Food Inflation Skyrockets | Broadcomm VMWare Mega-Tech Deal | Weekly Market Wrap up | 29 May

In this article

- What to expect from the markets

- Market Outlook

- Stock Pick

- Option-Hub

- Key Results

- Quick Bites

- IPO Corner

- Sustainability Corner

What do you do when life does not give you lemons? Or even tomatoes? A global food crisis is in the making, and the Indian crop prices are also facing the “heat”, quite literally in fact.

Countries including India had started putting export bans for their own food security. First, it was palm oil from Indonesia, then wheat from India and the latest to join the “Ban”dwagon is sugar. India recently banned all exports of sugar from June 1, and experts are speculating if rice will meet the same fate. FMCG companies have already responded by shrinking the weight of their products, and ride-hailing apps have also hiked fares to save the drivers from the impact of rising fuel prices.

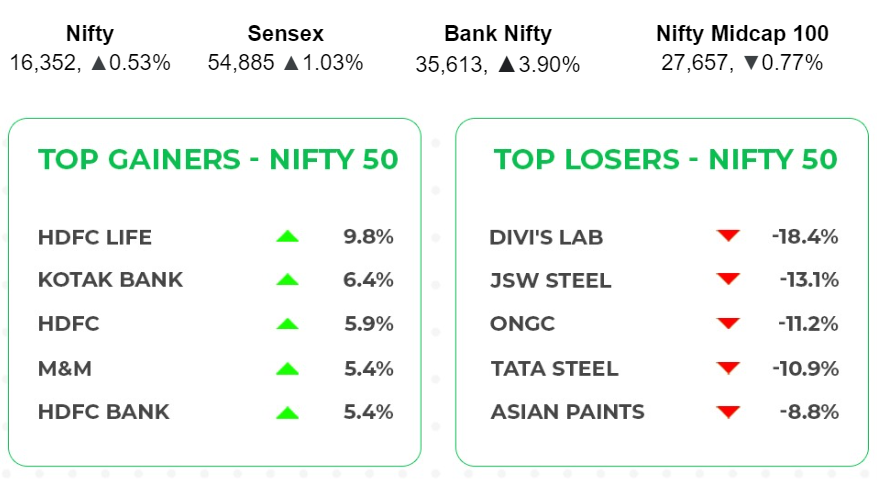

Meanwhile, the Indian benchmark indices ended the week with bleak returns. Nifty closed the week with a 0.53% profit at 16,352 and BSE Sensex ended the week at 54,885 On a week-on-week basis, Sensex increased 558 pts or 1.03%. Bank Nifty increased 3.9% during the week, ending at 35,613.

The government this past weekend imposed hefty export duties on crucial steel-making raw materials like iron ore and pellets. This may have been a factor making Nifty Metal the biggest loser among the sectoral indices at 8.7%. The sectoral indices in the banking and financial services were the major gainers, With the Nifty Financial Services, Nifty Private Bank and Nifty Bank gaining 4.32%, 4.0% and 3.9% respectively.

📊What to Expect from the Markets

-Mr. Abhishek Jain, Research Head, Arihant Capital

Indian markets closed with positive momentum on Friday for the second week in a row. Financial and auto stocks were the top sectoral gainers this week. All the sectoral indices ended on a mixed note for the week with Nifty Metals being the biggest laggard.

Global markets also rallied on strong numbers from Chinese tech stocks in Hongkong stock exchange. We continue to believe Nasdaq is a good buy at 11,500 levels.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart, Nifty formed a “Hammer Candlestick” pattern and on weekly front it has formed a “Doji candle” formation. We conclude that the market may consolidate and we may see stock specific activity. If Nifty crosses 16,420 it will see a bounce towards 16,550 and 16,700 levels, while on the downside support if it crosses below 16,150 then it can test 15,900 and 15,750 levels.

Bank Nifty

On the daily chart of Bank Nifty an upward gap area is visible and RSI is signalling a positive movement. On the weekly chart, a “Bullish” formation is visible. We conclude that a short covering may be observed. This week Bank Nifty futures closed at 35,645 levels. In the coming trading session, if it holds below 35,500 then weakness could take it to 35,100 and 34,700 levels whereas minor resistance on the upside is capped around 35,900-36,200 levels.

💰Stock Picks

From the Fundamental Desk

-Mr. Abhishek Jain, Research Head, Arihant Capital

We have been maintaining a positive stance on auto, insurance, financial and rural themes for many weeks now, and this recommendation has done well.

After a long time, we advised investors to add IT stocks to their kitty, expecting a bounce back. Investors should add these stocks on weakness now. Some of our covered midcaps have delivered a very good set of numbers, and are worth keeping on adding in tranches. Whirlpool can be a good trading bet for ₹2,000 by the next quarter’s numbers.

In case you missed our last newsletter, you can check out last week’s fundamental stock picks here.

