Indecision🤷♀️ and an Emergency call 📞Weekly Stock Markets Updates | Jan 8, 2023

Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team in our weekly stock market updates

In this article

Indecision

Driving growth or taming inflation?

These questions may have haunted Fed chairman Powell as he continues to battle sky-high inflation.

Concerns of recession are heard on Wall Street behind weaker-than-expected retail sales. On top of this, an increased number of COVID-19 cases are causing a dilemma for China to propel growth or control Covid to turn its economy around.

Will US Fed take a hawkish stance in 2023? Will China look to propel growth with rising Covid cases? Only time will tell.

Waiting

Investors await corporate earnings as they have a heightened ability to impact the market when fears of a recession rise. Indian investors are also keenly analysing budget expectations to understand where the economy is headed.

Mr Ashok Jain, MD and Chairman of Arihant Capital recently shared his outlook for 2023, which sectors to focus on and what to expect from the budget. You can check out this interview here.

Emergency call

The telecom operator Vi approached banks this week looking for emergency funding. Vi has dues of ₹ 7,500 crores to pay to Indus Towers. Upon failure to clear its dues, Vi would lose access to tower sites. Bankers seem reluctant to invest, cutting its runway short. Let’s see how Vi gets out of this soup.

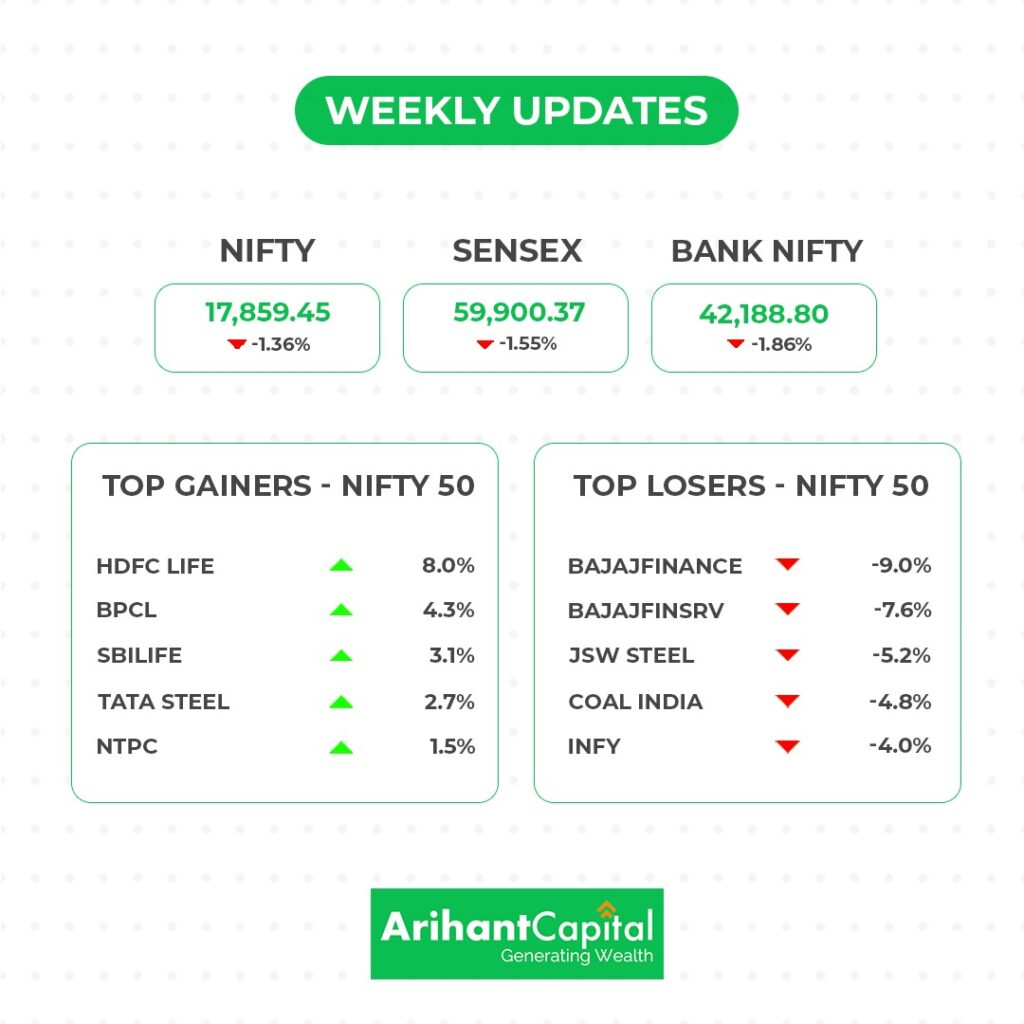

The stock markets ended the first week of the new year deep in the red with the 30-share Sensex closing at 59,900 down more than 1.5% and the Nifty closing at 17,859 lower by 1.4%.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of Nifty, we observe that it has touched the 100 SMA price level, and on the weekly chart, we observe that it has broken the support level of the lower trend line. It indicates we may see some pressure from the higher level in the market. If the Nifty starts trading above 18,050, it can test the levels of 18,250 – 18,400, while on the downside, support is at 17,780. If it starts trading below that level, it can test the levels of 17,600 and 17,450.

Bank Nifty

On the daily chart of Bank Nifty, we observe that it has broken the 50 SMA price level, and in the weekly chart, we observe that it has broken the support of the lower trend line. We believe that we can see pressure from the higher level in the coming trading session. If it trades above 42,300, then it can touch 42,600 and 42,850 levels. However, the downside support comes at 41,800; below that, we can see 41,500–41,200 levels.

