IPL at 108* not out; WTO breaks a 7-year hiatus| Weekly Market Wrap-up | 19 June

Grab a cup of coffee and let’s deep dive into what the stock markets were up to last week.

In this article

Cheer up, the stock markets have been crashing but there is some good news after all.

The homegrown sports league – IPL has become the world’s second most valuable sports league.

At the top of the charts is the National Football League (NFL) in the US at ₹136 crores per game. Then comes the IPL at ₹108 crores per game. And in third place, we have the English Premier League (EPL) at ₹82 crores per game.

WTO breaks a 7-year hiatus

WTO members sign a historic package after marathon talks. The issues addressed include the reduction of fishery subsidies and a loosening of vaccine-production limits. Union minister for commerce Piyush Goyal was particularly happy with the agreements.

After the US posted its highest inflation rate in four decades, and Fed decided to hike its rates by 75 bps; the Indian benchmark indices continued their southward journey. Nifty closed the week with a 5.61% negative at 15,294 decreasing by 908 pts and BSE Sensex ended the week at 51,360 down 5.42% or 2,943 pts on a week-on-week basis. Bank Nifty fell 5.05% during the week, ending at 32,743.

In the tryst of the Nifty 50 with the bears, there were no gainers this week. All the sectoral indices ended on a negative note, with Nifty Metal being the biggest laggard at -9.14%; followed by Oil and Gas at -8.52% and IT at -8.18%.

What to Expect from the Markets

What to Expect from the Markets

–Mr Abhishek Jain, Head Research, Arihant Capital

Indian markets closed with negative momentum on Friday, dragged by IT and metal stocks after the US Federal Reserve raised interest rates by 75bps. This is the biggest interest rate hike since 1994. Going ahead, the US Fed chairman’s speech and China’s interest rate decision would be important triggers for the markets. On the domestic front, the Covid trend and the progress of the monsoon will be in focus.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart of Nifty, a “bear candlestick” pattern is visible with high volumes. The index has given a breakdown of the “triangle” pattern formation on the weekly chart. We believe that the index may see a pressure from higher level, and investors need to take a cautious approach. Now it has to cross the 15,450 level to see a bounce towards 15,550 and 15,650 levels. On the downside support, if it trades below 15,200 then it can test 14,950 and 14,800 levels.

Bank Nifty

On the daily chart of Bank Nifty, a “candlestick” pattern is visible and on the weekly chart, it is trading near the lower trendline and the 200 WMA. We believe the index may consolidate further and will show pressure from a higher level. In the coming trading sessions, if Bank Nifty trades below 33,100 then weakness could take it to 33,500 and 33,900 levels. Minor resistance on the upside is capped around 32,100-31,700 levels.

💰Stock Picks

From the Fundamental Desk

–Mr Abhishek Jain, Head Research, Arihant Capital

This is a time to start investing aggressively, we believe inflation concerns are temporary and would abate in next 3 months. Too much pessimism is giving an opportunity to invest with a 3-years horizon. We believe hotel stocks can be a good buy at current levels with a view of 2-3 months. Taj GVK,Indian Hotel, EIH , Chalet & Lemon Tree look good to invest in. Delta Corp can be a good trading buy with price objective of ₹230.

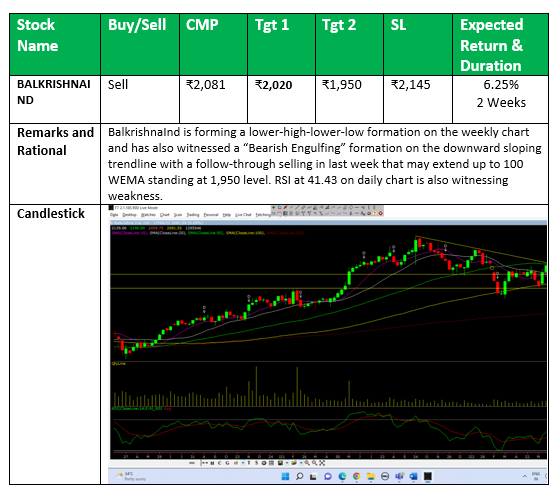

From the Technical Desk

-Ms. Kavita Jain, Head Learning and Senior Research Analyst, Arihant Capital

🔎Quick Bites

Global

- The US Federal Reserve announced the biggest hike since 1994 – interest rates go up by 0.75%. Many central banks followed suit, unleashing the most hawkish tightening campaign since the 1980s.

