The Sizzle of Steel Stock Investment 🔥| Stock Market Weekly Update Sep 09

Hello Readers!

This reading diet has a sizzling note on steel stocks!

Steel company stocks, including Tata Steel, JSW Steel, and Jindal Stainless, have surged by 5% to 12% in recent weeks. The NIFTY Metal index also boasts a robust 7.7% increase during the same period.

Well, what is fueling the steel stock rally?

Firstly, steel product prices are steadily climbing. Steel rebar prices have seen five consecutive weekly hikes, ranging from ₹1,500 to ₹2,500 per tonne. This surge is driven by pre-election solid demand. and rising costs of essential raw materials like iron ore and coking coal. Experts believe these price hikes will. safeguard the revenue and profitability of steel companies in the upcoming quarters.

Secondly, the robust domestic economy is a significant driver. India’s GDP surged at an impressive 7.8% rate in April-June. The government’s push for increased infrastructure spending before general elections boosts steel demand. Significant capital expenditure in railways, national highways, and housing is expected to fuel steel consumption further 🏘️.

Lastly, hopes of an economic revival in China contribute to the positive trend 🇨🇳. China’s government has introduced policies to stimulate economic growth, benefiting industrial commodity companies, as China is one of the world’s largest consumers of metals.

As a result, steel companies are ramping up production, with the top five metal companies allocating as much as ₹55,000 crores per year towards capital expenditure. This combination of factors has led to the recent strength in steel stocks 🔥.

