SBI Steals the Show with Mind-Boggling Profit Growth | Indian Stock Market Weekly Update 20 May

Banking Mammoth packs a punch!

It’s party time in the Indian banking sector 🥳. India’s top banks, including HDFC, ICICI, Kotak, RBL, IDBI, the Central Bank, and IDFC, have wowed with their stellar quarterly performances, propelling the banking sector to within a whisker of its all-time high as an index.

But one bank has truly stolen the spotlight—the mighty SBI, the big brother of banking. SBI has positively shocked the markets with a mind-boggling 83% year-on-year growth in standalone net profit of ₹16,695 crore for Q4 FY23.

But hold on, there’s more to this captivating tale! The SBI Board, in recognition of the bank’s exceptional performance, has declared an extraordinary dividend of ₹11.30 per equity share (1130%) for the financial year ending in March 2023.

SBI’s Net Interest Income(NII) has surged 29% to ₹40,393 crore, compared to ₹31,198 crore in the same quarter of the previous year. It’s a clear testament to the bank’s unwavering strength and dominance in the industry.

To learn more about net interest income click here!

🧾In this Article

- Stock Market Outlook

- Stock Picks

- Quick Bites

- IPO Corner

- Corporate Actions

- Sustainability Corner

- Result Calendar

- Knowledge Candy: Net Interest Income

– Mr. Abhishek Jain, Head of Research at Arihant Capital

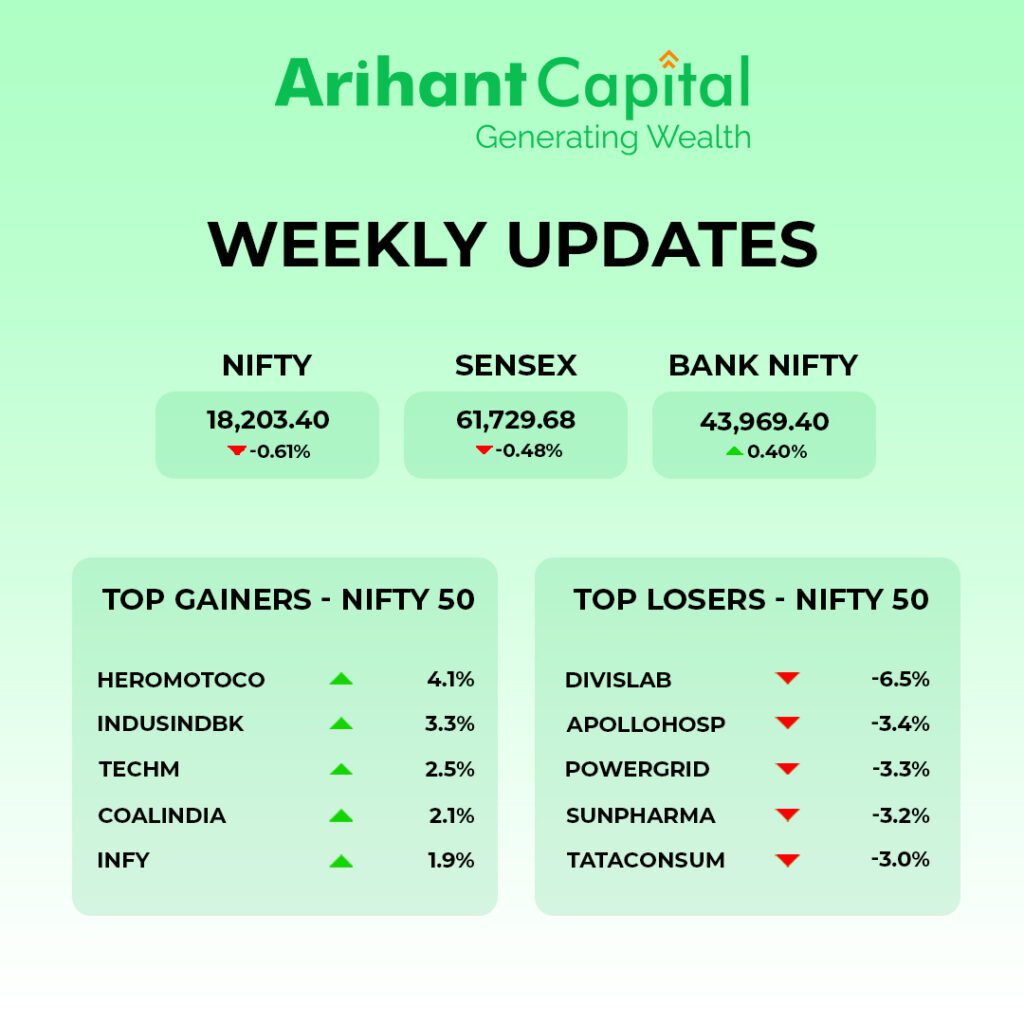

The Indian stock market bounced back after three consecutive days of losses, supported by increases in Adani Group, and information technology shares.

