Congress Wins Key Election | Indian Stock Market Weekly Update 13 May

Congress Gains a Majority in Karnataka Assembly Election

Congress swept past its rivals in the Karnataka Legislative Assembly election held earlier this week and gained a majority. This result was a stark contrast to the 2018 Karnataka Legislative Assembly election when the Bharatiya Janata Party (BJP) won 104 seats out of the 224 seats.

Karnataka is the only South Indian state where BJP has an elected government and with this loss, India’s ruling party might lose its foothold in South India.

It is expected that this election would influence assembly elections in other states. This win is also expected to boost Congress’ campaign for the 2024 General Elections.

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

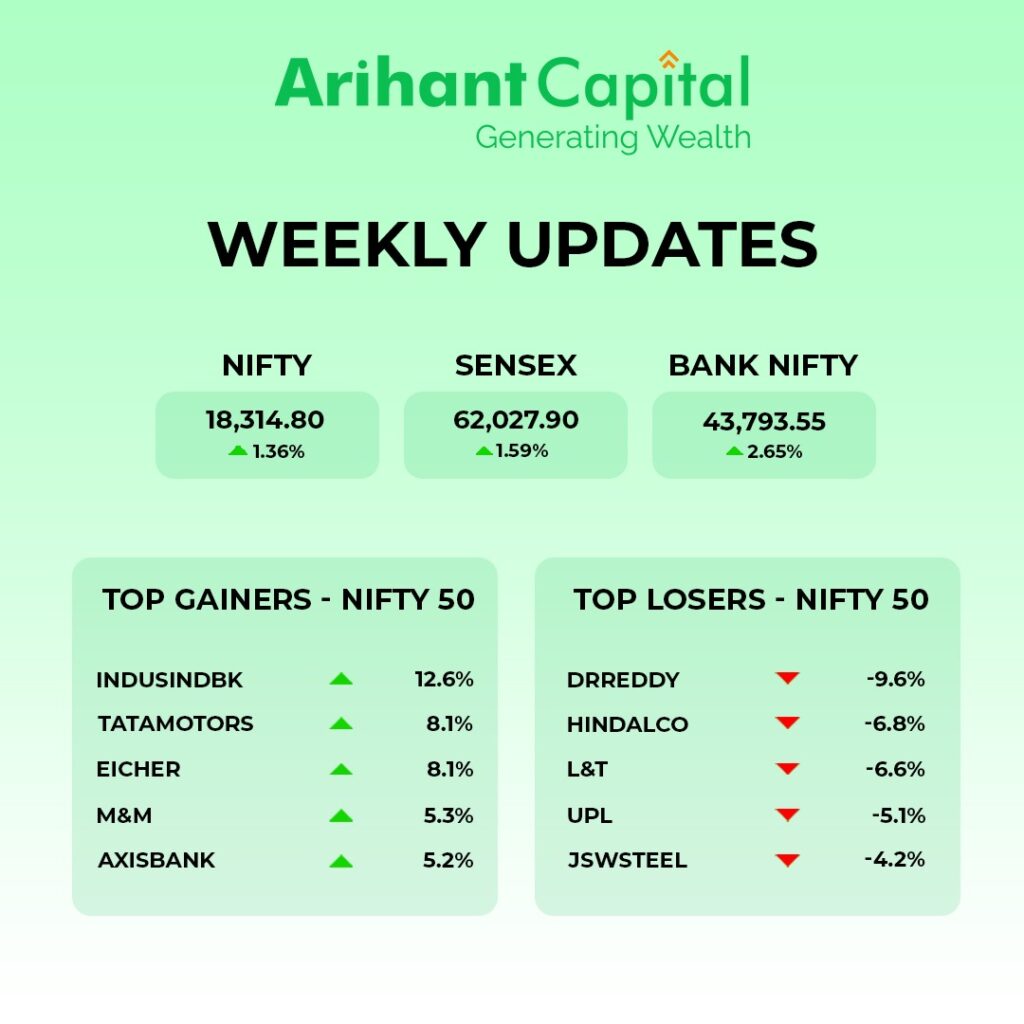

India’s benchmark stock indices ended higher on Friday after reversing early losses, helped by gains in banking and auto stocks. However, metal, energy, and media stocks declined. This week, Nifty ended 246 points up at the 18,315 level. Sensex was up and stood at 62,028 points and Nifty Bank was up by 2.65% at 43,795.