- Mukesh Ambani’s Reliance is considering buying out Revlon in US to save it from bankrupcy.

- WTO members successfully concluded the 12th Ministerial Conference (MC12) in Geneva on 17 June, securing multilaterally negotiated outcomes on a series of key trade initiatives. WTO members agreed in a declaration that they would take concrete steps to facilitate trade of food and agriculture, including cereals, fertilizers and other agricultural inputs, and reaffirmed the importance of limiting export restrictions.

Economy

- Edible oil manufacturers have reduced prices of edible oil by up to ₹15 per liter.

- India’s trade deficit for May widened to $24.29 billion from $6.53 billion a year ago. Imports rose 62.83% YOY to $63.22 billion, and exports rose 20.55% to $38.94 billion.

- India rose 6 positions from 43rd to 37th rank on the World Competitiveness Index annually compiled by the Institute for Management Development.

- WPI rose to 15.88% in May against 15.08% in April. Retail inflation (CPI) stood at 7.04% in May a decline from 7.79% in April.

- Rupee hit an all-time low of ₹78.13 per dollar. It closed at ₹78.04.

Automobile

- Ford has resumed production at its Tamil Nadu plant.

- Bajaj Auto has postponed its proposal to buy back shares.

- M&M seeks approval from NCLT to merge Mahindra Electric Mobility Ltd to M&M.

- Mahindra & Mahindra (M&M) is planning a ₹400 crore investment in a new tractor manufacturing plant in Mohali.

Banking and Finance

- HDFC Life has approved raising of funds through issuance of up to 3,500 non-convertible debentures for an aggregate nominal value of up to ₹350 crore.

- Shriram Group has received RBI approval for the merger of Shriram City Union Finance and Shriram Capital with Shriram Transport Finance Company. The merger will make it the largest non-banking financial company in India.

- Indian Overseas Bank to raise up to ₹1,000 crores in equity capital.

- Paytm witnessed strong growth in its lending business with 5.5 million loan disbursals in April and May with a y-o-y growth of 471%.

- AU Small Finance Bank to issue 31.51 cr bonus shares in the ratio of 1:1.

- India Post Bank may offer services via WhatsApp.

- Promoter, Vijay Shekhar Sharma buys 1.7 lakh shares of Paytm worth ₹11 crores.

- HDFC to sell four large distressed accounts to ACRE for 270 crore against a 577-crore portfolio.

- PNB Housing Finance to raise up to ₹2,000 crore by issuing bonds on a private placement basis.

- BC Asia Investments to acquire a 25% stake in IIFL Wealth Management.

Energy and Infrastructure

- Indian Oil has issued 25,000 Non-Convertible Debentures for ₹2,500 crore.

- Rail Vikas Nigam inks MOU with Syama Prasad Mookerjee Port, Kolkata for development of projects.

- Dredging Corporation bagged a 3-year maintenance contract from Jawaharlal Nehru Port with the project cost of about ₹250 crore per year.

- NLC India to set up a ₹4,400 crores methanol project in Neyveli. Engineers India: has been appointed as a project management consultant (PMC).

- Imported gas may fuel NTPC plants due to coal shortage.

- Assam joins hands with NLC India to set up 1GW solar power project.

- India’s first road constructed from steel slag was inaugurated in Surat.

- Tata Power to buy coal worth ₹12,000 cr from Indonesian miner in FY23.

IT and Telecommunications

- Maruti Suzuki invested Rs 2 cr in AI startup Sociographic Solutions.

