Booming Bright: Indian Economy Surges with Manufacturing Highs 🏭 ! | Indian Stock Market Weekly Update 3 June

Indian Economy Surges with Manufacturing Highs | Stock Market Weekly Update 3 June

Greetings, readers!

In this weekly reading diet, let’s examine the buzz and chatter around India 🌍

Good news for the Indian economy! Recent reports show that things are looking up. In May, the manufacturing sector, which makes products in factories, did really well. A measure called Manufacturing PMI, which shows how well factories are doing, reached a 31-month high. This means that factories are making more things and getting lots of orders.

Car sales, too, were really good in May. More people bought cars than ever before for that month. This is a positive sign for the auto industry. The availability of essential parts like computer chips has improved, and people are showing a strong interest in buying SUVs.

Another positive sign is the money the government collects from taxes on goods and services, called GST. In May, GST collections were 12% higher compared to the same time last year. This shows that people are spending money, and the economy is doing well. Also, the value of transactions made using a digital payment system called UPI increased by 43% compared to last year.

Overall, these good economic indicators suggest that our economy is healthy, even when the global economy is facing challenges.

Hey, do not forget to taste the Knowledge Candy 🍬 We have got something interesting for you.

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

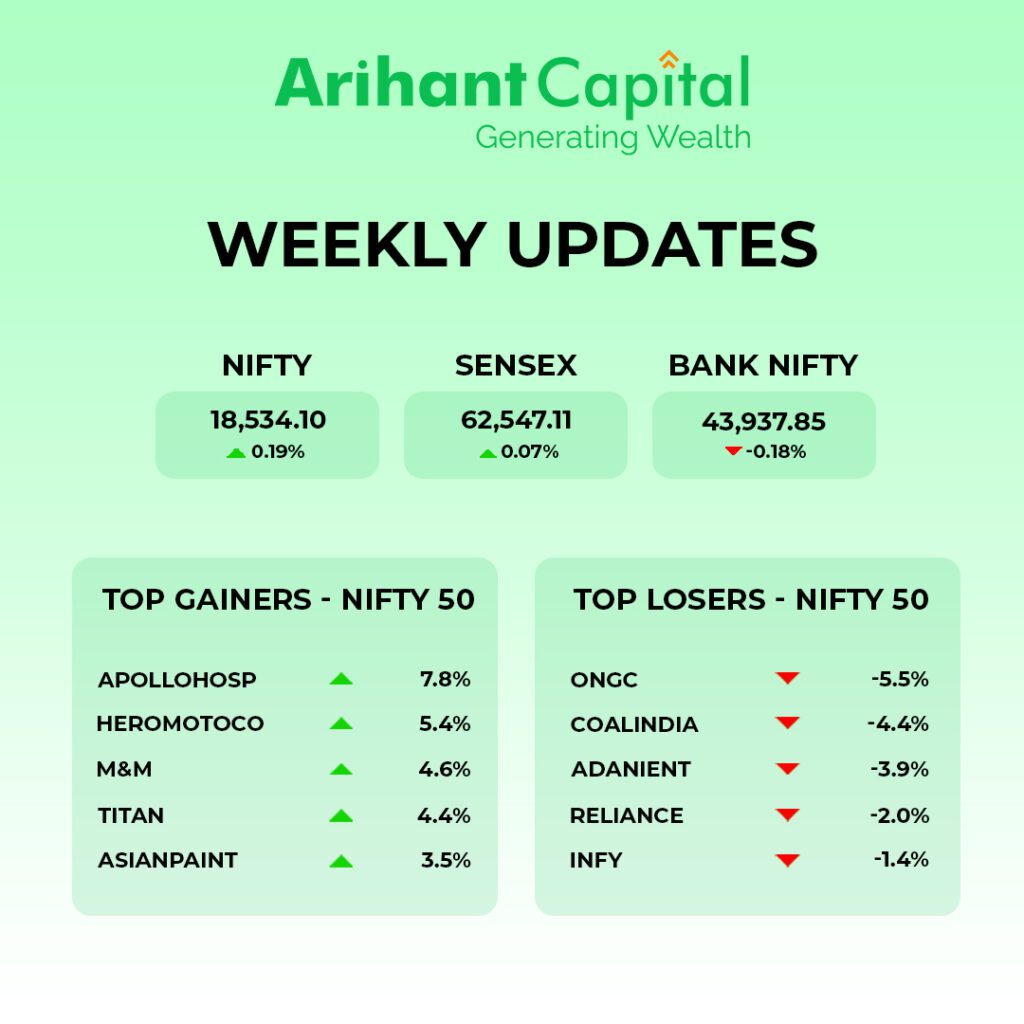

India’s major stock market indices showed signs of recovery on Friday, putting an end to a two-day decline and managing to secure slight gains for the week. Notably, real estate, metals, and public sector banks witnessed positive momentum, indicating a favourable market sentiment. On the other hand, the information technology and oil and gas sectors faced some downward pressure.