The US indices displayed mixed results as the January-March quarter results neared their end. Alphabet (Google’s parent company) drove the technology-heavy Nasdaq Composite to outperform other indices. US financial stocks were dragged lower by worries over certain regional banks.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we see a series of narrow-range body formations. On the weekly chart, we see a “Higher High” formation.

If we analyze both charts, it indicates that still positive momentum can continue and we should maintain a buy-on-dips approach. If Nifty starts trading above the 18,350 level, then it can touch the 18,500-18,650 level.

On the downside, support is 18,100 and if it starts to trade below then it can test the level 17,950 and 17,850 levels.

Bank Nifty

If we look at the daily chart of Bank Nifty, we see a breakout of the consolidation zone. On the weekly chart, Bank Nifty shows a “Higher High” formation.

It indicates that now once again Bank Nifty can outperform Nifty.

In the coming week if Bank Nifty trades above 43,850 then it can touch 44,200 and 44,500 levels. However, downside support comes at 43,650, and below that, we can see 43,450 and 43,100 levels.

🔐KEY RESULTS Q4FY23

- Asian Paints – Net profit up 45% YoY to ₹1,234 crore. Revenue increased 11.33% YoY to ₹8,787 crore.

- Tata Motors – Earned a net profit ₹5,408 crore in contrast to a loss of ₹1,032 crore in the same quarter last year. Revenue rose 35% to ₹1.06 lakh crore.

- Cipla – Net profit rose 40.7% YoY to ₹522 crore. Revenue rose 9.1% YoY to ₹5,739 crore.

- Vedanta – Net profit fell 67.5% YoY to ₹1,881 crore. Revenue dropped 5.4% YoY to ₹37,225 crore.

- L&T – Net profit rose 10% YoY to ₹3,987 crore. Net sales rose 10.38% YoY to ₹58,335 crore.

- Dr. Reddy’s Laboratories – Net profit fell 1.03% YoY to ₹960 crore. Net sales rose 15.35% YoY to ₹6,315 crore.

- Coal India – Net profit fell 17.68% YoY to ₹5,528 crore. Net sales rose 16.65% YoY to ₹38,152 crore.

- UPL – Net profit fell 37.75% YoY to ₹1,080 crore. Net sales rose 4.46% YoY to ₹16,569 crore.

- P&G – Net profit rose 60% YoY to ₹165 crore. Net sales dropped 1% YoY to ₹883 crore.

- Mahanagar Gas – Net profit rose 104% YoY to ₹268 crore. Revenue from operations grew 49% YoY to ₹1,771 crore.

- Kansai Nerolac Paints – Net profit rose 283% YoY to ₹94 crore. Net revenue from operations rose 13.6% to ₹1,605 crore.

- Hindustan Aeronautics – Net profit fell 8.82% YoY to ₹2,831 crore. Revenue from operations rose 8% YoY to ₹12,494 crore.

- Polycab India – Net profit rose 31.6% YoY to ₹428 crore. Revenue from operations grew 8.9% to ₹4,323 crore.

- Godrej Consumer Products – Net profit rose 24.5% YoY to ₹452 crore. Sales rose 10% YoY to ₹3,172 crore.

- SRF – Net profit fell 7.13% YoY to ₹562 crore. Net sales rose 6.44% YoY to ₹3,778 crore.

- Raymond – Net profit fell 25.85% YoY to ₹196 crore. Net sales rose 9.81% YoY to ₹2,150 crore.

- Pidilite Industries – Net profit rose 12.39% to ₹286 crore. Net sales grew 7.27% YoY to ₹2,689 crore.

- Olectra Greentech – Net profit rose 54% YoY to ₹27 crore. Revenue rose more than 38% YoY to ₹375 crore.

- Apar Industries – Net profit rose 193.83% YoY to ₹243 crore. Revenue rose 35% YoY to ₹4,088 crore.

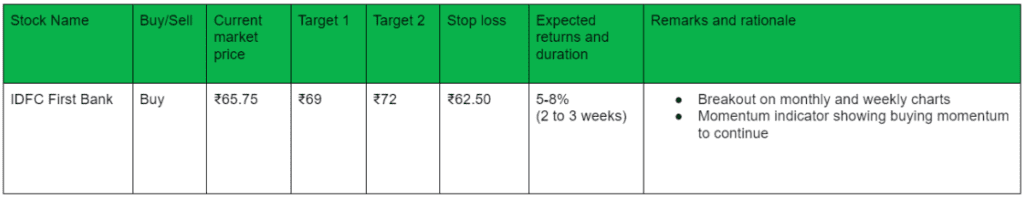

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

🔎Quick Bites

Global

- Retail inflation in the US fell to 4.9% in April from 5% in March.

