Inflation Drops in India and the US | Indian Stock Market Weekly Update 15 April

Markets take a breather as inflation falls

In March, inflation fell to 5.66% in India and 5% in the US. While US inflation remains above the US Federal Reserve’s target, India’s inflation is now within RBI’s target range. Falling inflation is the second big positive news for Indian companies in 2 weeks, with the previous one being that RBI hit a pause on repo rate hikes.

As inflation eases companies might get relief from rising raw material prices and also borrowing rates if inflation were to stay down.

Over the last 2 weeks, we saw Nifty 50 grow roughly 2.7%. In the same period, we saw Nifty Bank grow 3.75% and Nifty Realty grows 9.77%. Could this be the start of a cooling interest rate era?

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

The Indian stock market rose for the ninth consecutive day on Thursday, resulting in a seven-week high. This was the longest winning streak in two and a half years, with the indices showing growth for 10 days in a row from September 30 to October 14, 2020. The indices also showed growth for the third consecutive week.

The increase in Axis Bank, HDFC Life Insurance, IndusInd Bank, Kotak Mahindra Bank, and Maruti Suzuki India contributed positively to the change, while HCL Technologies, Infosys, Larsen & Toubro, Sun Pharmaceutical Industries, and Tata Consultancy Services had a negative impact on the Nifty 50.

