Climbing up | Stock Market Weekly Update Newsletter 13 Nov

👋 Get ready for Monday markets with Arihant Capital’s weekly market newsletter. Every week we bring you uncomplicated stock market news which is never boring. Because we believe investments can be simple with the right guidance. Grab your cuppa and get started!

In this article

COP 27

The 27th United Nations Climate Change Conference is happening and World leaders, policy-makers and delegates from nearly 200 countries have assembled in Egypt to tackle climate change from 6 November. Indian PM Narendra Modi is not in attendance, seemingly preparing for a G-20 presidency. Want to keep up with the conversation, read this article demystifying COP 27 terms.

Crypto exchange FTX blows up

In what can be only called a reminder to stay invested in regulated investment assets, the world’s second-largest crypto exchange FTX, (a company valued at $32 billion just blew up, swindling over $1b in clients’ funds.

If you are a regular investor in equity, mutual funds etc, another good news is that the government is reportedly looking to simplify the capital gains tax regime.

Pink slip in Meta and Twitter

We covered the possible layoffs in our last newsletter, this week we know that Musk has fired many of his staff and has warned others of tough times ahead. Even Meta has fired a whopping 11,000 employees but seems to have done it more gracefully.

Talking about tough times ahead, the US midterm elections remained too close to call, which left investors feeling jittery. While cooler-than-expected inflation numbers gave some much-needed respite to the markets and many of the indices climbed and 2 of the US indices had the best day in 2 years in the hopes that it is time the Fed will pump the brakes on the hikes.