- The Bank of England, the United Kingdom’s central bank, raised interest rates to 4.5% – the highest since 2008.

Economy

- Retail inflation in India fell to an 18-month low of 4.7% in April. Inflation has stayed within RBI’s target range of 4% to 6% for the second month in a row.

- In March, India’s industrial production growth fell to 1.11% as opposed to 5.78% in February.

Banking, Financial Services, and Insurance

- As global reinsurers raised rates by 40% to 60%, insurance costs for Indian companies are expected to rise.

- HDFC’s education loan, Credila, is attracting interest from 12-14 entities including sovereign wealth funds, private equity firms, and strategic investors.

- Since February 2023, to comply with SEBI’s takeover regulations, SoftBank sold a 2.07% stake in Paytm.

- Due to alleged corporate governance lapses, SEBI issued legal notices to PTC India and PTC India Financial Services.

- HDFC Bank raised lending rates by 0.15%.

Automobiles

- Eicher Motors will be making a cash outlay of ₹1,000 crore which will be used to develop new EV products and to strengthen its internal combustion engine portfolio.

- On 12th April, the Tata Nexon became the first model in Tata Motors’ seven-model ‘New Forever’ range of passenger vehicles to see the rollout of its 5,00,000th unit from the Ranjangaon plant in Pune. April 2023 also marked a similar milestone on the sales front.

- India’s automobile wholesale numbers for April 2023:

- Highest-ever passenger vehicle sales in April; including Tata Motors, total sales are 331,378 units

- Electric 3Ws sales were up 166%, expanding their market share to 7%

- Double-digit growth for both scooters and motorcycles

- Tata Technologies signs MoU with TiHAN (Technology Innovation Hub on Autonomous Navigation and Data Acquisition Systems at IIT Hyderabad) to collaborate and support innovation in software-defined vehicles and advanced driver assistance systems.

- Central Consumer Protection Authority (CCPA) issues orders on the top 5 e-commerce platforms for selling car seat belt alarm stopper clips, violating Consumer Protection Act, 2019.

Telecommunications

- Telecom secretary K Rajaraman stated that Vodafone Idea (Vi) is expected to unveil a revival plan within a month.

- Airtel added 19.8 lakh mobile customers in February. Vodafone Idea (Vi) lost 20 lakh customers in the same month.

Pharma

- Income tax officials are searching the premises of Mankind Pharma.

Oil

- Life Insurance Corporation of India (LIC) increased its stake in Hindustan Petroleum Corporation from 4.9% to 5%.

- Delhi high court dismissed a petition by the Union government against a consortium led by Reliance Industries. The petition is related to a gas dispute in the Krishna-Godavari basin.

- In April, as the purchase of Russian oil peaked, India’s oil imports from OPEC fell to 46% of the total OPEC oil sales.

- Om Prakash Singh, ONGC’s director of technology and field services, stated that it will begin oil production in the Krishna Godavari basin by June.

Power

- JSW Energy’s subsidiary, JSW Renew Energy Three secured a 300MW power purchase agreement with Solar Energy Corporation of India.

- SJVN secured a 100 MW wind power project in Gujarat.

- Thermax secured an order worth ₹271 crore from a domestic private oil refiner to set up a captive power plant to be used for a new oil-to-chemical (O2C) facility.

IPO Corner

- Mankind Pharma got listed on Tuesday and closed at a premium of 32% on the upper band of its issue price.

- Jupiter Hospital submits draft papers for an IPO with SEBI. The IPO will be a mix of an offer-for-sale and a fresh issue, with a total estimated value of close to ₹900 crore to ₹1,100 crore.

- JSW Infrastructure submits draft papers for an IPO with SEBI. The IPO will be made up entirely of a fresh issue, with an estimated value of close to ₹2,800 crore.