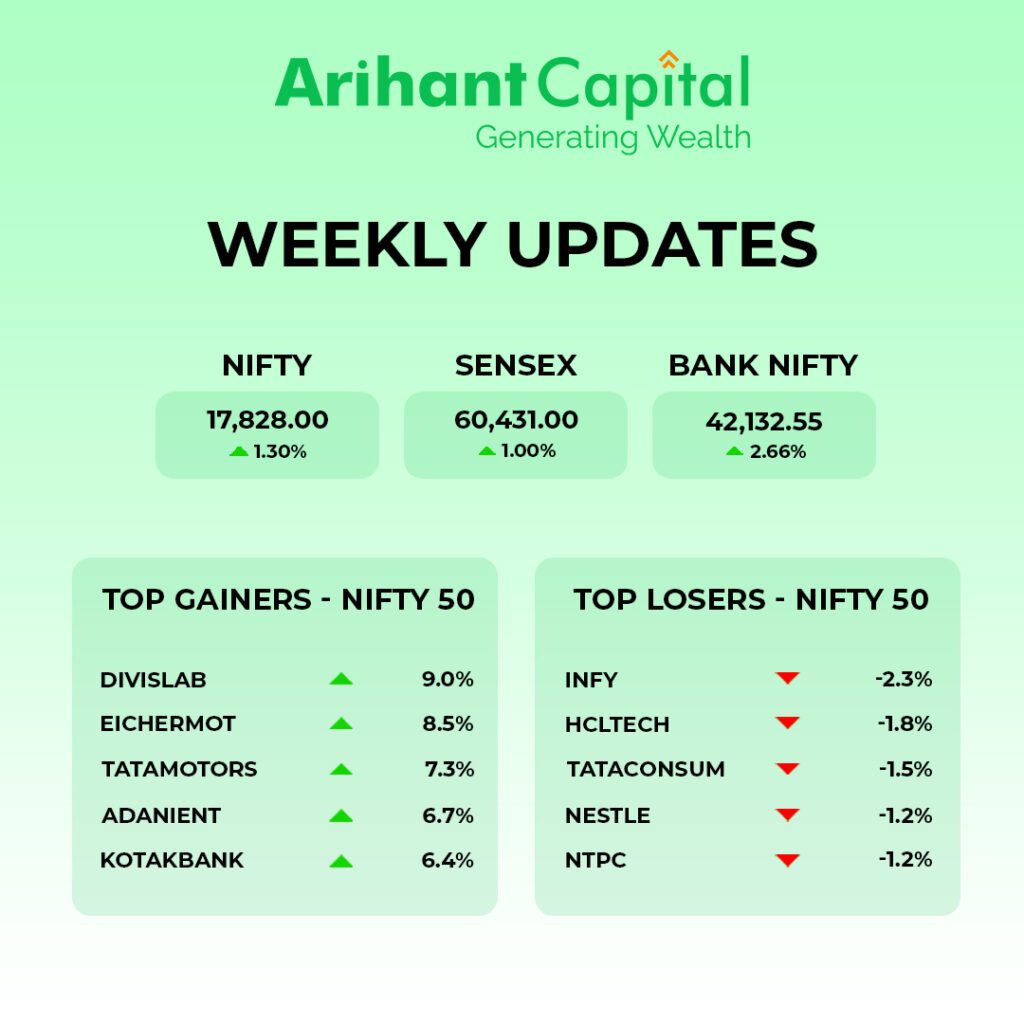

Nifty ended 0.09 points up at the 17,828 level. Sensex was up by 0.06% and stood at 60,431 and Nifty Bank was up by 1.38% at 42,133.

Over the last week, foreign portfolio investors made net investments worth ₹5,678 crores. In the same period, yields on India’s 10-year bonds rose from 7.219% to 7.229%.

The US broad market indices ended the week marginally better as investors dealt with mixed news with US inflation settling to the lowest in nearly 2 years and the economy showing signs of a slowdown. The Nasdaq Composite grew 1.24%, the S&P 500 grew 1.28% and the Dow Jones Industrial Index grew 1.38%.

We are expecting the market to open weak with the backdrop of Infosys and HDFC Bank results. We are advising investors to be stock-selective post this rally.

IT Giants Miss Expectations

This week, Infosys and Tata Consultancy Services released their Q4 FY 2022-23 results. The earnings of both companies fell short of analyst expectations. The companies believe that this is a result of the US banking crisis and cautious spending due to fears of a looming recession.

TCS reported a 14.8% growth in profit after tax in the last quarter on a YoY basis. The company also announced a final dividend of ₹24 per share. Infosys, on the other hand, suffered a 6% drop in profits after tax on a YoY basis and announced a final dividend of ₹17.5 per share.

As India’s second and sixth-largest listed companies miss expectations, what do you think we could expect from other companies?

Here, you can take a look at the companies whose results are expected next week.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we see a “DOJI” candlestick formation and that it is trading near its 100-day SMA level. On the weekly chart, we see a breakout of the falling channel.

If we analyze both charts, it indicates that the market will remain on the buy-on-dips strategy and stock-specific moves may continue.

If Nifty starts trading above the 17,850 level, then it can touch the 17,950-18,050 level. On the downside, support is 17,750, and if it starts to trade below then it can test the level of 17,600 and 17,500 levels.

Bank Nifty

If we look at the daily chart of Bank Nifty, we see that Bank Nifty is trading above all its key averages. On the weekly chart, we see a breakout of the falling channel.

If we analyze both charts, it indicates that Bank Nifty’s outperformance compared to Nifty will continue.

In the coming week if it trades above 42,250 then it can touch 42,500 and 42,800 levels. However, downside support comes at 42,050, and below that, we can see 41,850 and 41,700 levels.

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

🔎Quick Bites

Economy

- India’s exports in FY 2022-23 grew by about 6% from the previous fiscal year to $447 billion.

- The International Monetary Fund has lowered India’s growth projection to 5.9% from 6.1% for FY 2023-24.

Banking and Finance

- HDFC Bank will reduce lending rates by 0.85% for certain tenures from 10th April.

- HDFC Bank has access to a $300 million line of credit with the Export-Import Bank of Korea.

- HDFC Bank plans to raise ₹50,000 crore by issuing perpetual debt instruments and additional Tier-1 bonds.

- Bank of India aims to raise ₹6,500 crores in FY 2023-24 from means including share sales to fund business growth.

- Bank of Baroda reported a 19% growth in total advances and a 15.1% growth in deposits in Q4 of FY 2022-23 on a YoY basis.

Pharma

- Glenmark Pharmaceuticals is considering selling a stake in its active pharmaceutical ingredients business. Glenmark Life Sciences, to deal with debt.