The positive trajectory in the stock market was primarily influenced by the successful passage of the debt ceiling deal in Congress. This development boosted investor confidence and contributed to the upward movement observed in the market.

In terms of specific figures, the Nifty index closed 68 points higher at the level of 18,567. Similarly, the Sensex index showed an upward trend, gaining 178 points to reach a level of 62,680. Meanwhile, the Nifty Bank index remained relatively stable, maintaining a flat position at 44,021.7.

Overall, the rebound in the stock market, driven by favourable sector performances and positive market sentiment following the debt ceiling deal, reflects a promising outlook for investors and market participants.

What is next for Investors?

Looking ahead, investors should take note of the recent global market recovery, which signals a positive trend. Additionally, on the domestic front, favourable GDP numbers and a significant decrease in inflation, reaching an 18-month low, suggest that the Reserve Bank of India (RBI) may choose to pause interest rates during their upcoming meeting, following a slightly hawkish stance in April.

In light of these factors, it is advisable for investors to exercise caution against the sensationalized scenarios often portrayed by the media. Instead, increasing cash exposure at this stage may be a prudent strategy.

When it comes to specific stock recommendations, Piramal Enterprises and Petronet LNG appear favourable among large-cap stocks. Notably, UBL (United Breweries Limited) has the potential to surprise investors positively.

In the coming days, it will be valuable to pay attention to commentaries from various management teams, particularly Tata Communications and Hero Moto Corp, as they host their investor meetings. These insights can provide valuable information for making informed investment decisions.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of the Nifty, we are observing a “Doji” candlestick pattern formation, and on the weekly chart, it is still trading above short-term moving averages.

If we analyze both charts, it indicates that positive momentum can continue, but there could be some consolidation, and any dip can be used as a buying opportunity. If Nifty starts trading above the 18,580 level, then it can touch the 18,750–18,880 level, while on the downside, support is at 18,400, and if it starts to trade below, then it can test the levels of 18,320 and 18,200.

Bank Nifty

If we look at the daily chart of the Bank Nifty, we are observing the “Doji” candlestick formation, and on the weekly chart series, we are Narrow range body formation. It indicates that Banknifty is still in a consolidation mood, but momentum will remain on the positive side. In the coming week, if it trades above 44,100, then it can touch 44,300 and 44,500 levels. However, downside support comes at 43,850, and below that, we can see 43,600 and 43,450 levels.

🔎Quick Bites

- India’s GDP grew by 6.1% in Jan-March 2023, with a projected growth rate of 7.2% for the fiscal year.

- India’s power consumption rose by 1.04% in May.

- Manufacturing growth reached a 31-month high with a PMI of 58.7 in May.

- UPI transactions rose to Rs 14.3 lakh crore in May, a 2% increase from April.

- India’s non-fossil fuel-based power generation capacity is expected to reach 68.4% by 2031-32.

- Domestic coal production increased by 7.10% year-on-year in May.

- India’s forex reserves fell by $4.34 billion to $589.14 billion in May.

- India’s gross GST revenue collection in May stood at Rs 1.57 lakh crore, a growth of 12% YoY.

- Electric scooter registrations in May rose by 148% YoY and 57% MoM.

- India’s unemployment rate declined to 6.8% in Jan-March 2023.

- India’s moon mission Chandrayaan-3 will be launched in July 2023.

- Investment through participatory notes reached Rs 95,911 crore in April.

- The government removed ISTS charges on offshore wind, green hydrogen, and ammonia projects.

- India extended its $1 billion credit line to Sri Lanka for another year.

- Apple added three new suppliers in India, bringing the total to 14 companies.

YoY* is an acronym used for Year on Year

📈 Stocks in News!

- ICICI Bank will acquire an additional 4% stake in ICICI Lombard in multiple tranches.

- Reliance Industries‘ arm Reliance Consumer Products announced the launch of Alan’s Bugles corn chips brand in India.

- Go First is reportedly paying Rs 1 lakh per month extra salary to retain its pilots. Meanwhile, 200 of its pilots are shifting to Air India, as per reports.

- ONGC will invest Rs 1 lakh cr on energy transition by 2030 with the aim of achieving net zero carbon emissions by 2038.

- NMDC reduces iron ore lump and fines rates by Rs 300 and Rs 450 per tonne.

- Prestige Group completed the acquisition of Prestige (BKC) Realtors Private Ltd and Turf Estate Joint Venture for Rs 1,176 cr.

- Reliance’s JioCinema recorded over 3.2 cr viewers during the IPL final.

- BHEL recorded a 17% rise in new orders in Financial Year 2023.

- Xiaomi is reportedly partnering with Dixon Technologies to assemble its phones in India.

- Vedanta repaid $400 million of its loans, cutting gross debt to $6.4 billion.

