗 Tata Motors’ EV Milestone: Over 100,000 electric cars & SUVs sold in India, with 50% of EV sales from outside the Top 20 cities. Notably, 23% of buyers are first-time owners, and 24% are women, which is twice the industry average.

🛵 Electric Two-Wheeler Sales Surge: Sales are expected to rise by 35–40% in November, surpassing the previous peak of 1,05,000 units in May 2023.

🔋 Panel Discussion on E-Mobility: Attend the discussion with top industry executives on the future of India’s two-wheeler industry, focusing on electric vehicles.

🚜 VST’s Electric Tractor at Agritechnica2023: India’s VST Tillers Tractors unveils its electric Fieldtrac 929 EV with a 25kWh battery and 110 Nm torque in Hanover.

🌍 Vitesco’s Electrification Success: Almost 7 billion euros in order intake in the first 9 months of 2023, with 60% of Q3’s 2.5 billion euros for EV-related products, showing high demand in Asia and Germany.

🔧 Bosch’s New Electric Motor: Unveiled at EICMA2023, the 6 kW motor aims to electrify two-wheeler segments traditionally dominated by combustion engines.

📦 Amazon’s EV Initiative in India: Uses 6,000 EVs in 400 cities and launches a global-first 100% EV-only delivery program in India, introducing Mahindra Zor Grand e3Ws in the initial phase.

🛵 Scooter Market Revival in India: Record sales in October with 589,802 units, Honda’s Activa leading the market while TVS, Suzuki, Yamaha, Ather, and Bajaj Auto increase their market share from April to October.

💡🍬 Knowledge Candy: Have you heard about India’s GDP supposedly hitting $4 trillion?

It’s been all over social media, kicked off by Gautam Adani and followed by some prominent political names.

But here’s the twist – there’s yet to be an official word!

This buzz began with a screenshot from a live GDP tracker, which is said to be based on IMF data. However, remember that tracking GDP in real-time is pretty tricky, as it involves juggling a lot of delayed sector-specific data.

Although the Ministry of Finance and the National Statistical Office have yet to confirm this milestone, it didn’t stop folks from celebrating.

But let’s not get ahead of ourselves. Official sources suggest we’re not there yet, despite the optimism.

On the bright side, India’s economy is doing quite well. We saw a 7.8% GDP growth in the April-June period of 2023-24, which is impressive, especially considering we’re outpacing China.

The services sector is booming, and even agriculture is pitching in with some solid numbers.

In a nutshell, while the $4 trillion GDP news awaits official approval, India’s economic growth game is still strong.

Let’s keep an eye out for the official word!

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?