Wipro stuns by announcing ₹12,000 crore buyback | Indian Stock Market Weekly Update 29 April

IT giant has announced ₹45,500 crore buyback in 8 years

There was caution seen in the IT sector because of cutbacks from clients worrying about a banking crisis in the US. But, Wipro came out with a pleasant surprise in the form of a ₹12,000 crore buyback.

Wipro will pay ₹445 per share for 4.91% of the total shares. This buyback price is 15.67% higher than the closing price on Friday. The last buyback by Wipro was back in October 2020 and had a value of ₹9,500 crore. Over the past 8 years, the company has announced buybacks of shares worth ₹45,500 crore.

In FY 2022-23, Wipro reported a 13.73% rise in revenue but a 24.38% drop in net profit. It also reported a 49.98% drop in other incomes and an 18.34% rise in expenditure.

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

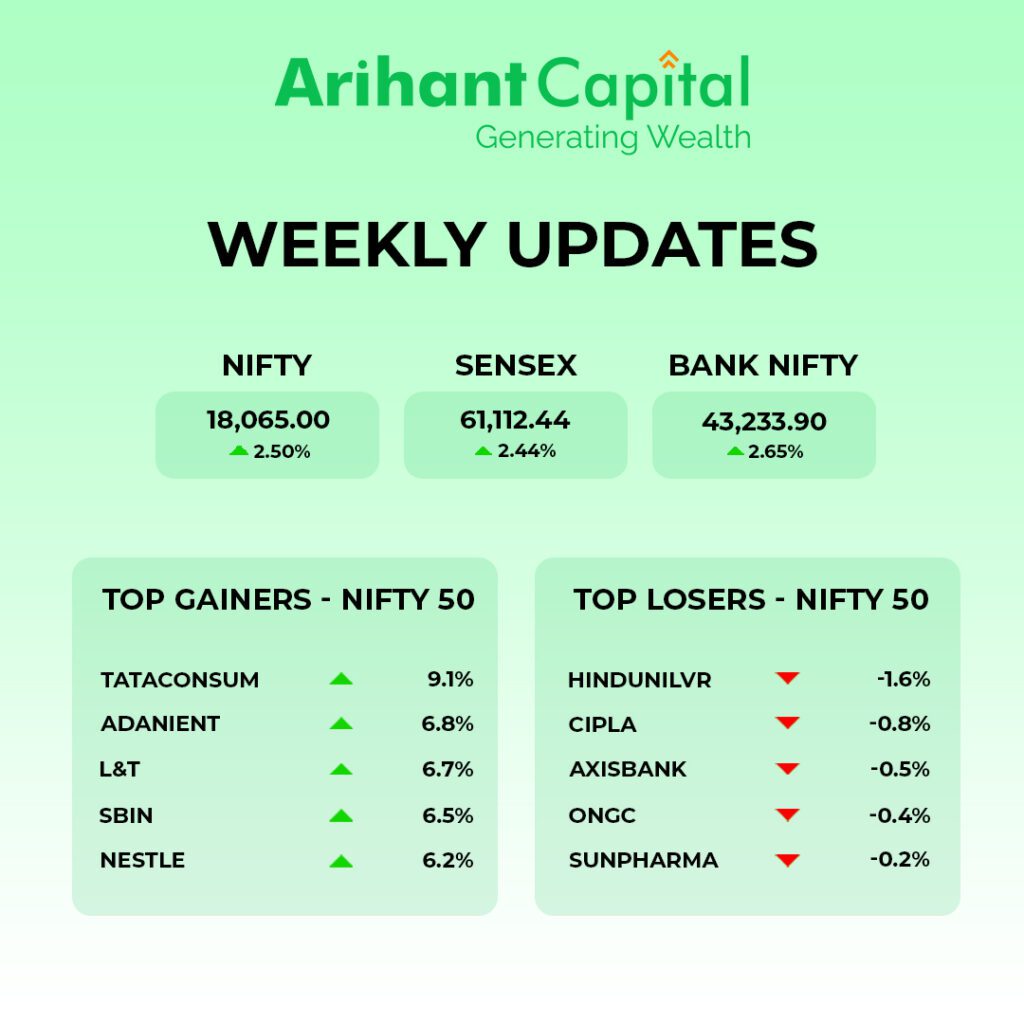

On Friday, the Indian stock market experienced a rise with both the Sensex and Nifty 50 closing higher. This resulted in the Nifty 50 having its best weekly performance in nine months, and the Sensex closing above 61,000 for the first time since February 17th.

