New Financial Year starts Apr 1, Unions Declared Bharat Bandh – Weekly Market Wrap up | 1 April

In this Weekly Market Newsletter:

- What to expect from the markets

- Market Outlook

- Stock Recommendation

- Options Hub

- Quick Bites

- IPO Corner

- Sustainability Corner

Arihant Capital wishes you all a happy and prosperous new financial year! We thank you for your trust and support and look forward to being your partner in the coming fiscal. Attention investors, update your KYC details with your broker today to avoid the deactivation of your Demat account. Check out this blog for details.

Geopolitical tensions loom even as peace talks resume between Russia and Ukraine. Trade unions’ and banks’ Bharat Bandh on 28th and 29th March to protest the central government policies, failed to affect the benchmark indices. The impending Fed rate hikes and downward revisions of India’s GDP forecasts were also affecting the market sentiments.

Indians breathe freely again as relaxation in covid norms makes wearing a mask optional in many places.

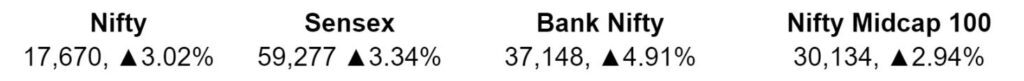

Sensex, Nifty, and Bank Nifty all ended the week in the green due to optimism on progress in Russia-Ukraine negotiations. Nifty closed the week with a 3.02% profit ending at 17,670 while BSE Sensex ended the week at 59,277 gaining 1,915 pts or 3.34%.

Most of the sectoral indices were in the green. All sectoral indices based on the banking sector were among the top gainers of the week, despite Bharat Bandh.

📊What to expect from the markets

–Mr. Abhishek Jain, Research Head, Arihant Capital

All benchmark indices closed the week in green due to optimism as geopolitical tensions seem to ease. On the sectoral front, Nifty Realty has done well ahead of strong momentum in the real estate sector gaining 5.66%. Large players led by DLF and Godrej Properties led the rally. Metal has been laggard as per our expectations.

The result season is around the corner, and IT companies will start posting the Q4 numbers soon. All eyes will be on the financial commentary. The market will look at these results for guidance on the growth and margins front.

🔭Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst

Nifty

In the daily chart of the Nifty, it is trading above all the important moving averages and has formed a “positive candle”. On the weekly front, it gave a breakout of an upward sloping trendline. Together, we conclude that stock-specific activity may continue and investors need to maintain a buy-on dip strategy. Now it has to cross the 17,800 level to see a bounce towards 18,050 and 18,200 levels, while on the downside support if it crosses below 17,550 then it can test the 17,400 and 17,200 levels.

Bank Nifty

On the daily chart of Bank Nifty, it is still trading above 200 SMA with a “positive candle” formation. On the weekly chart, the index still shows a positive formation. We conclude that Bank Nifty is also coming with a positive trend and investors need to follow a buy-on dip strategy. This week Bank Nifty futures closed at 37,240 levels. In the coming trading session if it holds below 36,900 then weakness could take it to 36,500 and 36,200 whereas minor resistance on the upside is capped around 37,900 – 38,500 levels.

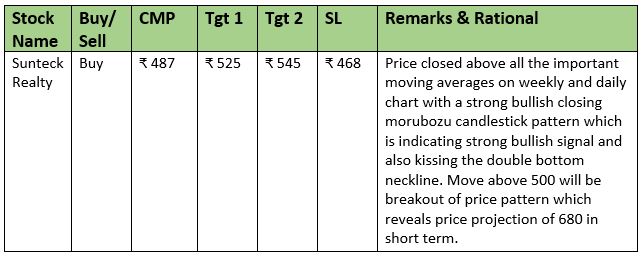

💰Stock Recommendation

From the Technical Desk

–Kavita Jain, Head Learning and Senior Research Analyst

From the Fundamental Desk

–Mr. Abhishek Jain, Research Head, Arihant Capital

We continue to believe the markets are a buy-on dip market. At current levels, auto stocks specially 2w offer great value at current levels. Maintain buy on Hero Moto Corp, Eicher, and Bajaj auto on all weaknesses.

