20K or Not 20K? NIFTY’s Teasing Teeter-Totter | Stock Market Weekly Update July 22

NIFTY’s Teasing Teeter-Totter| Indian Stock Market Weekly Update

Hello Readers!

Well! The market had all the excitement and anticipation of the NIFTY50 reaching the much-awaited 20,000 levels, but alas, it stumbled just before the finish line. Several factors contributed to this fall. 📉

Firstly, IT stocks took a beating as Infosys reported disappointing Q1 earnings. Their revenue saw a modest 1.3% rise, while net profit declined by 3%. The real shocker was the lowered FY24 revenue guidance from 4-7% to 1-3.5%. This sent Infosys shares plunging nearly 10% and had a cascading effect on other tech stocks like TCS, HCL Tech, and Wipro, which declined by 2-3%.

The NIFTY IT index itself dropped over 4%.

Secondly, FMCG stocks 🏭 were also affected as HUL reported below-par Q1 results, with only 3% YoY volume growth. HUL’s shares tumbled 3.6%, and other FMCG stocks followed suit, with Tata Consumer down by 2.3%. NIFTY FMCG took a hit, falling over 1%.

Additionally, heavyweight Reliance Industries witnessed a 3% decline ahead of its Q1 results due to selling pressure stemming from the demerger of Jio Financial Services from its parent entity. Moreover, the fall in the US markets has impacted our domestic markets too.

Now, the focus shifts to the June quarter earnings of other companies. Their performance could decide whether the markets will witness a turnaround next week.

Fingers Crossed!

Get ready to be amazed by the surprises waiting for you in the upcoming week!