The IT, PSU Banks, and media stocks led the gains. However, global stocks faced losses due to the announcement of further interest rate hikes in the US and Europe, resulting from persistent inflationary pressures and economic resilience.

On the other hand, Japanese stocks rose by up to 1.5% as the Bank of Japan reaffirmed its commitment to stimulus, leaving its short-term policy rate unchanged at -0.1%.

Nifty ended 441 points up at the 18,065 level. Sensex was up by 2.44% and stood at 61,112 and Nifty Bank was up by 2.65% at 43,233.

We are advising stocks like Tech Mahindra and Wipro for portfolio.

As traders expect RBI to prolong the pause on hiking interest rates, the yield on India’s 10-year government bonds fell to a 12-month low.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we see a breakout of the “Inverse Head & Shoulder” pattern. On the weekly chart, we see a breakout of the channel.

If we analyze both charts, it indicates that now we can see positive momentum in the market and we have to remain on the buy-on-dips strategy. If Nifty starts trading above the 18,1300 level, then it can touch the 18,300-18,500 level.

On the downside, support is 17,900, and if it starts to trade below then it can test the level of 17,800 and 17,680 levels.

Bank Nifty

If we look at the daily and weekly chart of Bank Nifty, we see a breakout of the “Channel” pattern.

It indicates that we can see some positive momentum in the Bank Nifty and we should remain on the buy-on-dips strategy.

In the coming week, if it trades above 43,300, it can touch 43,650 and 43,800 levels. However, downside support comes at 43,100, and below that, we can see 42,800 and 42,500 levels.

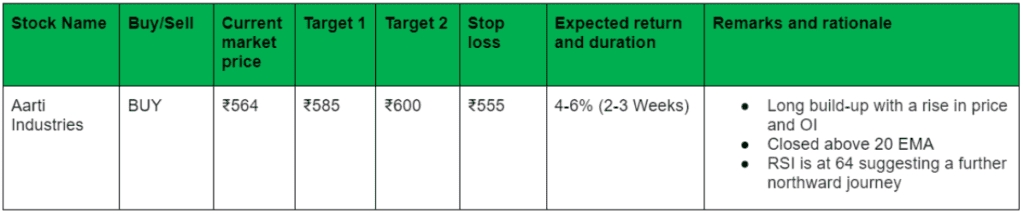

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

🔎Quick Bites

Global

- US GDP growth in Q1 of 2023 fell to 1.1% from 2.6% in Q4 of 2022.

Economy

- The finance ministry iterated that oil production cuts by OPEC and El Nino affecting monsoons could adversely drag India’s GDP growth below the previously estimated rate of 6.5%.

- Although India Meteorological Department (IMD) has stated that El Nino will have a minimal impact on rainfall, Skymet claimed that there is a 60% chance of drought in India.

Banking, Financial Services and Insurance

- State Bank of India (SBI) is being careful not to accidentally trigger US sanctions by processing payments for Indian oil refiners who might have bought Russian oil above the $60 per barrel price cap set by a US-led coalition.

- IndusInd International Holdings, a Hinduja Group firm, has emerged as the highest bidder for Reliance Capital at ₹9,650 crores.

- After Uday Kotak’s term ends in December, RBI may examine the proposal to appoint him as a non-executive director on the board of Kotak Mahindra Bank.

- Bajaj Finance reported that in the last quarter, its net profit grew 30% on a YoY basis to ₹3,158 crore.

- HDFC Life reported that in the last quarter, its net profit declined by more than 28% on a YoY basis to ₹361 crores.

- AU Small Finance Bank reported that its net profit grew 23% on a YoY basis to ₹425 crore in the last quarter.

- ICICI Bank reported that its net profit grew by 30% on a YoY basis to ₹9,121 crore in the last quarter.

- Yes Bank has reported that its net profit dropped by 45% on a YoY basis to ₹202 crores in the last quarter.

- IndusInd Bank reported that its net profit grew 46% on a YoY basis to ₹2,043 crore in the last quarter.

- Bank of Maharashtra reported that its net profit rose 136% on a YoY basis to ₹840 crores in the last quarter and that it aims to raise ₹7,500 crores through a follow-on public offer (FPO).

- HDFC Asset Management Company reported that its net profit grew 9% on a YoY basis to ₹376 crores in the last quarter.