🧾In this Article

– Mr Abhishek Jain, Head of Research, Arihant Capital

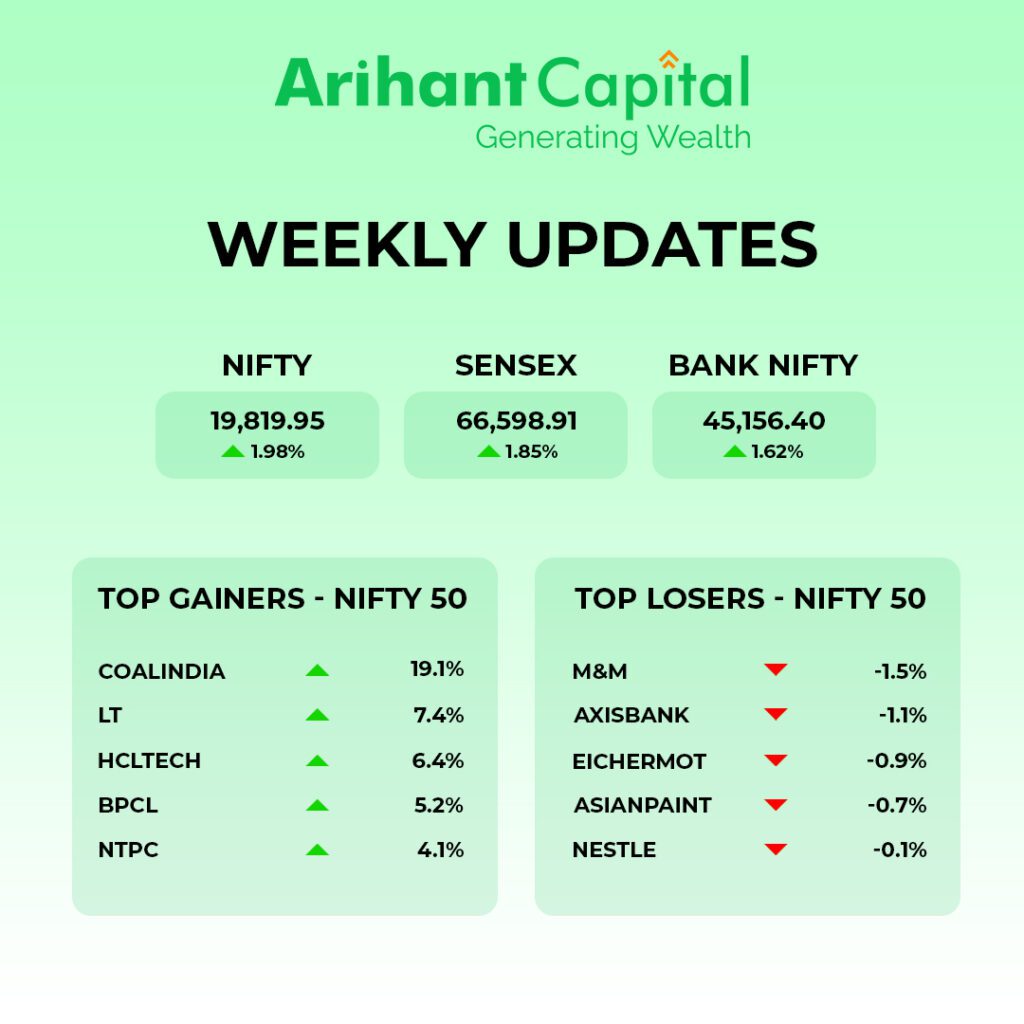

India’s benchmark stock indices logged their best week in two months after rising for six consecutive sessions on Friday. Intraday, Nifty 50 crossed the 19,800 level, and Sensex rose beyond the 66,700 level for the first time in over six weeks since July 27, 2023. The indices showed strong growth for the second time this week, primarily driven by the real estate, media, and metal sectors. This marked the most successful week for these indicators since June 30, 2023. Nifty ended up by 0.47% at 19,820 level. Sensex was up 0.50%, at 66,599, and Nifty Bank was up 0.62% at 45,156.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we are observing prices have closed above 50 DMA & upper line of the channel, and on the weekly chart, we get close above the short-term moving average. Analyzing both chart patterns indicates that we can adopt the “Buy on Dips” approach. If Nifty starts trading above the 19,880 level, then it can touch the 19,990-20,100 level, while on the downside, support is 19,700, and if it starts to trade below, then it can test the level 19,550 and 19,350 levels.

Bank Nifty

Let’s look at the daily chart of Bank-Nifty. We are observing the prices close above 50-day moving averages & given a breakout of “channel”, and on the weekly chart, we observe taking support of short-term moving averages. Bank-nifty starts trading above 45,300, then it can touch 45,650 and 45,800 levels. However, downside support comes at 44,800; below that, we can see 44,650 and 44,450 levels.

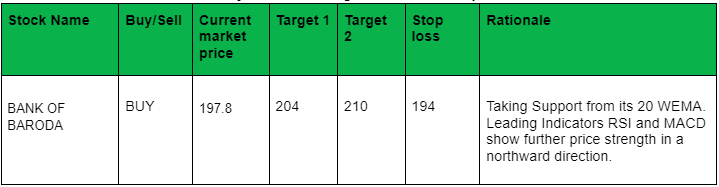

💰Stock Picks

– Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital.

🔎Stocks in News

📈 Tejas Networks: Received an advance of ₹750 cr from TCS.

🤝 Reliance: Nvidia has inked partnerships with Reliance and Tata Group to bring advanced AI technology to India.

🚄 IRCTC: The Ministry of Railways has authorized the company to cater to full-tariff coaches or trains.

🏭 Vedanta: Started a new subsidiary in Goa, ‘Sesa Iron and Steel’.

🛍️ Reliance: Reliance Retail has purchased a 51% stake in clothing brand Ed-a-Mamma.

💰 Nazara Tech: SBI Mutual Fund will invest ₹410 cr in the company.

🏗️ L&T: Got a ₹33,260 cr order from Saudi Aramco.

👨💼 United Breweries: Appointed Vivek Gupta as MD & CEO.

💼 Jio Financial: Will be removed from Nifty indices from 7 Sept.

🏢 NBCC: Won a project worth ₹2,000 cr from the Kerala State Housing Board.