NCR-based Tarc limited is a good pick in the real estate segment. There has been a revival in the realty segment in the North. Tarc has good projects with a strong balance sheet. The company has receivables of ₹1,000 crores from government entities on land monetization and is expected to be debt-free in the next 2 years. We are recommending buying with a price objective of ₹80 in the next year. For the traders, hotel stocks can be an interesting play ahead of results.

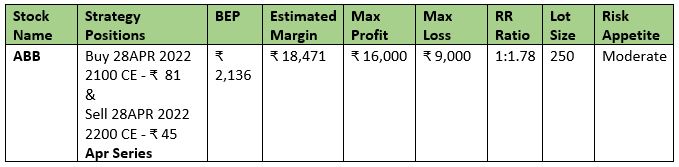

🏷️Options Hub

Option Strategy

🔎Quick Bites

Global

- Attacks continue amid Russia-Ukraine peace talks.

- Sri Lanka’s economy, battered by low tourism and forex reserves, crumbles. Sri Lanka asks India for an additional $1.5 B credit line for import essentials.

- Hit wicket for Imran Khan as he faces a no-confidence vote.

- To battle the oil crisis, the US is all set to release oil from reserves, in a joint plan with India, and other nations.

Economy

- FPI outflow shoots past the ₹2 lakh crores mark in 2022.

- After petrol, diesel ATF price hiked by 2% to an all-time high.

- Bharat Bandh may have impacted transactions worth at least ₹18,000 crores.

- The current account deficit jumps to $23 billion in Oct-Dec, the highest in 9 years.

- India’s external debt rose by $11.5 billion in Oct-Dec 2021 to $614.9 billion.

- Several rating agencies reduce India’s growth forecasts.

Energy and Infrastructure

- GAIL continues to pay for Russian LNG imports in US dollars.

- Government to sell off 1.5% stake in ONGC to raise ₹3,000 crores.

- GAIL to buy back 5.7 crore shares for ₹1,083 crores.

- NCC to sell Vizag Urban Infra arm for ₹200 crores.

- NTPC clocked the highest ever annual electricity generation of 360 billion units in 2021-22.

- Adani Enterprises’ arm gets LoA for a highway project in Maharashtra.

- IOC unit to release 6,000 MT diesel to help ease the power crisis in Lanka.

- Power Grid Corporation of India approves investments in 5 projects across India worth ₹821.29. PGCIL transfers a 26% stake in Powergrid Vizag Transmission for ₹330 crores.

- Tata Power gets NCLT approval for the merger of CGPL.

Industry

- Sansera Engineering is close to bagging a ₹300 to 400 crores order from BMW Motorrad.

- The finance ministry to sell the entire government stake in Ferro Scrap Nigam Ltd (FSNL).

- Tata Steel to acquire ferroalloys producing assets of Stork Ferro and Mineral Industries for ₹155 crores.

- PTC Industries rights issue to give 3 rights equity shares for every 2 equity shares held by eligible shareholders as on the record date.

IT and Telecommunications

- Bharti Airtel to acquire a 7% stake in Avaada KNShorapur.

- Vodafone Idea Board approves raising funds of up to ₹4,500 crores from promoters by allotting 338.34 crore equity shares to three promoter or promoter group entities at₹13.30 per share.

- Tata’s Tejas acquires the majority stake(64%) in semiconductor firm Saankhya Lab for₹284 crores.

- Exide announces investment of ₹6,000 crores in Karnataka to set up one of India’s largest Giga factories for Li-ion cell tech.

- Jio lost 93.22 lakh subscribers, Vi lost 3.89 lakh subscribers, and Airtel adds 7.14 lakh users.

- Bharti Airtel, Tech Mahindra partner to co-develop, market 5G use cases.

- Airtel announced the acquisition of a 4.7% stake in Indus Towers from the U.K.’s Vodafone Group for around ₹2,388 crores.

- Motherson Sumi Wiring shares list after the demerger.

Automobile

- Hero Moto Corp shares tank as IT search reveals ₹10,000 crores bogus expenses. The company denies media reports. In other news, the company will increase the prices of its motorcycles and scooters by up to ₹2,000 from April 5.

- Honda India Power Products announced its foray into the marine outboard business.

- Maruti Suzuki plans to hike prices again on costlier inputs. Tata, Hero among other automakers to hike vehicle prices.