- Union Bank of India plans to raise up to ₹10,100 crore through equity issues and debt.

Pharmaceuticals

- IPCA Laboratories to acquire a 33.4% stake in Unichem Laboratories. It will also acquire another 26% of shares through a public offer at ₹440 per share. The total consideration is ₹1,840 crore.

- GlaxoSmithKline Pharmaceuticals announced the launch of a vaccine for the prevention of shingles.

- Zydus Lifesciences has received approval from the US FDA for marketing a skin disorder treating ointment.

- Sun Pharma has launched a medicine to treat dry eye disease.

- Sun Pharma has halted shipments to the US after the US FDA asked it to take corrective actions.

- The Serum Institute of India will invest $150 million in Biocon’s subsidiary, Biocon Biologics.

IT

- Tech Mahindra reported that its net profit fell by 26% on a YoY basis to ₹1,118 crore in the last quarter.

- L&T Technology Services reported that its net profit grew 18% on a YoY basis to ₹309 crore in the last quarter.

- India’s IT companies are expected to experience a drop in attrition rate from the current 20%-plus levels to as low as 16%.

Automobiles

- Bajaj Auto reported that its net profit dropped by 2% on a YoY basis to ₹1,433 crore in the last quarter.

- In FY 2022-23, Mahindra & Mahindra sold 1 lakh units of Bolero SUVs.

- Maruti Suzuki reported that its net profit grew by 42.7% on a YoY basis to ₹2,623 crore in the last quarter.

- JSW Group is considering buying a stake in MG Motor India of about 15%.

FMCG

- Tata Consumer reported that its net profit grew 21% on a YoY basis to ₹290 crore in the last quarter.

- Nestle India reported that its net profit grew 24.6% on a YoY basis to ₹737 crore in the last quarter.

- Hindustan Unilever reported that its net profit rose 10% on a YoY basis to ₹2,552 crore in the last quarter.

- Godrej Consumer Products will buy Raymond Consumer Care’s FMCG business for ₹2,825 crore.

Retail

- Future Retail received permission to take help from law enforcement authorities to gain access to stores it was locked out of due to disputes with landlords.

Airlines

- IndiGo plans to buy 20 wide-body planes for its international operations.

Power

- India is considering linking its power grid through undersea cables to the power grids of Saudi Arabia and the United Arab Emirates.

Mining

- As potential investors expressed their intention to have the government stay as a minority shareholder, the government might not disinvest from Hindustan Zinc Limited (HZL).

Real estate

- Mahindra Lifespaces secured a redevelopment project in Mumbai with potential revenue of ₹850 crore.

Oil

- CPCL reported that, in the last quarter, its net profit rose 602% on a quarter-on-quarter basis to ₹1,012 crore.

Infrastructure

- KEC International reported that its transmission, civil, and cable segments secured orders worth ₹1,017 crore.

🏢IPO Corner

- Mankind Pharma’s IPO was subscribed 15.32 times with retail investors subscribing 0.92 times.

- SEBI has given its approval to EbixCash and Survival Technologies to launch their IPOs.

🏗️Corporate Actions

| Bonus | ||

| Company | Ratio | Ex-Date |

| SRU Steels | 1:2 | 03-May-2023 |

| Split | ||

| Company | Ratio | Ex-Date |

| Apollo Micro Systems | 1:10 | 04-May-2023 |

| Rights issue | ||

| Company | Ratio | Ex-Date |

| Samor Reality | 1:1 | 02-May-2023 |

| Buyback | ||||

| Company | Ex Date | Start Date | End Date | Offer Price |

| SYMPHONY LIMITED | — | 03-05-2023 | 17-05-2023 | 2000.00 |

| Dividend for May 01st – May 06th 2023 | |||

| Company | Type | Dividend | Ex-Date |

| Elantas Beck India | Dividend | ₹5.00 | 02-May-2023 |

| Stovec Industries | Final Dividend | ₹47.00 | 02-May-2023 |

| Castrol India | Final Dividend | ₹3.50 | 04-May-2023 |

| CRISIL | Interim Dividend | ₹7.00 | 04-May-2023 |

🪜Others

- Voltas reported that its net profit grew 140.85% on a YoY basis to ₹1,405 crore in FY 2022-23.

- Century Textile reported that its net profit grew by 69% on a YoY basis to ₹142 crore in the last quarter.

- Emirates Telecommunications Group increased its stake in Vodafone Idea’s holding company, Vodafone Group.