- Coal India has increased prices of non-coking coal by 8%.

- SBI Card is planning to raise up to Rs 3,000 cr by issuing debentures.

- Mauritius Holdings sold a 1.66% stake of HDFC Life to HDFC Bank.

- HDFC has raised Rs 8,235 cr by issuing two-year bonds at a coupon rate of 7.80%.

- The government has appointed Ashwani Kumar as Managing Director of the Uco Bank.

- Patanjali Foods’s promoters are planning to sell around a 6% stake in the company to meet SEBI’s minimum public shareholding rule.

TVS Motor hiked prices of its EV scooter by Rs 17,000 – Rs 22,000.

🏗️Corporate Actions

| Split | ||

| Company | Ratio | Ex-Date |

| HARDWYN INDIA LTD | 1:10 | 05-June-2023 |

| RADHAGOBIND COMMERCIAL LTD | 1:10 | 08-June-2023 |

| Rights | ||

| Company | Ratio | Ex-Date |

| HARDWYN INDIA LTD | 1:3 | 05-Jun-2023 |

| Buyback | ||||

| Company | Ex Date | Start Date | End Date | Offer Price |

| WIPRO | 16-June-2023 | – | – | 445.00 |

| Dividend for 22nd – 27th 2023 | |||

| Company | Type of dividend | Dividend | Ex-Date |

| Shyam Metalics and Energy Ltd | Interim Dividend | ₹1.8 | 5-Jun-23 |

| Prime Securities Ltd | Dividend | ₹0.5 | 6-Jun-23 |

| Asian Paints | Final Dividend | ₹21.25 | 9-Jun-23 |

| HDFC AMC Ltd | Dividend | ₹48 | 9-Jun-23 |

| Indian Hotels Co. Ltd | Final Dividend | ₹1 | 9-Jun-23 |

| National Fertilizers | Final Dividend | ₹1.53 | 9-Jun-23 |

| Voltas Ltd | Final Dividend | ₹4.25 | 9-Jun-23 |

🔌Sustainability Corner

- Tata Motors has introduced the upgraded Nexon EV Max XZ+ Lux, with a starting price of INR 18.79 lakh (ex-showroom, all India for the 3.3 kW AC charger).

- Royal Enfield has expanded its global manufacturing presence by establishing its fifth completely knocked-down (CKD) assembly unit in Nepal, adding to its existing units in Brazil, Thailand, Colombia, Argentina, and its manufacturing hub in Tamil Nadu.

- The Tata Group is venturing into the electric vehicle (EV) battery cell manufacturing business and aiming to establish a local supply chain. Agratas Energy Storage Solutions, a company within the group, will construct a lithium-ion cell plant worth INR 13,000 crore in Sanand, Gujarat, with an initial manufacturing capacity of 20 GWh.

- The impact of the FAME 2 policy has led electric two-wheeler startups, such as Ola Electric and Ather, to absorb the majority of the subsidy shock in order to maintain their market position. Here’s a glimpse of their pricing strategies:

- In May 2023, electric two-wheeler retail sales in India reached a record-breaking 104,755 units before the reduced FAME subsidy and increased vehicle prices came into effect. Within the last eight days of May, 57,917 e-2Ws were purchased, with Ola, TVS, Ather, and Bajaj achieving their highest-ever monthly sales.

- Wardwizard Innovations, an electric scooter manufacturer, has established an Electric Vehicle Centre of Excellence at the Dogra Regimental Centre in Ayodhya Cantt, Faizabad, Uttar Pradesh. The center aims to facilitate skill development and create employment opportunities for retired army personnel.

Knowledge Candy 🍬📚

Imagine you’re playing in the snow and decide to make a small snowball. As you roll it on the ground, it starts gathering more snow, getting bigger and bigger. The more snow it collects, the faster it grows. Soon, what started as a tiny snowball becomes a huge one that was too big for you to handle.

Now, apply this analogy to the Indian economy. Just like the snowball, the economy is picking up momentum and growing exponentially.

There are several factors driving this snowball effect. First, India’s population is a major contributor. With nearly 70% of the population falling into the working age group, there’s a larger proportion of people who can drive consumption and economic growth. Additionally, the trend of nuclear families and migration to cities for work is expected to boost urban consumption, leading to increased demand for housing and vehicles.

To avoid inefficiencies, the government has launched programs like the Gati Shakti Mission to ensure better coordination among departments and maximize the utilization of resources. Efforts to improve the distribution of welfare subsidies, using tools like Aadhar cards and Direct Benefit Transfer, are reducing leakages and reaching the intended beneficiaries.

As companies witness these changes, they are increasing their investments. Private companies are announcing and building new projects, while foreign companies are choosing India as a manufacturing destination. This amplifies the snowball effect.

📬Also Read: Sustainable Investing in India: ESG Investments