However, on a weekly basis, the Nifty 50 index experienced a 0.61% decline, while the Sensex index dropped by 0.48%.

Among the sectors, Nifty Pharma witnessed the biggest decline this week, followed by Nifty Media and Nifty Metal. On the other hand, Nifty Realty performed the best with the highest gains, followed by Nifty IT.

₹2000 Notes Bow Out After A Short Innings

– Mr. Abhishek Jain, Head of Research at Arihant Capital

On 19th May, the Reserve Bank of India announced that it plans to withdraw ₹2000 notes from circulation. The common public can deposit or exchange. The note will be in banks until 30th September. The central bank also announced that ₹2000 would continue to be legal tender until 30th September.

❓ How does this look in contrast with the demonetization that took place in 2016?

We believe this would not lead to chaos like demonetization in 2016. The people are given ample time to deposit or exchange their notes. The RBI has also announced that they will remain in circulation until 30th September. This is quite different from 2016. There are no big lines in banks or ATMs like in 2016. Market, if any correction comes, may happen due to recent rallies and valuations that have become a little expensive after the recent rally in markets.

Demonetization, where common people struggle to deposit or exchange their invalidated ₹500 or ₹1000 notes. One important thing to understand is that, as a percentage, ₹2000 notes are minuscule in comparison to the 2016 demonetisation. As per industry reports, 86% of notes under circulation were impacted by demonetization in 2016. While this number is expected to be minuscule as the central bank has already stopped printing the ₹2000 note for the last 3 to 4 years.

❓ How would the economy respond to this?

We do not see any significant impact or a slowdown in the economy because of this decision. There have been some signs of a slowdown in orders and retail sales in March and April. On the positive side, this may lead to higher sales of consumer durables, luxurious products, et cetera.

❓ How would financial institutions be affected?

We do not see any impact on financial institutions like NBFCs or MFIs in 2016. The economy is much more digital than ever. Despite fears of lower rainfall due to El Nino, the rural economy has been buoyant in the last few weeks.

❓ How could this be favorable for the economy?

On the positive side, this can lead to a flux of deposits in the bank, which can also lead to a lowering of interest rates. Investors should add IT stocks, NBFCs, consumer durables, pharma, capital goods, insurance, financials, capital goods, and telecom on weakness. As per our channel checks in various cities, like Jaipur, Indore, Bhopal, and Delhi, ₹2000 notes are accepted, commonly as legal tender, in malls, petrol pumps, retailers, etc.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we see a “High wave Doji” candlestick formation. On the weekly chart, we see a “Doji” candlestick formation.

If we analyze both charts, it indicates that still positive momentum can continue and we should maintain a buy-on-dips approach.

If Nifty starts trading above the 18,280 level, then it can touch the 18,380 to 18,500 level. On the downside, support is 18,150 and if it starts to trade below then it can test the levels of 18,050 and 17,900 levels.

Bank Nifty

If we look at the daily chart of Bank Nifty, we see a “Hammer” candlestick formation. On the weekly chart, Bank Nifty is still trading above short-term moving averages.

It indicates that now once again Bank Nifty can outperform Nifty. In the coming week, if Bank Nifty trades above 44,100 then it can touch 44,300 and 44,500 levels.

However, downside support comes at 43,850 and below that, we can see 43,600 and 43,450 levels.

🔐KEY RESULTS Q4FY23

| Company | Net Sales Growth Rate | Net Sales (crore) | Net Profit Growth Rate | Net Profit (crore) |