- Divi’s Laboratories reported a jump in exports in March to $92 million from an average of $55-60 million in the last 11 months.

- Laurus Labs reported a jump in exports in March to $50 million from an average of around $25 million over the last 11 months.

- Cipla has signed a perpetual license agreement with Novartis Pharma AG to manufacture and market combinations used in the treatment of type 2 diabetes.

- Shilpa Medicare has received USFDA approval for Apremilast tablets, the market for which is reported at $3.5 billion.

Power

- National Thermal Power Company has raised ₹3,000 crores through bonds paying investors 7.35%.

- Suzlon Group has secured a project for developing a 50.4 MW wind power project.

- Tata Power’s joint venture with the government of NCT of Delhi has entered into a ₹150 crore agreement with Asian Development Bank for boosting Delhi’s power distribution.

- Kalpataru Power and its subsidiaries secured orders worth ₹3,079 crores from the start of March 2023.

Metals

- Jindal Steel and Power has plans to set up a rail mill in Odisha to double its rail-making capacity.

- Vedanta’s board has approved raising ₹2,100 crore through bonds.

- JSW Steel’s crude steel production rose 13% during the last quarter of FY 2022-23 on a YoY basis.

- The Indian government plans to introduce a ‘Brand India’ label for steel products to boost the reputation of Indian-made products.

Infrastructure

- Larsen & Toubro, Afcons Infrastructure, JSW Infrastructure, and a few other companies are competing to build an International Trans-shipment Terminal in Great Nicobar worth ₹42,000 crores.

- Larsen & Toubro secured a new order in the range of ₹1,000 crores to ₹2,500 crores for setting up a new plant for a fertilizer company.

- IRB Infrastructure reports that toll collection rose 20% to ₹369.9 crore in March 2023.

Chemicals

- Anupam Rasayan signed a ₹1,500 crore deal to manufacture and supply 3 high-value chemicals for the next 7 years.

- Neogen Chemicals will obtain a manufacturing technology license for electrolytes, a component in lithium-ion batteries, as a result of its partnership with Japan’s MU Ionic Solutions.

Automobiles

- Ashok Leyland has announced the launch of Re-AL, an online marketplace for used commercial vehicles.

- Tata Motors reported that its global wholesale volume rose 8% in Q4 of FY 2022-23 on a YoY basis.

- Passenger vehicle sales volume grew by 27% in FY 2022-23.

- Bajaj Auto has completed the acquisition of Triumph Motorcycles’ sales and marketing operations in India.

Real Estate

- In FY 2022-23, Puravankara reported a 29% rise in sales at ₹3,107 crores.

Airlines

- According to ICRA, air passenger traffic rose 60% in FY 2022-23 with 13.6 crore airline tickets being sold.

Oil and gas

- Companies including GAIL, Mahanagar Gas, and Indraprastha Gas have reduced prices of CNG and piped natural gas (PNG).