📈 Bikaji Foods: Lighthouse India Fund III sold 1.3% stake in the company.

☀️ Tata Power: Tata Power Renewable Energy will set up a 12 MW solar project for Tata Motors in Maharashtra.

🏍️ Hero Moto: To invest ₹550 cr in Ather Energy.

🚆 RVNL: Was the lowest bidder for a railway project worth ₹174 cr.

💊 Cipla: Planning to acquire South Africa-based Actor Pharma.

🏭 Shree Cement: Set up a new ₹550 cr grinding unit in West Bengal.

🏭 Tata Steel: Will pay ₹314.70 cr as an annual bonus to employees.

💼 Kotak Mahindra: Uday Kotak resigned as MD and CEO.

✈️ IndiGo: IndiGo and Air India will set up their leasing business at GIFT City, Gujarat.

🏭 Coal India: 13% year-on-year growth in production at 52.3 million tonnes in August.

⛽ Oil India: Approved equity contribution of ₹1,738 cr in North East Gas Distribution Company (its Joint Venture with Assam Gas Company).

💡 GMR Power: Subsidiary, GMR Smart Electricity Distribution, got a ₹5,123.37 cr order from the UP government.

🍽️ Zomato: Its Czech-based step-down subsidiary is filing for liquidation.

🛩️ HAL: Shareholders approved stock split.

🔬 Biocon: Acquired Eywa Pharma Inc’s manufacturing facility in the US for around ₹63 crore.

📰 Quick Bites

⚡ India’s Electricity Usage: Rose 16% year-on-year in August to 151.66 billion units.

🚗 Fuel Usage in August:

- Diesel usage fell 2.9%

- Petrol usage rose 0.4%

- Aviation fuel usage was up 9.5%

- LPG usage increased by 4.4%.

💼 EMS Limited IPO: Will be open between 8th to 12th Sept.

🏭 Pepsi: Reportedly planning to build a ₹778 cr factory in Assam.

🪑 Stanley Lifestyles: Luxury furniture brand filed for an IPO.

🚗 India’s Auto Sales: Rose 9% year-on-year in August, according to FADA. Notably, 3-wheeler sales jumped 66% to a record high of 99,907 units.

💰 Vishnu Prakash R Punglia IPO: Listed on NSE at ₹165, a premium of 66.67%. On BSE, it listed at ₹163.3, up 64.95%.

📈 Ratnaveer Precision IPO: Subscribed 21.82 times. Retail investors have subscribed 23.12 times. It is open till 6th Sept.

📊 SEBI Approval for IPOs: SAMHI Hotels Ltd and Motisons Jewellers Ltd have received SEBI approval to launch IPOs.

🏭 Hitachi Payment Services: Announced the launch of India’s first-ever UPI-based ATM.

🌱 Sustainability Corner:

🚗 Growing shift to e-mobility now reflected in India’s component industry numbers – EV parts supplies comprised 2.7% of the best-ever turnover of ₹560,000 crore in FY23, up 33% on strong India market sales, aftermarket & steady exports.

🏍️ TVS Motor Co, which has sold 150,000 iQubes since launch, targets a 40% share from EV sales by 2025. Now India’s second-largest 2W exporter, it is eyeing Europe, SE Asia, UAE & LATAM with its just-launched tech-laden, premium X EV.

⚙️ Endurance Tech’s EV parts order book jumps 420% to ₹380 crore in FY2023, wins 15 EV programs from 11 OEMs including suspension parts from Ather Energy, Ampere & Hero Electric, EV brake biz from Ather, Okinawa, Ampere & Hero MotoCorp.

🚌 Big business coming up for electric bus manufacturers in India. Last month, the Union Cabinet approved ₹57,613 crore for the operation of 10,000 e-buses in 169 cities; infrastructure to be upgraded in 181 cities.