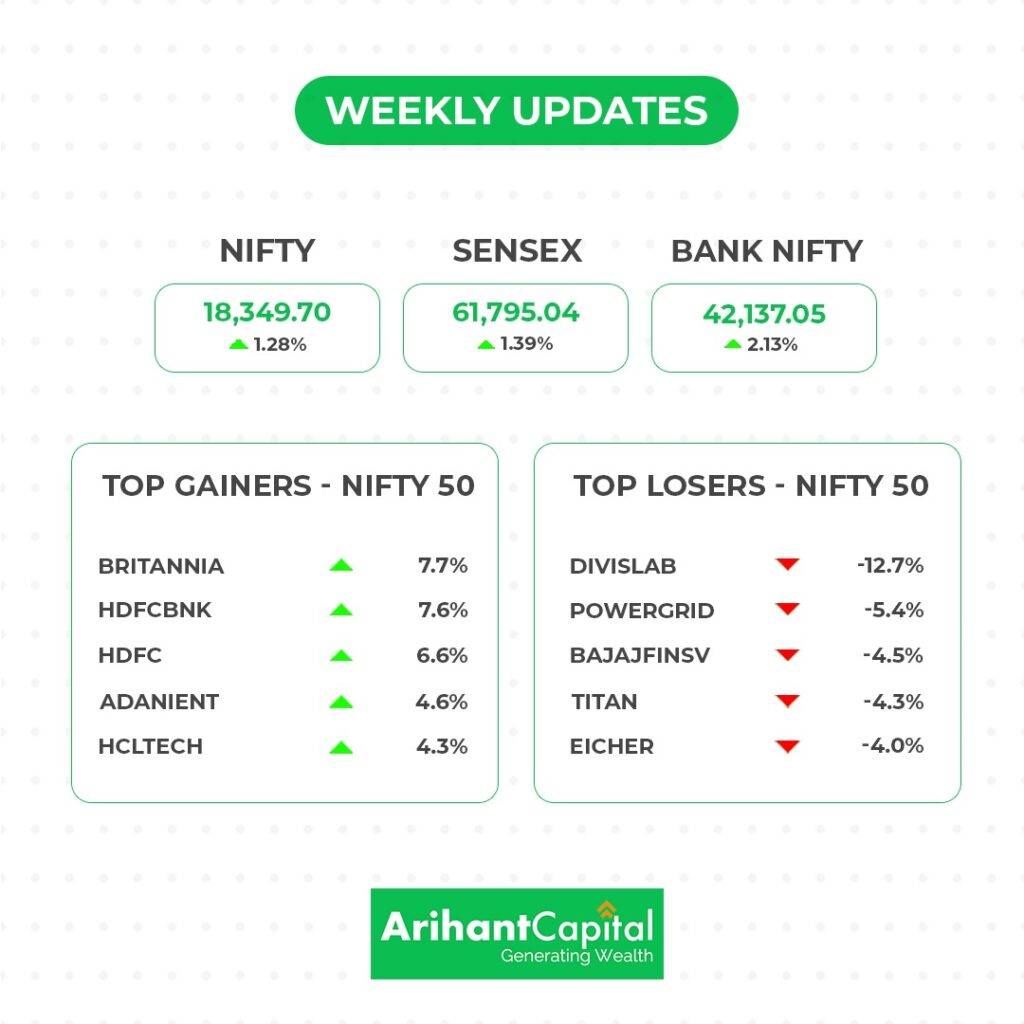

Even the Indian indices showed cheer on positive sentiment, the benchmark indices climbed up and are just 1% shy of their all-time high. Nifty closed the week at 18,350 up 1.28% from last week with an all-time high of 18,604, Sensex is also pretty close to its high of 62,245 by closing at 61,795 up 1.39% from last week.

💰Stock Picks

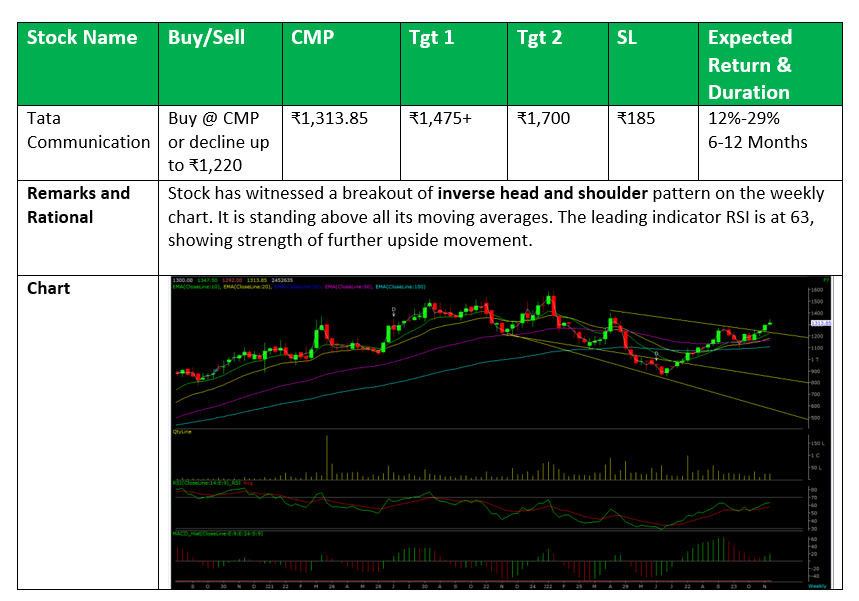

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the technical chart of Nifty, we observe Runaway Gap formation on the daily chart. On the weekly chart, the Nifty broke and sustain above its upward trendline resistance level. It seems that stock-specific action will continue and we will maintain buy on dips strategy. Nifty can face resistance around the 18,450 level if it starts trading above then it can touch 18,600-18,750 levels, while on the downside support is 18,250 if it starts to trade below then it can taste the level of 18,050 and 17,900 levels.

Bank Nifty

On the daily and weekly chart of Bank Nifty, we observe Runaway Gap formation. It appears that Bank Nifty may show some positive movement after breaking out of its consolidation range. In the coming trading session if it trades above 42,500 then it can touch 42,800 and 43,100 levels, however, downside support comes at 42,050 below that we can see 41,700-41,500 levels.

🚀IPO corner

- Inox Green IPO was subscribed 0.46 times on day 1.

- Archean IPO saw 32.23 times subscription.

- Five Star Business Finance was subscribed 0.70 times.

- Kaynes IPO subscribed 1.1 times till day 2.

- Bikaji Foods IPO subscribed 26.67 times

- Keystone Realtors to hit capital market on Monday to raise ₹635 crore

- Medanta IPO subscribed 9.58 times.

🔎Quick Bites

Global

- Britain’s economy shrank in the third quarter as inflation soars. The UK GDP fell 0.2% in Jul-Sep period.

- Inflation in the US was at 7.7% in Oct, as compared to 8.2% in the previous month.

- Russia buys more tea from India as Kenya tea turns costlier.

Economy

- Moody’s has lowered India’s growth predictions from 7.7% to 7%.

- INR/ USD rate fell strengthening the rupee, at 80.80 per dollar.

- Inflation in Oct may be lower than 7% according to RBI.

- Industrial output grew 3.1% in September.

- Balance of Payments may slip into a $45-50b deficit in the current fiscal, according to the finance ministry. It stood at a surplus of $47.5 billion in FY22.

Banking and Finance

- The merged entity of HDFC – HDFC Bank may enter the indices early.

- Govt to sell entire 1.55% holding in Axis Bank.