Banking and Finance

- Citigroup announced the sale of its Indian consumer banking businesses, including credit cards, retail banking, and consumer loans, to Axis Bank for ₹12,325 crores.

- HDFC Bank to infuse ₹3 crores to acquire a stake in debt resolution firm IDRCL. ICICI bank will buy a 15% stake in IDRC for ₹7.5 crores.

- Bain Capital to acquire a nearly 25% stake in IIFL Wealth.

- Equitas Small Finance-Equitas Holdings merger swap ratio questioned by analysts.

- ADB, HSBC India launches a $100 mn partial-guarantee program for microcredit.

- PNB to raise capital up to ₹12,000 crores. J&k Bank raised ₹360 crores and Karnataka Bank raised ₹300 crores by issuing bonds.

- Axis Bank and RBI to advance digital financial inclusion for Indian women.

- IDBI Bank to divest its stake in two entities -NSDL and Ageas Federal Life Insurance Company Limited (AFLI)

Other

- Blockbuster merger: PVR and INOX to merge.

- Tata Consumer Products to merge Tata Coffee business with itself.

- Tata Consumer to buy 10.15% stake in Tata Consumer Products UK Group.

- Aster DM Healthcare to invest ₹500 crores to set up healthcare facilities in Tamil Nadu.

- ITC sees a 3-fold rise in India wheat exports to 21 mt in FY23.

- Loss incurred by Air India, AI Express, Alliance Air ₹17,032 crores in April 2020-December 2021 period.

- Future Enterprises defaults on loan repayment of ₹2,888 crores. RIL justified taking over the stores of Future Retail due to mounting dues of $634 million. Bankers decide to refer Future Retail to NCLT.

- Aurobindo Pharma announced the acquisition of the domestic formulation business of Veritas Healthcare.

- Akasa Air is all set to roll out its commercial operation in June.

🚀IPO Corner

- Hemani Industries files draft papers, to raise ₹2,000 crores via IPO.

- SEBI gives a 3 -day window for investors to withdraw applications from Ruchi Soya FPO due to the circulation of unsolicited SMSs.

- General Atlantic-backed KFin Tech files draft paper for ₹2,400 crore IPO.

- Uma Exports IPO subscribed 7.67 times, and the retail portion was booked 10.11 times on the final day.

- Veranda Learning IPO subscribed 3.53 times, and the retail portion was booked 10.76 times on the final day.

- Hariom Pipe Industries Limited IPO subscribed 1.88 times, and the retail portion was booked 4.65 times on the second day.

🔌Sustainability Corner

- Tata Power partners with Rustomjee Group to install EV chargers in Mumbai.

- Adani Total forays into electric mobility infrastructure.

- GEF Capital closes a $200 million climate fund as CDC, IFC, and others chip in.

- Tata Motors says a 20% rise in battery cell costs increases short-term pressure.

- Tata Steel UK uses bacteria technology to recycle its emissions.

- P&G India becomes a ‘plastic waste neutral’ company.

- DVC and NTPC form a JV for renewable power projects.

- The government and RBI are working on a framework for Green Bonds.

- Vedanta to source 580 MW of green energy for India operations.

- Exicom becomes India’s biggest EV charging brand with 5,000 installations.

- 59% of owners of over 1.39 lakh EVs provided subsidies for electric vehicles in Delhi.

- The hydrogen-powered Toyota Mirai has begun testing on Indian roads.

- Multiple electric scooter fire incidents reported in India. Concerns over the safety and reliability of these vehicles may derail the electric vehicle transition in India.

- The number of electric vehicles on roads in India has reached over ten lakh with around 1,700 charging stations operational in public places across the country, India registered a 162% growth in EV sales this year.

- Tata Motors gets the first tranche of ₹7,500-crore investments for its new passenger electric vehicle subsidiary from TPG Rise.

- Sundram Fasteners receives GOI approval under PLI for manufacturing Advanced Automotive Technology (AAT) components like powertrain sub-assemblies for EVs and Internal combustion engines.

- Tata Power and Social Alpha to build a ‘Net-Zero Industry Accelerator’ focussed on industrial use cases of clean energy transition and industrial decarbonization contributing towards India’s net-zero targets.

That’s all for now folks! See you next week!