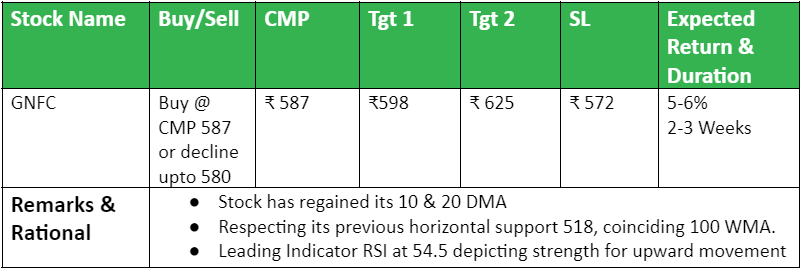

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

💰Options hub

Quick Bites

Global

- China signed a deal with the Taliban to produce oil in Afghanistan.

- Euro-area inflation returned to single digits for the first time since August.

- Russia ships recorded 1.17 Mn barrels/day of crude to India in December.

Economy

- India’s purchasing managers’ index (PMI) for manufacturing rose to a 26-month high of 57.8 in December.

- Reserve Bank puts on hold NUE Licensing.

- Net corporate tax collection stood at ₹ 7.12 lakh cr in the financial year 2021-22.

- The government is working on a national policy to boost local manufacturing of fertilizers and reduce dependency on imports.

IT and Telecommunications

- BSNL to commence 5G services in 2024.

- Microsoft building global products in India now.

- Bharti Airtel is seeing an opportunity to push its revenue market share (RMS) to over 40% in the next 12-18 months, from its current lifetime high of 38%.

- Airtel launched 5G services in Indore.

- Reliance Industries, Jio 5G is now available in over 72 cities.

- Amazon to see 18,000 job cuts soon.

Banking and Finance

- The government received several expressions of interest (EoIs) for the strategic sale of a stake in IDBI Bank held by the Centre and state-owned Life Insurance Corporation of India (LIC).

- Edelweiss Financial Services will raise ₹ 400 cr via debentures.

- RBI may expand the use cases of the digital rupee after the ongoing pilot project.

- SBI to raise ₹ 10,000 cr through infrastructure bonds in 2023.

- UCO Bank approved raising ₹ 1,000 cr through bonds.

- Canara Bank hiked the repo rate linked lending rate to 9.15% from 8.80%.

- IIFL Finance is planning to raise up to ₹ 1,000 cr via debentures.

- RBI lifted a ban on the Mahindra Finance’s outsourcing loan recovery.

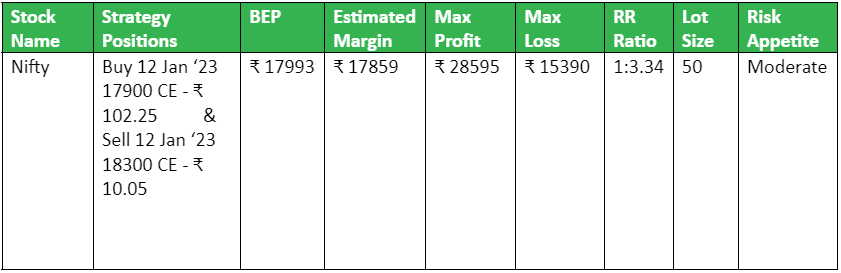

Automobile

- Retail sales of vehicles in India grew by 15.28% to 2.1 cr units in 2022: FADA.

- Here’s a quick snapshot of the monthly performance of automobile cos

- Bharat Forge has partnered with General Atomics to manufacture aerostructures.

Other

- Titan reports 12% business growth in Q3.

- Torrent bids ₹8,640cr upfront for Reliance Capital.

- Kalyan Jewelers Q3 update: Revenue grows 13% YoY.

- NCC won orders worth ₹ 3,601 cr in Dec 2022.

- PTC India approved a final dividend of ₹ 5.80 per share.

- Coal India’s supply to the power sector rose 11% to 432.7 million tonnes in the April-Dec period.

- The Indian Performing Right Society (IPRS) has filed a petition against ZEE claiming a default of Rs 211.4 cr in music royalty payments.

- Dabur completed the acquisition of a 51% stake in Badshah Masala.

- NCLAT has directed Google to pay ₹133.8 cr penalty for using its dominant position unfairly.

- RELIANCE CONSUMER PRODUCTS LIMITED said it will acquire 50% equity stake in Gujarat-headquartered beverages firm Sosyo Hajoori Beverages (SHBPL).

- RHI Magnesita has received approval from BSE and NSE for the acquisition of the refractory business of Dalmia Bharat Refractories. The deal is worth ₹1,708 crores.

- KKCL announced a strategic partnership with BCCI as the Indian cricket team’s ‘official partner’.

🚀IPO Corner

- Sah Polymers IPO was subscribed 17.46 times. Retail investors subscribed 39.78 times.

- Rishabh Instruments has filed draft papers with SEBI for an IPO.

- Radiant Cash Management is listed at a 9.57% premium on NSE. On BSE, it listed with a 5.64% premium

🔌Sustainability Corner

- The govt has approved ₹ 19,744 cr National Green Hydrogen Mission.

- Renault is considering building a mass-market electric vehicle in India.

- Electric scooter maker Bounce said it had let go about 4% of its workforce on Friday.

- NTPC launched India’s first green hydrogen blending project.

- Hero Moto started deliveries of its first electric scooter Vida V1.

- Govt to take a call on minimum green hydrogen purchase by sectors

- TVS iQube e-scooter recorded best-ever sales in Dec.

- Delhi recorded the highest-ever monthly electric vehicle sales as compared to all other states and UTs. 7,046 EVs were sold in Delhi, a growth of 86%. 2 wheelers contribute around 55% of the total sales.