🧾In this Article

📊 Weekly Update

– Mr Abhishek Jain, Head of Research, Arihant Capital

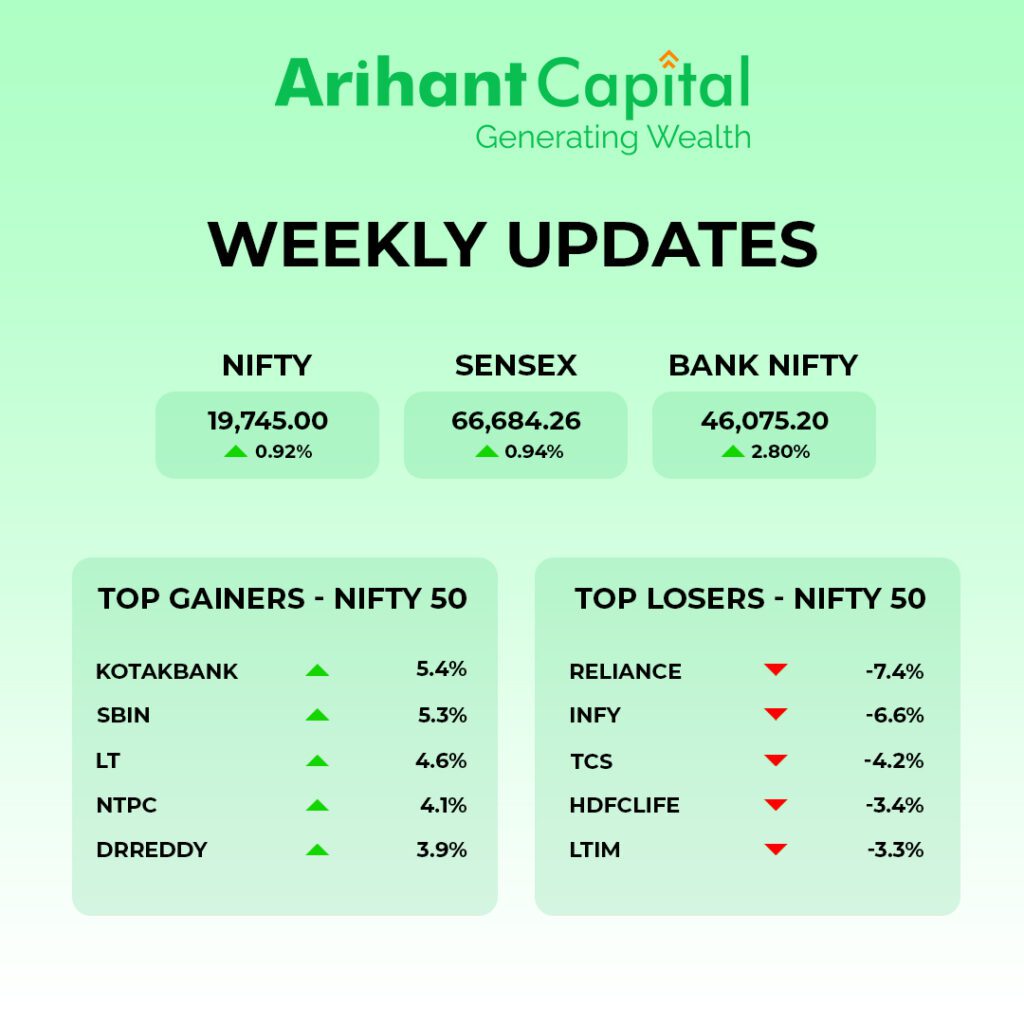

On Friday, the stock market indices in India concluded a record-setting week on a negative note, mainly dragged down by declines in Infosys, Tech Mahindra, and Hindustan Unilever (HUL). Despite this, the industrial and capital goods sectors emerged as the top gainers. Among the Nifty indices, the PSU Bank sector showed the most significant advancement during the week, followed by Nifty Media, Nifty Bank, Nifty Pharma, Nifty SmallCap100, Nifty MidCap100, and Nifty FMCG. However, Nifty IT, Nifty Realty, and Nifty Metal were the laggards.

By the end of the trading day, Nifty closed down by 1.17%, reaching 19,745. The broader market index, Sensex, also experienced a decline of 1.31% to stand at 66,684. Nifty Bank witnessed a minor decrease of 0.24%, settling at 46,075. Despite the negative closing, the overall week had seen remarkable highs and strong performances in various sectors, highlighting the dynamic nature of the Indian stock market.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we observe higher high formation. We keep narrow-range body formation on the weekly chart, which suggests positive momentum may continue. Still, with some consolidation, we may see. If Nifty starts trading above the 19,780 level, then it can touch the 19,850-19,950 level, while on the downside, support is 19,650, and if it starts to trade below, then it can test the level 19,550 and 19,450 levels.

Bank Nifty

Let’s look at the daily chart of Bank-Nifty. We are observing “Doji” candlestick formation and weekly chart breakout of consolidation, which suggest that compared to Nifty, Bank-nifty may outperform. If it trades above 46,150, it can touch 46,350 and 46,500 levels. However, downside support comes at 45,900; below that, we can see 45,750 and 45,550 classes.

🔎Stocks in News

🏗️ L&T: Bagged an order worth over Rs 7,000 crore from National High-Speed Rail Corporation Limited (NHSRCL).

💼 Bajaj Finserv: Announced the launch of its first open-ended equity scheme.

🎬 PVR Inox: Launched a super-plex with 12 screens in South Bengaluru.

🏍️ Eicher Motors: Set to reveal Bullet 350, as per media reports.

💰 Federal Bank: Raised $116.92 million through preferential issues of shares to the International Finance Corporation (IFC).

📈 Reliance: Jio Financial Services’ share price stood at Rs 261.85 after a special trading session for Reliance stock. Reliance stock settled at Rs 2,580 after the session.

🌐 Adani Group: Confirmed no plans to merge Ambuja Cement and ACC brands; will continue using both.

🚗 Olectra Greentech: Placed an order with Megha Engineering to construct an EV plant.

🛣️ PNC Infratech: Won 3 orders from NHAI worth Rs 3,264 crore.

🥗 Patanjali Foods: GQG Partners acquired a 5.96% stake in the company.

🏢 Sundaram Clayton: Renamed as TVS Holdings Ltd.

💸 Federal Bank: Fixed floor price for its QIP at Rs 132.59.

📺 Dish TV: The board of directors rejected minority shareholders’ request for an Extraordinary General Meeting.

🥨 Bikaji: Acquired a 49% stake in Bhujialalji Pvt Ltd.

⚡ Tata Group: To invest over 4 billion pounds in setting up a new electric vehicle (EV) battery plant in Britain.

🌾 Godrej Agrovet: Inaugurated an edible oil refinery in Andhra Pradesh.

📈 ITC: Crossed Rs 6 lakh crore market cap, becoming the 7th Indian company.

📆 Federal Bank: Board to meet on 21st July to consider fundraising.

🍃 Torrent Pharma: Subsidiary commissioned a 115 MW wind project in Devbhumi Dwarka district of Gujarat.

👔 LIC: Appointed Sat Pal Bhanoo as Managing Director.

🤝 TCS: Signed a multi-year partnership with BBC.

🤖 Infosys: Reached an agreement with an existing client for AI and automation services worth $2 billion over five years.

💰 Happiest Minds: Raised Rs 500 crore via Qualified Institutional Placement (QIP) route.

🛢️ Indian Oil: Signed long-term contracts to import LNG from Abu Dhabi Gas Liquefaction and TotalEnergies.💼 Piramal Pharma: Received SEBI’s approval to raise up to Rs 1,050 crore through a rights issue of shares.