- Rail Vikas Nigam acquired the Navratna status. RVNL became the 13th company to gain Navratna status.

- In FY 2022-23, the combined value of block deals jumped 63% from the previous financial year to ₹1.87 trillion.

- Vedanta Resources repaid all its maturing loans and bonds due in April 2023 to reduce its gross debt by $1 billion.

- The National Financial Reporting Authority (NFRA) has debarred a Coffee Day Group firm’s auditor for deficiency in a statutory audit.

- 6 people were banned from participating in stock markets by SEBI as they were involved in stock manipulation through Telegram.

🔌Sustainability Corner

- Zomato ordered 1 lakh electric scooters from Zypp Electric to be delivered by 2024.

- Suzlon received a new order to supply 13 wind turbines with a combined installed capacity of 39 MW from Thermax Group.

- India’s KPIT Technologies, which recorded 27% growth in revenues of ₹3,447 crore in FY2023 (47% from Europe, 36% from the USA, and 17% from Asia) and has bagged business from Honda and Renault for work on software-defined vehicles, expects to grow by 27–30% in FY2024.

- Bosch to acquire US chipmaker TSI Semiconductors. Rising demand from the EV industry for silicon carbide chips, which enable increased range and more efficient recharging for EVs, sees Bosch make moves to expand its global portfolio of SiC semiconductors.

- PLI scheme for construction equipment is likely to attract $4 billion of domestic and foreign investments in the near term, SAYS ICEMA.

- ZF reveals modular electric high-speed air compressors for fuel-cell-powered Medium and Heavy Commercial Vehicles. It leverages Liebherr-Aerospace’s tech. The air bearing design of the optimized compressor offers benefits like oil-free, high-speed, efficient operation, and high power density.

- The Ministry of Heavy Industries (MHI) announced the release of SOPs under the Production Linked Incentive ( PLI) Auto scheme for testing agencies. The applicants under the scheme can now submit their applications for the testing and certification of AAT products (both OEMs and components), which will help them qualify for incentives under the PLI Auto scheme.

- Autoliv to set up an airbag cushion and fabric plant in Vietnam, which has drawn investment in local production from Skoda and BMW; aims to meet expanded future airbag production needs for the fast-growing ASEAN market.

- Cummins and Tata Motors strengthen a 30-year alliance; sign a definitive agreement to manufacture a range of low- to zero-emissions technology products in India over the next few years.

- Bajaj Auto plans INR 500 crore capital expenditure in its EV business in FY2024. This includes EV component volumes and also building capabilities for its soon-to-be-revealed electric three-wheeler.

- Mahindra Last Mile Mobility breaks ground on a new EV plant in Zaheerabad, Telangana. It will house a state-of-the-art battery assembly line producing power packs and will also manufacture electronic, drivetrain components for 3- and 4-wheeled EVs.

Result Calendar for May 01st – May 06th 2023

| 1st May | |||

| Adani Green Energy | — | — | — |

| 2nd May | |||

| Tata Steel | Home First Fin Company | DCM Shriram | Varun Beverages |

| Ambuja Cements | KEI Industries | Punjab & Sind Bank | UCO Bank |

| Adani Total Gas | — | — | — |

| 3rd May | |||

| SIS | Sonata Software | Petronet LNG | Jyothy Labs |

| Cholamandalam Investment and Finance Company | Aavas Financiers | KEC International | ABB India |

| Havells India | Titan Company | Godrej Properties | Tata Chemicals |

| Solar Industries India | Anupam Rasayan India | Sona BLW Precision Ltd. | K.P.R. Mill Ltd. |

| MRF | Adani Wilmar | — | — |

| 4th May | |||

| Tata Power Company | Dabur India | IDFC | HDFC |

| Aptus Value Housing Finance | Sundram Fasteners | United Breweries | Hero MotoCorp |

| TVS Motor Company | Blue Star | Ceat | Adani Enterprises |

| Firstsource Solutions | 360 One Wam | — | — |

| 5th May | |||

| Ajanta Pharma | Alembic Pharmaceuticals | Bharat Forge | Tata Investment Corp. |

| Blue Dart Express | Marico | Federal Bank | Equitas Small Finance Bank |

| Sundaram-Clayton | — | — | — |

| 6th May | |||

| Aether Industries | Bank Of India | Grindwell Norton | CAMS |

📬Also Read: Sustainable Investing in India: ESG Investments