- TCS to become Qiagen’s strategic partner for its cloud transformation journey.

- Super fast speeds are on their way: cabinet approves 5G spectrum auction.

- Airtel launched a multiplex that will be accessible on a metaverse platform called Partynite Metaverse.

- Infosys goes all out to retain talent, increase promotions, and ESOP coverage.

Industry

- Tata Steel will acquire 1.05 crore equity shares of Tata Steel Mining.

- JSW Steel reported a 31% YoY growth in the production of crude steel at 17.89 lakh tons for May 2022.

- Tata Steel unveiled a £7 million investment plan for Hartlepool Tube Mill in England.

- RITES bags order worth ₹365 Crore from Container Corporation of India.

- Adani Group to raise up to $4.5 billion via a mix of offshore loans to fund its recent acquisition of Ambuja Cements and ACC. This will be the biggest foreign currency loan by an Indian corporation.

Other

- Reliance’s Viacom 18 won the digital rights to IPL for a bid of ₹23,758 crores. Star India won the India TV rights for IPL for a bid of ₹23,575 crores. IPL rights jumped 3-times from the last contract.

- CCI approves the acquisition of AirAsia India by Air India.

- Krishna Institute Of Medical Science will acquire a 51% stake in KIMS Manavata Hospitals for ₹362 crores.

- Lemon Tree signed a license agreement for a 44-room hotel in Andhra Pradesh.

- Zydus Lifesciences said its ₹750 crore-share buyback offer will commence on June 23 and close on July 6.

- NCLAT upholds the CCI order, and directs Amazon to pay ₹200 crores to Future Retail.

- GSK Velu in talks with investors, PEs & banking firms to buy Metropolis Healthcare stake.

🔌Sustainability Corner

- Coal India is considering green mining options to minimize environmental impacts.

- Jio-BP and Zomato tie-up for battery swapping stations.

- Torrent Power acquired a 50-MW solar plant for ₹416 crores in Telangana.

- 30% of vehicles sold in India by end of the decade will be electric. The domestic EV industry is to see 10 million vehicle sales by 2030.

- Prices of all-electric vehicles to be on par with the cost of petrol vehicles within a year: Nitin Gadkari.

- Azure Power to invest ₹100 crore in Premier Energies Group, ties up for modules supply.

- France’s TotalEnergies to buy 25% in Adani New Industries. The JV, “ANIL” will invest $50 billion over the next 10 years. The company plans to develop a green hydrogen production capacity of 1 million tons per year by 2030.

- Two-wheeler EV startup Ather Energy to go for IPO in 24 months

- Re-use at its best: Nunam deploys Audi E-Tron’s used batteries in e-rickshaws.

- Solar projects: Brookfield commissions the first solar project in India with a 445 MW capacity. Axis Energy commissions a 445-MW solar plant in Rajasthan. APM Terminals Pipavav commissions 1,000 kWp rooftop solar power plant

- Green hydrogen focus: PTC India and Greenstat Hydrogen India ink pact to develop green hydrogen solutions. OIL signs pact with homiHydrogen for green hydrogen. Amara Raja bags contract from NTPC to set up a green hydrogen fuelling station in Leh.

- Adani Transmission’s $700-mn revolving facility gets a ‘green loan’ tag by Sustainalytics.

- ACME Group proposes ₹52,000 crores green hydrogen plant in Karnataka.

- Welspun Corp ropes in Tata Steel to develop a framework and manufacture pipes for hydrogen transportation.

- GE’s arm buys a 49% stake in Continuum’s onshore wind project in Gujarat.

- Ayana Renewable to invest ₹12,000 crores in the wind and solar projects in Karnataka.

- EV battery startup Alsym aims to slash costs and eliminate lithium and cobalt.

- Crayon Motors inks a pact with Bounce Infinity to set up interoperated battery network.

- Hero MotoCorp-backed EV maker Ather Energy is in talks with states to set up a third manufacturing plant.

That’s all for now folks! See you next week!

What to Expect from the Markets

What to Expect from the Markets