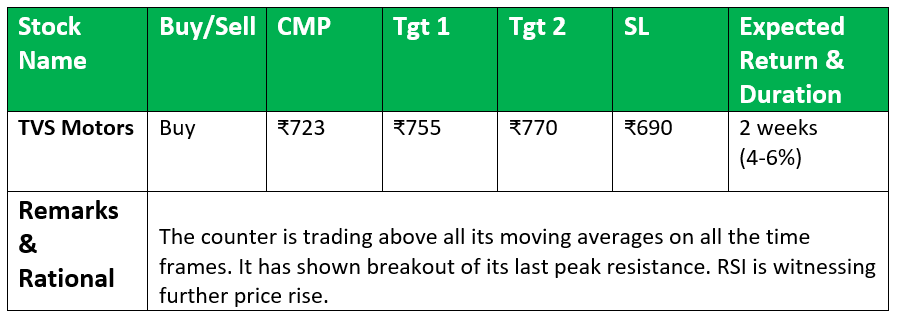

From the Technical Desk

-Ms. Kavita Jain, Head Learning and Senior Research Analyst, Arihant Capital

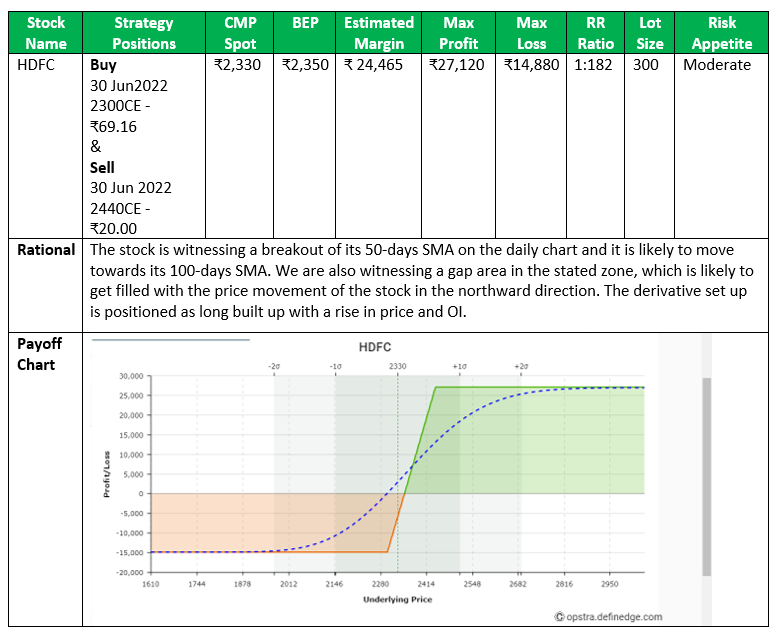

🏷️Options Hub

-Ms. Kavita Jain, Head Learning and Senior Research Analyst, Arihant Capital

📝Key Results

- Hindalco posted a 100% YoY rise in consolidated net profit to ₹3,851 crores. The revenue from operations was up 38% to ₹55,764 crores. Dividend of ₹4 per share declared.

- Coal India’s profit was up 46.3% year on year to ₹6,715 crores. Revenue from operations increased 22.4% to ₹32,706 crores. Dividend of ₹3 per share declared.

- M&M profit jumps 17% YoY to ₹1,167 crores; ₹11.55 per share dividend declared.

🔎Quick Bites

Global

- The chip maker Broadcomm is all set to acquire cloud computing company, VMWare for a whopping $61 Billion. This deal is the second biggest acquisition of 2022, after Microsoft’s $68.7 billion acquisition of video game maker Activision Blizzard Inc.

- India in talks with UK and EU for Free Trade Agreements.

- US President Biden announced the launch of a 12 nation Indo-Pacific Economic Framework. The countries part of the group include India, Australia, South Korea, and New Zealand.

Economy

- RBI warns of high WPI fuelling the high CPI rates. CPI rates touched an 8 year high of 7.79% in April. Tomato, mango and lemon prices sizzle in the heat.

- Government imposes restrictions on sugar exports From June 1 to prevent surge in domestic prices.

- The government reduced the excise duty on fuel to control inflation. This cut means a reduction of around ₹9.5 a liter on petrol and ₹7 a liter on diesel. Several states have also announced that they will be further reducing VAT on petrol and diesel.

- RBI surplus fell in FY 22 as expenditure jumped 280%. Exports rise 21% to $23.7 bn during May 1-21.

Automobile

- Maruti Suzuki has bought a 12.09% stake in AI software company Sociograph Solutions for ₹1.99 crores to create a customized sales experience on the web, and in virtual and augmented reality.

- TVS Motor strengthens its product portfolio in Kenya by unveiling 2 new limited-edition vehicles

- Tata Motors filed a record 125 patents related to powertrain technologies in the last financial year.

Banking and Finance

- Tata Group may abandon plans to enter banking.

