What are upper and lower circuit limits?

Upper and lower circuit limits order with Arihant Capital Find out here

In this article

- What is a circuit limit

- How Circuit limit Work

- How circuit limit decided

- understand with an example

- Advantages of circuit limits

- Circuit breakers in Arihant Plus Mobile app

If you are into adventure sports, chances are you might have tried or seen someone riding a “Bungee Trampoline“. There is a trampoline at the bottom, preventing you from falling down and bungee cords, stopping you from shooting very high.

But why are we talking about bungee trampoline when you actually play the adventure sport of the stock markets? Here’s why: Just like in this sport, the stock markets also have built-in protections, which prevent the stock prices of any stock from shooting too high or falling too low. And these protections are called circuit limits.

In this blog, we will review what is a circuit limit and how it impacts you as a trader. Let’s get started.

What is a circuit limit?

A circuit limit or price band defines the price range within which a stock can trade during a particular trading session. Every stock has upper and lower trading limits, and crossing that threshold will cause trading in that stock to pause. Circuit limits are primarily safeguards set by the exchange to prevent abrupt large movements in stock prices in a very short time.

The main aim of keeping a price band for every stock is to reduce volatility and protect investors’ money. It also helps in preventing panic selling in case of an adverse market situation.

How do circuit limits work?

Stocks can move within a set price range in one particular session. India’s capital markets regulator – the Securities and Exchange Board of India (SEBI) sets these price limits. The index-oriented circuit prices were introduced in the Indian stock exchange markets in the year 2001. There are different circuit breakers for every stock.

These price ranges vary between 2-20% and depend on the size, volume and liquidity associated with each stock. Stock brokers will not accept any orders outside of these price bands, and they will stand rejected. Whenever a stock reaches the upper or lower circuit limit, all orders for that particular stock at that price will be kept pending on the exchange.

How are circuit limits decided?

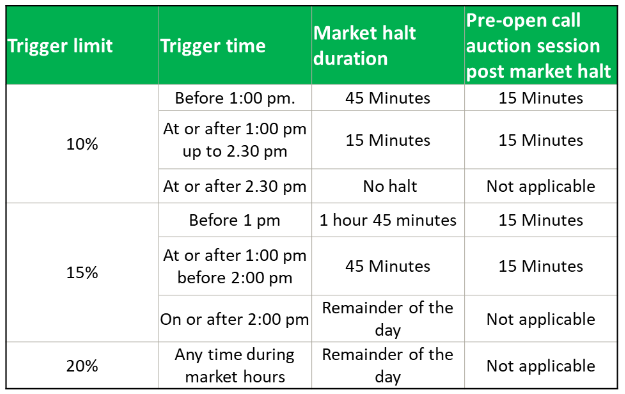

The index-based circuit breaker gets triggered when any index breaches 10%, 15% and 20% of its price either way. It can be an increase or decrease in their value. In case the circuit breaker is triggered, there will be a halt in trading for varying time periods.

The extent of duration of a market halt has been discussed below:

Similarly, there are different circuit limits for every stock. According to NSE and BSE circuit breaker rules, trading will halt for varying periods if a stock price breaches 2%, 5%, 10%, and 20% of its daily price level.

Let us understand this with an example:

Upper Circuit

Private equity firm Advent International, which holds a majority stake in DFM Foods via its subsidiary AI Global Investments, on 15 August announced the proposal to delist the snack maker from the bourses. In a regulatory filing, Advent expressed AI Global’s intention to “acquire all the equity shares that are held by public shareholders, either individually or collectively, as the case may be.”

Obviously, seeing its demand, everyone flooded to buy the stock while they could. As a result of this, at 9.50am, shares of DFM Foods were trading at ₹304.30 apiece on BSE, up 20%. At 20%, the stock DFM Foods hit upper circuit and trading halted.

Lower Circuit

Insolvency plea against Future Enterprises was filed in NCLT on 18 Aug 22. Everybody tried to sell the stock in panic, the stock hit its 52-week low price. Since the price fell by around 5% during the day, the stock hit lower circuit at ₹2.10. This lead to a halt in trading.

Advantages of circuit limits

Window for recalibration

One of the biggest advantages of a circuit limit is that it allows traders a window in which they can think and recalibrate their positions. The trading halt allows investors and traders time to properly analyse the situation due to which the indices might have seen sharp movements in their prices.

Stability

Circuit limits were introduced with the primary objective of stabilizing the stock exchanges. It prevents panic selling since as soon as the price falls below the lower limit, trading gets halted, and all orders are kept pending. It safeguards investors’ money and prevents capital erosion.

Disadvantages of Circuit Limits

Prevents price discovery

Manual intervention in stock markets violates the fundamental principle of allowing market forces to discover prices. When SEBI forcefully suspends trading, it affects real-time price discovery of the stock in the real stock market

Information asymmetry

There is a chance that some players may gain an unfair advantage due to asymmetry in information sharing. Individuals who get hold of good or bad news early can benefit by trading before circuit breakers kick in.

On the other hand, market players who have delayed access to the news may incur losses due to an abrupt halt in trade.

So what’s the deal:

The concept of a circuit limit came into existence after the October 1987 stock market crash in the USA. Investors incurred significant losses, and companies faced huge capital erosion. India decided to adopt this system in 2001. Since then, circuit limits have helped maintain market stability and avoided large-scale market crashes.

How do I find out the circuit limits for today in the Arihant Plus Mobile app?

- Search for a stock in the explore section.

- Go to the stock quotes page of any stock in the Arihant Plus app.

- Click on “Buy” or “Sell” to lead to the order pad.

- The “Price Range” shows the circuit limits.

Check out this video for a step-by-step guide.

Also read: What is the stop-loss order and trigger price?