| ITC | 7.35% | ₹19,058 | 23% | ₹5,175 |

| IndiGo | 76.55% | ₹14,161 | – | ₹919 |

| Airtel | 14.31% | ₹36,009 | 50% | ₹3,006 |

| Indian Oil Corporation | 10.36% | ₹2,30,712 | 52.93% | ₹10,841 |

| Jindal Steel and Power | -2% | ₹15,781 | -69.50% | ₹465.6 |

| Chemplast Sanmar | -37% | ₹1,147 | -80% | ₹46 |

| Pfizer | 4.10% | ₹572.6 | 3.10% | ₹129.6 |

| PBCL | 12.70% | ₹1,373.80 | 15.80% | ₹102.2 |

| Avenue Supermarts (DMart) | 20.10% | ₹10,337 | 8.30% | ₹505.2 |

| HPCL | 8.70% | ₹1,14,445 | 78% | ₹3,608 |

| Oberoi Realty | 18% | ₹995 | 106.20% | ₹480 |

| Max Healthcare | 26% | ₹1,637 | 86% | ₹320 |

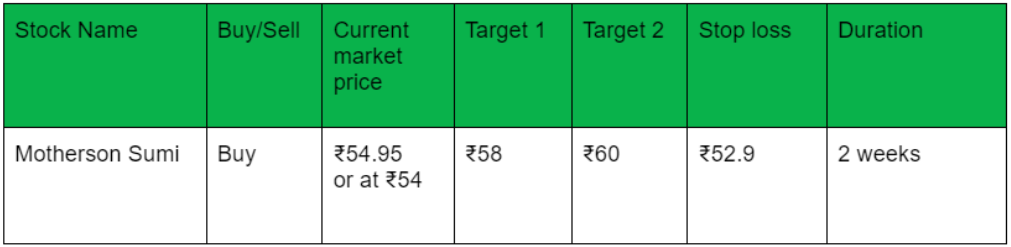

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

🔎Quick Bites

Economy

- In April, wholesale prices in India fell by 0.92% in comparison to the same month last year.

- In April, India’s trade deficit stood at $15.24 billion (₹1,26,136 crore).

- In April, India’s exports to the UAE fell by 22% to $2.23 billion (₹18,450 crore) as opposed to $2.86 billion (₹23,663 crore) last year.

Banking, Financial Services, and Insurance

- SBI Funds Management gets approval from RBI to buy a 9.99% stake in HDFC Bank.

- Paytm will partner with SBI Cards and Payment Services to launch a new credit card.

- Last year, IRDAI gave out insurance licenses to 3 companies. This year, the regulatory body plans to give out insurance licenses to 12 companies.

- REC plans to raise the share of renewable energy in its loan portfolio to around 25-30% and double its loan portfolio to ₹10 lakh crore by FY30.

- Bank of Baroda reported that its net interest income grew 33.8% YoY to ₹11,525 crore and that its net profit rose 168% YoY to ₹4,775 crore.

Information Technology

- Infosys entered into an agreement with BP, an energy company, for a deal worth $1.5 billion (₹12,417 crore).

- Infosys came out with a 60% variable pay for Q4 of FY 2022-23. This was 10% lower than the variable pay in the first quarter of FY 2022-23.

Telecommunications

- Airtel, Vodafone Idea (Vi) and Reliance Jio are implementing measures like blocking incoming calls once the plan period ends to increase their average revenue per user (ARPU), including.

- TRAI has stated that it is not probing past tariff plans filed by telecom companies except those specific plans under examination.

- Boeing is in a dispute with Indian telecommunications companies regarding 5G services near airports. The aircraft-maker contests that 5G services should be barred at least 5.1km from airports, a view which is opposed by telecommunication companies.

Automobiles

- Maruti Suzuki India announced that its hatchback car, WagonR, reached the sales milestone of 30 lakh.

- ICRA stated that the revenues of automobile dealerships are expected to grow by 11% to 13% this fiscal year.

Airlines

- SpiceXpress and Logistics, SpiceJet’s subsidiary, to receive a $100 million (₹828 crore) investment from a UK-based group.

Mining

- Sonal Shrivastava has been appointed as the new CFO of Vedanta with effect from 1st June.

Oil

- Gazprom Marketing and Trading Singapore went back on a commitment to supply liquefied natural gas (LNG) to GAIL India last year, for which GAIL India is seeking damages.

- The windfall tax on petroleum crude of ₹4,100 per tonne was removed with effect from 16th May.

- India will import 92 lakh barrels of crude oil as a part of its strategic reserve.

🏗️Corporate Actions

| Split | ||

| Company | Ratio | Ex-Date |

| Radhika Jeweltech | 1:5 | 26 May 2023 |

| Right | ||

| Company | Ratio | Ex-Date |

| Sharanam Infraproject and Trading | 2:3 | 22 May 2023 |

| Buyback | |||

| Company | Start Date | End Date | Offer Price |

| TeamLease Services | 12 May 2023 | 25 May 2023 | 3050.00 |

| Hinduja Global Solutions | 22 May 2023 | 02 June 2023 | 1700.00 |

| Dividend for 22nd – 27th 2023 | |||

| Company | Type of dividend | Dividend | Ex-Date |

| Bank of Maharashtra | Final | ₹1.3 | 23 May 2023 |

| Great Eastern Shipping | Interim | ₹9 | 24 May 2023 |

| Manappuram Finance | Interim | ₹0.75 | 24 May 2023 |

| Rossari Biotech | Final | ₹0.5 | 24 May 2023 |

| Kansai Nerolac Paints | Final | ₹2.7 | 25 May 2023 |

| Kennametal India | Interim | ₹20 | 25 May 2023 |

| TRENT | Dividend | ₹2.2 | 25 May 2023 |

| Pearl Global Industries | Interim | ₹5 | 26 May 2023 |

🪜Others

- Jubilant FoodWorks, the company behind Domino’s, is planning to join the ONDC network.