- Union Bank Of India: aiming to raise equity capital up to ₹3,800 crores and issue AT 1/Tier 2 bonds not exceeding ₹4,300 crores.

- HDFC has sold 10% stake in HDFC Capital Advisors to the Abu Dhabi Investment Authority for ₹184 crores.

Energy and Infrastructure

- Coal India will open a new Siarmal mine in eastern Odisha, which may just be one of the country’s biggest coal mines, reaching a capacity of 50 MT in about 5-7 years.

- ONGC becomes the first entity to sell gas from KG Basin block on Indian Gas Exchange.

- PSUs (OIL and GAIL ) are unable to send $120 million as dividend from Russia

- Shell is in talks with Indian cos to sell a Russian stake.

- Hunt for a private sector captain to run ONGC begins. ONGC will invest ₹31,000 crores in the exploration of oil and gas over the next 3 years.

- JSW Energy hopes to raise ₹5,000 crores through equity shares, bonds, and other securities.

IT and Telecommunications

- Singtel set to dial Sunil Mittal to sell part stake in Bharti Airtel.

- Droney capitalism: Adani to acquire 50% stake in drone co. General Aeronautics. Jio using drones for tower surveillance.

- SEBI has exempted the government from making an open offer to the shareholders of Vodafone-Idea (Vi) to acquire over 33% stake of Vi.

- Siemens to sell Large Drives Application business for ₹440 crores to its subsidiary, Siemens AG.

Industry

- Steel maker AM/NS India to expand in AP with an additional investment Of ₹1,000 crores.

- The cabinet is likely to approve the sale of the government’s 29.5% stake in Hindustan Zinc.

Other

- Grasim Industries intends to invest ₹10,000 crores for its paint foray by FY25.

- Marico has acquired a 54% stake in healthy breakfast and snack company HW Wellness.

- IndiGo fined ₹5 lakh for denying boarding to the specially-abled children.

- Google in talks to join Indian eCommerce network ONDC.

- United Spirits to sell 32 mass-brands to Inbrew for ₹820 crores.

- InterGlobe Enterprise to form 50:50 JV with logistic giant UPS.

- Spicejet systems faced ransomware attacks which impacted and slowed down morning flight departures.

- Aditya Birla Fashion and Retail to raise up to ₹2,195 crores by the preferential issue of equity and warrants.

🚀IPO Corner

- Aether Industries IPO was subscribed 6.26 times, the retail portion fully booked, QIB portion booked 17.57 times.

- eMudhra IPO subscribed 2.72 times. The public issue subscribed 2.61 times in the retail category, 4.05 times in QIB, and 1.28 times in the NII category.

- Venus Pipes & Tubes IPO shares debut at 335, a 3.5% premium to the issue price of ₹326/share, and later traded at a premium of 7.9%.

- SoftBank owned Delhivery listed at ₹495 – a 1.64% premium to its issue price of ₹487. stock jumps over 10% on market debut ending at ₹536.35 on BSE, and ₹537.25 on NSE.

- Paradeep Phosphates made a strong debut at the exchanges on Friday, listing at ₹43.55 against an issue price of ₹42, a premium of 4.76%. Post listing, the stock of the fertiliser company surged as much as 13% to ₹47.25.

🔌Sustainability Corner

- Power Ministry seeks 2-yr extension to meet the emissions deadline in light of the power crisis.

- GAIL laid a pipeline of ₹142 crores which will supply 1 MMSCMD gas to HMEL.

- MFL to set up a wind-solar hybrid project with ReNew Green Energy in Gujarat. ReNew Power to spend about ₹100 crores in Maharashtra and Karnataka.

- French energy company, EDF to collaborate with NPCIL for the Jaitapur plant.

- Tesla is not to manufacture EVs in India till it is allowed to sell and service vehicles here. Ola Electric CEO says, “Thanks, but No Thanks”.

- Niti aayog kickstarted the Indo-Norway Clean energy task force. The task force will facilitate collaboration between the two countries on hydrogen, renewables, low carbon solutions and energy storage.

- Adani Green arm commissions India’s first wind-solar hybrid power plant in a 390 MW wind-solar hybrid power plant at Jaisalmer.

- BMW aims to introduce multiple EV models in India.

- SJVN inks pact to supply 200 MW solar power to discoms in Bihar. Also ties up with Tata Power Solar Systems for a 1,000 MW solar project in Bikaner.

- Rise in module, steel and freight costs to hit 5 GW solar capacity under implementation according to Crisil.

- Over 3 GW of solar energy capacity was installed in India in Jan-Mar 2022, says Mercom India.

- ACME Solar commissions a 300 Mw solar project in Rajasthan.

- G7 vows to end fossil-fuel financing.

- DRDO report finds serious battery defects in EVs that caught fire owing to “lower-grade materials to cut costs”.

- NHPC to raise up to ₹6,300 crores during the financial year 2022-23.

That’s all for now folks! See you next week!