🔌 Tata Motors’s Nexon.ev facelift constitutes the first midlife refresh for India’s best-selling electric passenger vehicle; major mechanical updates contribute to improved efficiency. ARAI-claimed range of 325km (MR) & 465km (LR).

⚡ Ashok Leyland unveils new electric light commercial vehicles from its EV division, Switch Mobility. The Switch IeV 3 & IeV 4, equipped with a 25.6 to 32.2 kWh battery pack, are claimed to deliver up to 300km range in a day.

🍃 Vedanta Aluminium develops multiple lightweight solutions to enable electric vehicle manufacturers to extend vehicle range as well as reduce their carbon footprint with its ‘green’ aluminium branded Restora & Restora Ultra.

🛴 Uno Minda Group’s electric 2-wheeler kit value jumps to ₹35,000, almost 4 times its ICE biz. Its comprehensive e-parts catalogue for 2Ws & 3Ws has won ₹600 crore biz in Q1 FY2024. CFO Sunil Bohra reveals the future growth strategy.

📈 EV sales in India hit a million units in just 9 months & for the 2nd year in a row. Two- & three-wheelers lead the charge even as demand grows for electric passenger vehicles, last-mile mobility CVs, and zero-emission public transport.

💼 TCS wins $1 billion JLR biz to develop future-ready digital core, optimize Reimagine strategy & electrification plans; contract spans application development & maintenance, enterprise infrastructure management, cloud migration, cybersecurity & data services.

🔋 Accelera by Cummins, Daimler Truck, and PACCAR to localize battery cell production in the US. JV will manufacture battery cells for electric commercial vehicles; total investment is expected to be in the range of $2-3 billion for the 21 GWh factory.

💰 Kinetic Green Energy and Axis Bank offer 100% finance (on-road price) for Kinetic’s electric two-wheelers with flexible financing tenures extending up to 48 months; the scheme will also cover the upcoming Kinetic E-Luna.

🏍️ TVS Motor Co looks to double 310cc bike sales with the new Apache RTR 310; has invested ₹50 crore in developing the new bike which is based on the existing platform co-developed with BMW Motorrad & holds export potential for ASEAN, LATAM & European markets.

🌟 Ather Energy has announced a ₹900 crore rights issue from current shareholders Hero MotoCorp and GIC; the company intends to use the funding to launch a new product as well as expand its charging infrastructure and retail network.

💡🍬 Knowledge Candy:

In the first half of 2023, the Indian aviation sector experienced significant growth, with passenger numbers surging by more than 33% YoY to reach 76 million passengers. Lower crude oil prices also provided a boost to the industry’s revenues and profitability during this period. However, industry experts are sounding a cautionary note, suggesting that the domestic aviation sector may encounter challenges in the latter half of 2023.

One of the primary concerns stems from the escalating costs of aviation turbine fuel (ATF), which is expected to hinder the industry’s growth. Since June 1, 2023, oil-marketing companies have raised ATF prices by a substantial 26%, including a notable 14.1% increase on September 1. This surge in ATF prices is closely linked to the rising global crude oil prices, which have surged by over 18% since the beginning of July.

Fuel represents a significant portion of airlines’ overall expenditures, accounting for nearly 40% of their total costs. Consequently, any spike in ATF prices directly impacts the profitability of airline companies.

Furthermore, the aviation sector is grappling with subdued passenger traffic during the second quarter of FY24. Historically, the period from July to September tends to be a weaker season for airline companies.

In July 2023, passenger volumes experienced a 3% sequential decline due to uncertain weather conditions. While data for August and September is pending, it is expected that passenger traffic will remain subdued during these months, partly because the festival season has been postponed to October this year.

These challenges have had a tangible impact on stock prices, with shares of Interglobe Aviation witnessing a decline of more than 6% in August, while SpiceJet’s shares fell by nearly 19% in the same period.

In response to these headwinds, airlines are strategically redirecting their fleets toward high-yield international routes. This strategic move allows airlines to expand their footprint on international routes and enhance their overall profitability.

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?