🍟 Quick Bites

📈 Netweb Tech IPO: Subscribed 9.14 times; Retail investors subscribed 8.77 times. 💼

🛢️ India: Expected to cross China as the main source of growth of global oil demand by 2027: International Energy Agency (IEA). ⛽

✈️ Dubai: Saw a 23% rise in visitor arrivals from India between Jan-May 2023 vs Jan-May 2019. 🏖️

💼 Yatharth Hospital and Trauma Care Services Limited IPO: Open between 26 – 28 July 2023. 💉

🛢️ India: Imported crude oil worth $31.4 billion during the April-June period, lower than $48.1 billion last year. ⛽

🚗 MG Motor India: Sales rose 21% YoY to 29,000 units in the first half of 2023. 🚘

💰 Fino Payments Bank: Looking to become a small finance bank according to MD Rishi Gupta. 🏦

📺 Netflix: Restricted password sharing in India. 🚫

🎬 Box office collection for movies released between Jan to June stood at Rs 4,868 crore. 2023 will end with a box office collection of Rs 9,736 crore, 8% lower than 2022: Ormax Media report. 🎥

🛍️ India’s retail sales rose 7% YoY in June: Retailers Association of India. 🛒

🍅 The Department of Consumer Affairs has directed NCCF and NAFED to sell tomatoes at a retail price of Rs 70 per kg, effective from 20th July 2023. 🍅

📱 Madras High Court has passed an interim order directing Google to charge Disney India only 4% commission for all payments made on the Disney + Hotstar app. 🤝

🛂 India’s passport moved up seven places from its position in 2022 and now ranks at the 80th spot, enabling Indians to travel to 57 destinations without a Visa. Singapore’s passport ranked first: Henley Passport Index. 🛂

🌱 Sustainability Corner

🚗 Anand Group: Commissions Anevolve Headspring Engineering Centre in Gurugram; to develop e-mobility products (on-board chargers & inverters for 4-wheelers, chargers for e2- & 3-wheelers, and BLDC controllers for consumer electronics).

🔋 Stellantis & Saft: Develop smarter, more efficient EV batteries. ‘IBIS’ integrates the electric charger & inverter functions into lithium-ion battery modules, reducing space and cost in EVs.

⚙️ With battery electric vehicles offering almost three times higher sales potential than combustion engines, MAHLE positions itself as a system champion for e-mobility with innovative products and tech.

🔋 Tata Group: To build a 40GW battery cell giga-factory in the UK. Over £4 billion investment to deliver e-mobility & renewable energy storage solutions for customers in UK & Europe. JLR & Tata Motors to be anchor customers, supplies from 2026. 🇬🇧

🔌 Tamil Nadu: Adopts cluster-based approach to develop EV charging infrastructure; prioritising Chennai, Coimbatore, Salem, Madurai, Tirunelveli & Trichy to boost EV volumes. 🏙️

📈 Tata Elxsi: Revenue crosses Rs 850 crore in Q1 FY24; wins multi-year, multi-million US$ biz with a leading Asian OEM for SDV platform & software development, and multi-country licensing & deployment of its Connected Vehicle platform with a global Top 5 OEM. 📊

🛵 Okinawa Autotech: Rolls out upgraded flagship electric scooter Okhi 90 with an AIS-156-compliant battery pack, new motor & enhanced features; claimed top speed of 90kph and 160km range per charge. ⚡

🌍 India Auto Inc’s exports plunge 28% in Q1 FY2024 to 10,32,449 units as monetary crisis hits Africa & other developing markets; car exports down 5% to 152,156 units; CV & 3W shipments down 25%, 2Ws down 31%. 📉

💡Knowledge Candy🍬: What is EBITDA?

EBITDA stands for “Earnings Before Interest, Taxes, Depreciation, and Amortization.” It is a financial metric used by companies to understand their profitability and financial performance.

In simple language, EBITDA is like a way to see how much money a company makes before taking into account certain expenses like interest on loans, taxes, and the cost of assets (like buildings or machinery) getting older over time.

It gives a clearer picture of the company’s core operating profitability, making it easier to compare different companies or industries. EBITDA is widely used in the business world as it helps investors and analysts understand how well a company is doing without getting tangled in complicated accounting details.

How can EBITDA help you?

Trend Analysis: By looking at a company’s EBITDA over several periods (e.g., quarterly or annually), you can identify trends in its core operating profitability. Increasing EBITDA over time indicates improving performance, while declining EBITDA may suggest challenges.

🤝 Comparing with Industry Peers: EBITDA allows you to compare the performance of a company with its industry peers. Higher EBITDA than competitors might indicate that the company is more efficient in generating profits. 💼

💰 Assessing Financial Health: EBITDA helps evaluate a company’s financial health without considering certain non-operational expenses. A positive EBITDA suggests that the company is making profits from its core operations.

Happy trading!

Also Read: Understanding ESG Investing & Its Emergence in India