🏗️Corporate Actions

| Bonus | ||

| Company | Ratio | Ex-Date |

| Veerkrupa Jewellers | 2:3 | 16 May 2023 |

| Split | ||

| Company | Ratio | Ex-Date |

| Visaka Industries | 1:5 | 15 May 2023 |

| Veerkrupa Jewellers | 1:10 | 16 May 2023 |

| Buyback | |||

| Company | Start Date | End Date | Offer Price |

| Symphony | 3 May 2023 | 17 May 2023 | ₹2000 |

| TeamLease Services | 12 May 2023 | 25 May 2023 | ₹3050 |

| Dividend | |||

| Company | Type | Dividend (₹) | Ex-Date |

| Anupam Rasayan India | Interim Dividend | 1.5 | 15 May 2023 |

| Sula Vineyards | Final Dividend | 5.25 | 15 May 2023 |

| Tata Coffee | Dividend | 3 | 15 May 2023 |

| GM Breweries | Final Dividend | 6 | 16 May 2023 |

| HDFC | Interim Dividend | 44 | 16 May 2023 |

| HDFC Bank | Final Dividend | 19 | 16 May 2023 |

| Sundram Fasteners | Interim Dividend | 3.06 | 16 May 2023 |

| Foseco India | Final Dividend | 25 | 17 May 2023 |

| Man Infraconstruction | Interim Dividend | 0.36 | 19 May 2023 |

| Home First Finance Company India | Final Dividend | 2.6 | 19 May 2023 |

| JM Financial | Final Dividend | 0.9 | 19 May 2023 |

| Rain Industries | Interim Dividend | 1 | 19 May 2023 |

| Tata Consumer Products | Final Dividend | 8.45 | 19 May 2023 |

🪜Others

- Jaiprakash Associates reported that it defaulted ₹3,946 crore as on April 30, 2023, to various banks.

- SN Subrahmanyan will succeed AM Naik as Larsen & Toubro chairman from 1st October.

- Ambuja Cements looks to increase its clinker capacity by 80 lakh tonnes at its Bharatpara and Maratha units.

- Hindustan Copper plans to ₹548 crore through financial routes and is seeking shareholder approval to raise up to ₹500 crore to offer, issue, and allot secured or unsecured non-convertible debentures or bonds on private placement.

- JioCinema, the OTT that comes under the umbrella of Reliance Industries, recorded over 1,300 crore views in the first 5 weeks.

- Aditya Birla Fashion and Retail plans to acquire a 51% stake in TCNS Clothing Co for ₹1,650 crore.

- Anupam Rasayan India renewed a long-term with a German multinational company worth ₹436 crore.

- Krishna Defence secured an order worth ₹63 crore to supply special heating equipment to be used by Indian armed forces at high altitudes.

- In FY 2023, India’s coal imports rose by 30% to 1,624.6 lakh tonnes.

- Invesco slashed Swiggy’s valuation by 32.93% to $5.5 billion. Vanguard reduced Ola’s valuation by 35% to $4.8 billion.

- In the last quarter, India shipped 2.51 crore wearables such as smartwatches recording an 80.9% YoY growth.

- Till 30th June, importers with TRQ licenses will be exempted from basic customs duty and related cess for imports of crude soybean and sunflower oil.

🔌Sustainability Corner

- Tata Motors eyes the growing EV market in Nepal and expands its portfolio with the launch of the Nexon EV Max.

- Amara Raja Batteries eyes the Indian government’s lithium initiatives as it rushes to finish the first phase of its lithium-ion battery gigafactory by April 2026.

- Ather Energy developing a new low-cost electric scooter; the new model, which is likely to be less feature-laden than the flagship 450X, is expected to be Ather’s new entry-level EV in India.

- The government may provide incentives for eco-friendly shipping vessels and port projects to promote sustainability and carbon transition.

- Honda revealed an electric EM1 e-scooter with a 41 km range and 45 kmph top speed. The new Honda EV is the first of the company’s planned 10 or more electric two-wheelers by 2025.

Result Calendar for May 15th – May 20th 2023

| 15th May | |||

| Procter & Gamble Health | Pfizer | Coromandel International | Kalyan Jewellers India |

| PCBL | Century Plyboards (India) | ||

| 16th May | |||

| Bharti Airtel | Granules India | CreditAccess Grameen | Kajaria Ceramics |

| Indian Oil Corporation | |||

| 17th May | |||

| Vaibhav Global | Glaxosmithkline Pharma | TeamLease Services | Deepak Fertilisers |

| Jubilant FoodWorks | Endurance Technologies | Timken India | Sterlite Technologies |

| 18th May | |||

| Bata India | Gland Pharma | Container Corporation Of India | GNFC |

| ITC | Clean Science And Technology | The Ramco Cements | State Bank Of India |

| Sumitomo Chemical India | |||

| 19th May | |||

| JSW Steel | Motherson Sumi Wiring India | Glenmark Pharmaceuticals | Crompton Electricals |

| 20th May | |||

| Bharat Electronics | |||

📬Also Read: Sustainable Investing in India: ESG Investments