Energy and Infrastructure

- Adani Ports acquired a 49.38% stake in Indian OilTanking for ₹1,050 crores.

- Siemens set up a factory in Aurangabad to produce rail bogeys.

- L&T realty and CapiaLand ink pact to develop 6 m sq feet office space.

- Macrotech developers to launch 16 projects worth ₹10,300 crores in the second half of fiscal 2023.

- Adani Power will sell its entire stake in its wholly-owned subsidiary Support Properties to AdaniConnex for ₹1,556 crores.

IT and Telecom

- The govt has approved BSNL and TCS deal to roll out 4G services.

- RIL and HCL are independently evaluating deals to purchase a 30% equity stake each in semiconductor wafer fab applicant ISMC Analog.

- Reliance Jio has launched 5G beta services in Bengaluru and Hyderabad.

Automobile

- Peugeot Motorcycles will cease to be a subsidiary of Mahindra Two Wheelers Europe Holdings, a wholly owned subsidiary of the company.

- Maruti Suzuki India may increase its Manesar plant production capacity by one lakh units before its Sonipat facility commences operations in 2025.

Other

- RIL, Adani and 13 others will fight it out for Future Retail.

- Saudi Arabia’s SALIC acquired a 9.2% stake in LT Foods.

- Dr Reddy’s has earmarked a CAPEX of around ₹1,500 crores for FY23.

- Malaysia’s IHH Healthcare is ready to give an open offer on Fortis.

- Lupin gets the USFDA nod for a medicine to treat bacterial infections.

- Indigo has grounded 30 planes due to supply chain disruptions.

- Reliance will acquire Metro’s Cash and Carry India business for ₹4,060 crores.

- Bajaj Electricals will add a ‘premium’ touch for better margins.

📝Key Results

- LIC Q2 net surges to ₹15,952 crores.

- Jindal Steel & Power (JSPL) reported a sharp decline(92%) in its consolidated profit at ₹200 crores for Q2 on account of high input costs.

- Tata Motors has posted a net loss of ₹944.6 crores for Q2, narrowing from a loss of ₹4,441 crores in Q2’21, with strong operating and top-line performance. Revenue from operations at ₹79,611 crores grew by 30% and EBITDA increased by 35.4% to ₹5,572 crore YoY.

- Food delivery firm Zomato’s revenue from operations jumped 62.2% to ₹1,661 crore. Its net loss pared to ₹251 crores in Q2 FY22.

- State Bank of India has become the country’s most profitable firm with a consolidated net income of ₹14,752 crore.

🔌Sustainability Corner

- Tata Power Renewable Energy has received LoA from MSEDCL to set up a 150MW solar project in Solapur, Maharashtra.

- Happiest Minds Technologies announced a partnership with Singapore-based ESG solution provider CredQuant for BFSI customers.

- SJVN has secured an 83 MW floating solar project in Madhya Pradesh from REWA Ultra Mega Solar Ltd. at ₹3.70 per unit on a build-own-and-operate basis.

- Sona Comstar to invest up to ₹1,000 crores by FY25 to scale up capacity, majorly for EV business.

- TVS-backed Ultraviolette set to kick-start e-bike race as bigger rivals loom.

- By 2030, Tata Power aims clean energy as 80% of its generation capacity and targets net carbon zero by 2045.

- KKR to invest $400 million in Vedanta’s renewable arm Serentica Renewables.

- KKR to power Sterlite’s clean energy business with $400 million.

- Shriram Transport Finance and Euler Motors to finance EV3-wheeler cargo vehicles for last-mile logistics solutions.

- LML opens booking for its ‘Star’ electric scooter.

- BluSmart, an EV cab service provider starts its operation in Bengaluru.

- Volton launches a new series of e-bicycles in India.

- MT Autocraft sets up ‘MTA E-Mobility’ with ₹100 crore funding

- Tata Motors celebrates its production milestone of 50,000 EVs

- Servotech partners with BPCL to install EV chargers

- Charzer and Nirman developers to install EV charging stations in Pune.

- Ola Electric rolls out its 100,000th electric scooter from TN Futurefactory.

- Saera Electric partners with Shriram Transport Finance for EV financing

- EVR Motors partners with EKA Mobility to build electric motors for e-buses.

- GreenCell receives a $55 million sanction from DFI’S ADB, AIIB & a grant Of $5.2 million from Goldman Sach’s & Bloomberg for safer e-buses in India

- Mahindra, Jio-bp, Charge+Zone, and Statiq partner to provide charging solutions

- Amazon, TVS sign MoU to scale EV deployment.

Also Read: Sustainable Investing in India: ESG Investments