- NDTV will seek permission from the Ministry of Information and Broadcasting for the launch of nine news channels in different Indian languages.

- PVR Inox intends to shut down 50 loss-making cinema screens over the next six months.

- Adani Transmission is seeking shareholder approval to issue equity shares on a qualified institutional placement basis.

- In FY 2023, Adani Ports handled 12 crore metric tonnes of rail cargo, up by 22.2% from last year.

- BPCL to add an ethylene cracker project with a capital outlay of ₹49,000 crore.

- Jupiter Wagons announced that it raised ₹125 crore through qualified institutional placement.

- Adani Enterprises seeks to raise ₹12,500 crore through qualified institutional placements (QIPs) by issuing shares or other securities.

- The Supreme Court has given SEBI a deadline of August 14 to conclude its probe into the Adani Group regarding the allegations made by Hindenburg Research.

- SP Hinduja, the Hinduja Group chairman, died in London after a prolonged illness.

🔌Sustainability Corner

- NTPC’s subsidiary and a joint venture of Hindustan Petroleum Corporation and Mittal Energy Investments have joined hands to explore opportunities in the generation of green hydrogen and green chemicals.

- The government announced reforms related to solar photovoltaic modules aimed at reducing costs and increasing the ease of doing business in the sector.

- The Union Ministry of New and Renewable Energy stated that India’s G20 presidency opens up opportunities for offshore wind projects.

- Tata Motors‘ bid for the electric bus contract with BEST was dismissed by the Supreme Court. Avinya EV concept wins the Green Good Design Sustainability award, paving the way for future electric models based on Tata’s GEN 3 architecture.

- TVS Motor reports strong growth in the domestic EV two-wheeler industry. Plans to launch new EV products, including electric three-wheelers, and expand into international markets.

- The government plans to make it mandatory to use sustainable aviation fuel by 2025.

Result Calendar for May 22nd – 27th May 2023

| 22nd May | |||

| HEG | Gujarat Alkalies And Chemicals | Shree Cement | EIH |

| Capri Global Capital | Indiabulls Housing Finance | Finolex Industries | Sun Pharma |

| Garware Technical Fibres | CESC | Aditya Birla Fashion and Retail | SJVN |

| Bharat Petroleum Corporation | PB Fintech | ||

| 23rd May | |||

| Dixon Technologies | Bajaj Electricals | Amara Raja Batteries | Ashok Leyland |

| Varroc Engineering | JCHAC | Fortis Healthcare | Thyrocare Technologies |

| Polyplex Corporation | Biocon | Akzo Nobel India | NMDC |

| Linde India | Galaxy Surfactants | JSW Energy | Metro Brands |

| 24th May | |||

| Hitachi Energy India | Cummins India | Avanti Feeds | The Phoenix Mills |

| Brigade Enterprises | Fine Organic Industries | The India Cements | ZFCV India |

| National Aluminium Company | Bayer CropScience | Borosil Renewables | Indian Railway Finance Corp |

| Nesco | Ircon International | Caplin Point Laboratories | JB Chemicals & Pharmaceut |

| Oil India | Hindalco Industries | Lakshmi Machine Works | Trident |

| Shyam Metalics And Energy | Adani Green Energy | Gujarat Pipavav Port | Life Insurance Corporation of India |

| FSN E-Commerce Ventures | |||

| 25th May | |||

| Bata India | Gland Pharma | Container Corporation Of India | GNFC |

| ITC | Clean Science And Technology | The Ramco Cements | State Bank Of India |

| Sumitomo Chemical India | |||

| 26th May | |||

| JSW Steel | Motherson Sumi Wiring India | Glenmark Pharmaceuticals | Crompton Electricals |

| 27th May | |||

| Bharat Electronics | |||

💡🍬 Knowledge Candy: Net Interest Income

Since we have spoken about Net Interest Income(NII) above, we would love our readers to understand the mechanics of NII and how it serves as an important KPI for a bank.

When a bank borrows money from depositors or other sources, it pays an interest cost, which is like a fee for using that money. This is known as the “cost of liabilities” or the average borrowing cost. On the other hand, when the bank lends money to individuals or businesses, it charges them an interest rate that is higher than what it pays to borrow. This is called the “average lending cost.”

So let’s say the average borrowing cost of the bank (also known as the cost of liabilities) is 3.80% and the average lending cost is 9.60%; the difference, which is 5.80% (9.60%-3.80%), is called the Net Interest Income(NII). This is the main business of the bank. The higher the growth in NII, the better it is.

📬Also Read: Sustainable Investing in India: ESG Investments