🏗️Corporate Actions

| Bonus | ||

| Company | Offer price | Ex-Date |

| Global Capital Market | 6:10 | 20-Apr-2023 |

| IFL Enterprises | 1:4 | 21-Apr-2023 |

| Jet Infraventure | 1:1 | 21-Apr-2023 |

| Split | ||

| Company | Ratio | Ex-Date |

| Global Capital Market | 1:10 | 20-Apr-2023 |

| IFL Enterprises | 1:10 | 21-Apr-2023 |

| Tips Industries | 1:10 | 21-Apr-2023 |

| Right | ||

| Company | Ratio | Ex-Date |

| GI Engineering Solutions | 8:11 | 18-Apr-2023 |

| Prerna Infrabuild | 1:2 | 21-Apr-2023 |

| Dividend for next week | |||

| Company | Type of dividend | Dividend per share | Ex-Date |

| Dhampur Sugar Mills | Interim | ₹5 | 18-Apr-2023 |

| Dhampur Sugar Mills | Special | ₹1 | 18-Apr-2023 |

| Muthoot Finance | Interim | ₹22 | 18-Apr-2023 |

| Huhtamaki India | Final | ₹2 | 20-Apr-2023 |

| Thyrocare Technologies | Interim | ₹18 | 20-Apr-2023 |

| E.I.D. – Parry (India) | Interim | ₹4 | 21-Apr-2023 |

| Mold-tek Technologies | Interim | ₹2 | 21-Apr-2023 |

| Mold-tek Packaging | Interim | ₹4 | 21-Apr-2023 |

| Nestle India | Final | ₹75 | 21-Apr-2023 |

| Nestle India | Interim | ₹27 | 21-Apr-2023 |

🪜Others

- The government will be inviting bids for the Shipping Corporation of India’s privatization next week.

- Reliance Retail, a subsidiary of Reliance Industries, and an Adani Airport Holdings joint venture are among 49 entities looking to acquire Future Retail.

- Coal India experienced a 17.2% growth in coking coal production in FY 2022-23 on a YoY basis.

- Sula Vineyards has reported a 30% growth in premium wine sales in FY 2022-23 on a YoY basis.

- Titan reported a 25% YoY increase in revenue in Q4 of FY 2022-23.

- Bharat Heavy Electricals and Titagarh Wagons secured an order worth ₹9,600 crores to supply 80 Vande Bharat trains in 6 years.

- NSE Indices has launched India’s first-ever real estate investment trust (REIT) and infrastructure investment trust (InvIT) indices.

- In FY 2022-23, fast-moving consumer goods (FMCG) was the best-performing sector for foreign portfolio investors (FPIs) with the assets under custody rising over ₹2 lakh crore.

- In March, equity mutual funds recorded the highest monthly inflows in a year at ₹20,534 crores.

- The Ministry of Ports, Shipping, and Waterways is working on a ₹5,000 crore package to encourage the construction of inland vessels and ships.

- India Meteorological Department (IMD) forecast a normal monsoon despite El Nino.

- Comcast Corporation received approval from the Competition Commission of India to acquire a stake in Viacom18.

🔌Sustainability Corner

- In FY 2022-23, electric vehicle sales in India crossed the 10 lakh mark for the first time ever.

- Electric 2-wheeler sales in India rose 2.5 times in the last financial year.

- Automotive Axles is considering investing in Torrent Saurya Urja, a solar power generation company.

- Maruti Suzuki India is aiming to sell 5 lakh CNG cars in the next 2 years.

- Adani Green Energy has reported that its renewable energy capacity increased by 49% at the end of FY 2022-23 on a YoY basis.

- ZF begins series production of electric drives for light commercial vehicles. Designed for light commercial vehicles up to 7.5 tons, CeTrax lite has a peak performance of 150 kW and a torque of 1500 Nm. It’s first application with Isuzu for its new ELF EV.

- Tata Nexons past 500,000 production milestone in 67 months – surging demand for India’s best-selling utility vehicle sees the last 100,000 units produced in just six-and-a-half months, the fastest in the compact SUV’s half-a-million run since its launch.

- Apollo Tyres pushes the sustainable mobility solutions envelope – develops car and SUV tires with 75% sustainable materials; high-performance Apollo Amperion for EVs and ultra-high-performance Aspire 4G+ use bio-based and recycled materials in their construction

- Gurugram-based Greenfuel Energy Solutions targets Rs 1,000 crore turnover in 4 years; plans to expand hydrogen and lithium-ion battery business alongside core CNG conversion kits.

- Sona Comstar inaugurates its second-largest plant in Chakan, Pune. This is an environmentally sustainable industrial unit and will manufacture driveline products for EV and non-EV applications with a production capacity of 11.8 million gears per annum.

- Royal Enfield plots a new factory in Tamil Nadu and revs up for a global ride and EV foray. The midsize motorcycle major acquired 60 acres in Cheyyar, on the outskirts of Chennai, to be future-ready for volume expansion for both ICE and electric bikes.

📬Also Read: Sustainable Investing in India: ESG Investments